Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All of the following regarding the Trust Fund Recovery Penalty under Section 6672 are true except: The Trust Fund Recovery Penalty is a penalty against

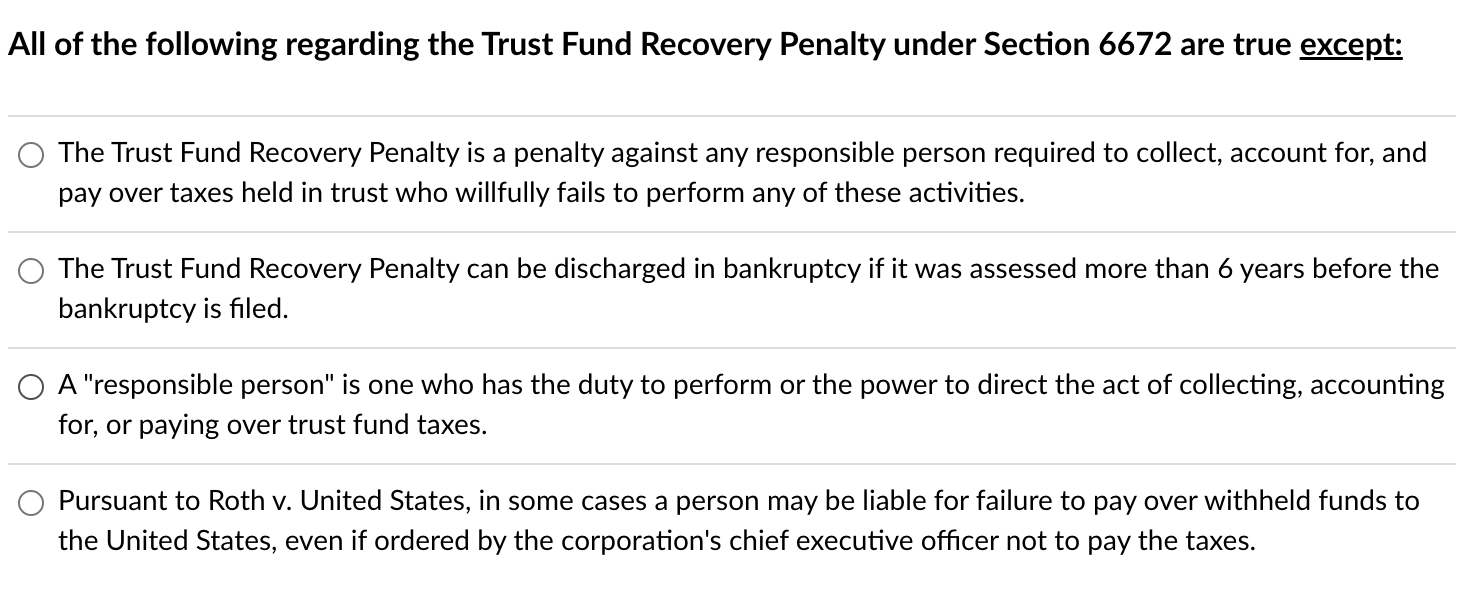

All of the following regarding the Trust Fund Recovery Penalty under Section 6672 are true except: The Trust Fund Recovery Penalty is a penalty against any responsible person required to collect, account for, and pay over taxes held in trust who willfully fails to perform any of these activities. The Trust Fund Recovery Penalty can be discharged in bankruptcy if it was assessed more than 6 years before the bankruptcy is filed. A \"responsible person\" is one who has the duty to perform or the power to direct the act of collecting, accounting for, or paying over trust fund taxes. Pursuant to Roth v. United States, in some cases a person may be liable for failure to pay over withheld funds to the United States, even if ordered by the corporation's chief executive officer not to pay the taxes

All of the following regarding the Trust Fund Recovery Penalty under Section 6672 are true except: The Trust Fund Recovery Penalty is a penalty against any responsible person required to collect, account for, and pay over taxes held in trust who willfully fails to perform any of these activities. The Trust Fund Recovery Penalty can be discharged in bankruptcy if it was assessed more than 6 years before the bankruptcy is filed. A \"responsible person\" is one who has the duty to perform or the power to direct the act of collecting, accounting for, or paying over trust fund taxes. Pursuant to Roth v. United States, in some cases a person may be liable for failure to pay over withheld funds to the United States, even if ordered by the corporation's chief executive officer not to pay the taxes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started