All of the info and numbers are provided in thequestion

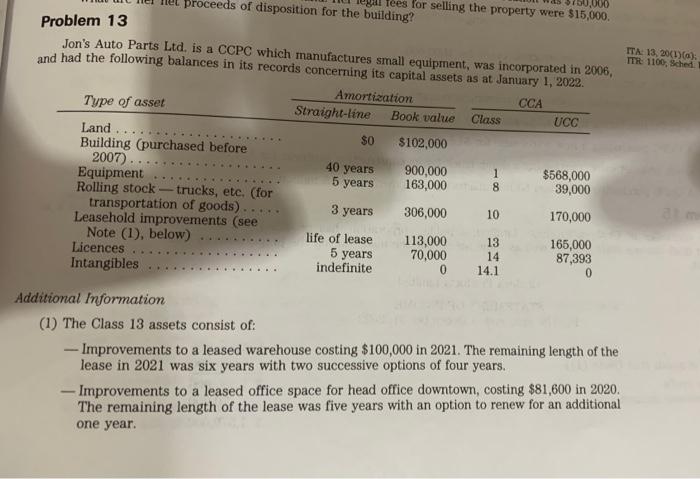

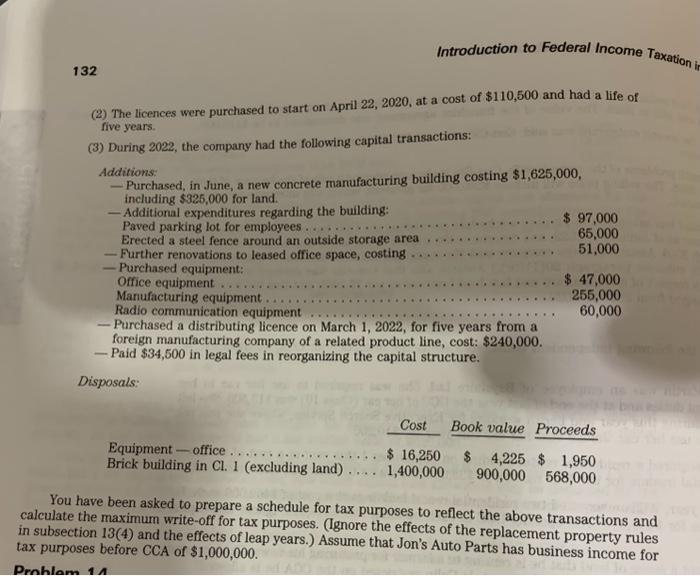

Problem 13 Jon's Auto Parts Ltd, is a CCPC which manufactures small equipment, was incorporated in 2006 and had the following balances in its records concerning its capital assets ne at lannuma- 1 nana dditional Information (1) The Class 13 assets consist of: - Improvements to a leased warehouse costing $100,000 in 2021. The remaining length of the lease in 2021 was six years with two successive options of four years. - Improvements to a leased office space for head office downtown, costing $81,600 in 2020. The remaining length of the lease was five years with an option to renew for an additional one year. 132 (2) The licences were purchased to start on April 22,2020 , at a cost of $110,500 and had a life of five years. (3) During 2022, the company had the following capital transactions: Disposals: You have been asked to prepare a schedule for tax purposes to reflect the above transactions and calculate the maximum write-off for tax purposes. (Ignore the effects of the replacement property rules in subsection 13(4) and the effects of leap years.) Assume that Jon's Auto Parts has business income for tax purposes before CCA of $1,000,000. Problem 13 Jon's Auto Parts Ltd, is a CCPC which manufactures small equipment, was incorporated in 2006 and had the following balances in its records concerning its capital assets ne at lannuma- 1 nana dditional Information (1) The Class 13 assets consist of: - Improvements to a leased warehouse costing $100,000 in 2021. The remaining length of the lease in 2021 was six years with two successive options of four years. - Improvements to a leased office space for head office downtown, costing $81,600 in 2020. The remaining length of the lease was five years with an option to renew for an additional one year. 132 (2) The licences were purchased to start on April 22,2020 , at a cost of $110,500 and had a life of five years. (3) During 2022, the company had the following capital transactions: Disposals: You have been asked to prepare a schedule for tax purposes to reflect the above transactions and calculate the maximum write-off for tax purposes. (Ignore the effects of the replacement property rules in subsection 13(4) and the effects of leap years.) Assume that Jon's Auto Parts has business income for tax purposes before CCA of $1,000,000