Answered step by step

Verified Expert Solution

Question

1 Approved Answer

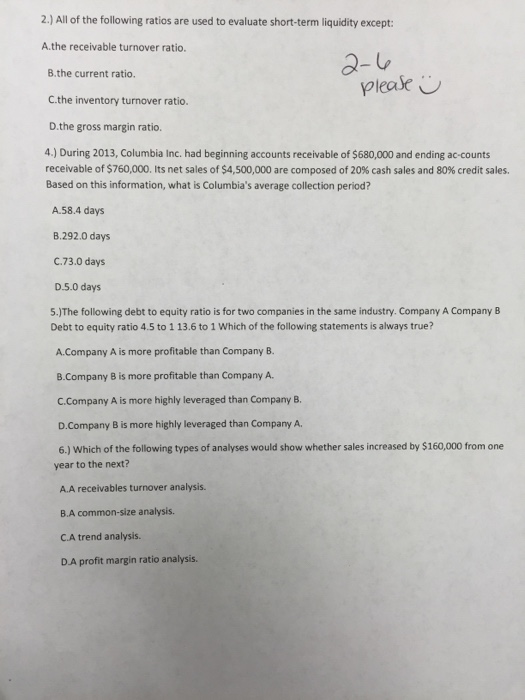

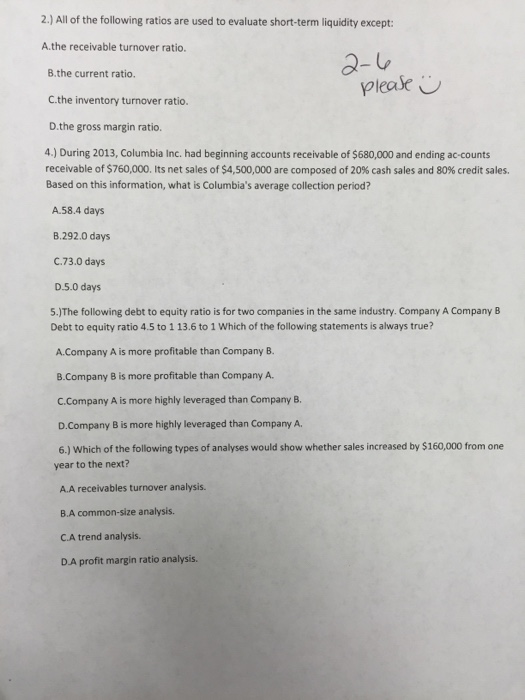

All of the following ratios are used to evaluate short-term liquidity except: the receivable turnover ratio. the current ratio. the inventory turnover ratio. the gross

All of the following ratios are used to evaluate short-term liquidity except: the receivable turnover ratio. the current ratio. the inventory turnover ratio. the gross margin ratio. During 2013, Columbia Inc. had beginning accounts receivable of $680,000 and ending ac-counts receivable of $760,000. its net sales of $4, 500,000 are composed of 20% cash sales and 80% credit sales. Based on this information, what is Columbia's average collection period? 58.4 days 292.0 days 73.0 days 5.0 days The following debt to equity ratio is for two companies in the same industry. Company A Company B Debt to equity ratio 4 5 to 1 13.6 to 1 Which of the following statements is always true? Company A is more profitable than Company B. Company B is more profitable than Company A. Company A is more highly leveraged than Company B. Company B is more highly leveraged than Company A. Which of the following types of analyses would show whether sales increased by $160,000 from one year to the next? A receivables turnover analysis. A common-size analysis. A trend analysis. A profit margin ratio analysis

All of the following ratios are used to evaluate short-term liquidity except: the receivable turnover ratio. the current ratio. the inventory turnover ratio. the gross margin ratio. During 2013, Columbia Inc. had beginning accounts receivable of $680,000 and ending ac-counts receivable of $760,000. its net sales of $4, 500,000 are composed of 20% cash sales and 80% credit sales. Based on this information, what is Columbia's average collection period? 58.4 days 292.0 days 73.0 days 5.0 days The following debt to equity ratio is for two companies in the same industry. Company A Company B Debt to equity ratio 4 5 to 1 13.6 to 1 Which of the following statements is always true? Company A is more profitable than Company B. Company B is more profitable than Company A. Company A is more highly leveraged than Company B. Company B is more highly leveraged than Company A. Which of the following types of analyses would show whether sales increased by $160,000 from one year to the next? A receivables turnover analysis. A common-size analysis. A trend analysis. A profit margin ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started