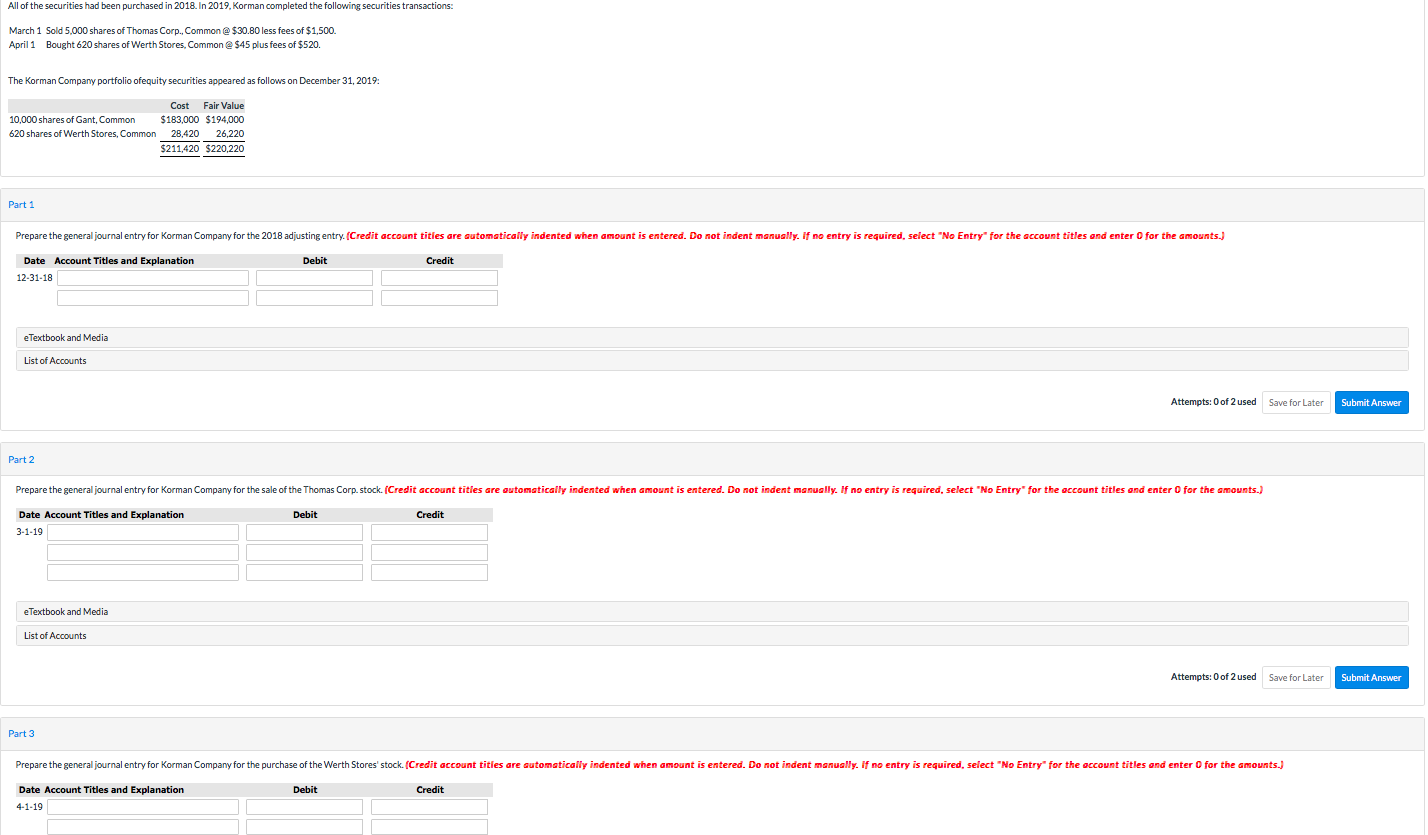

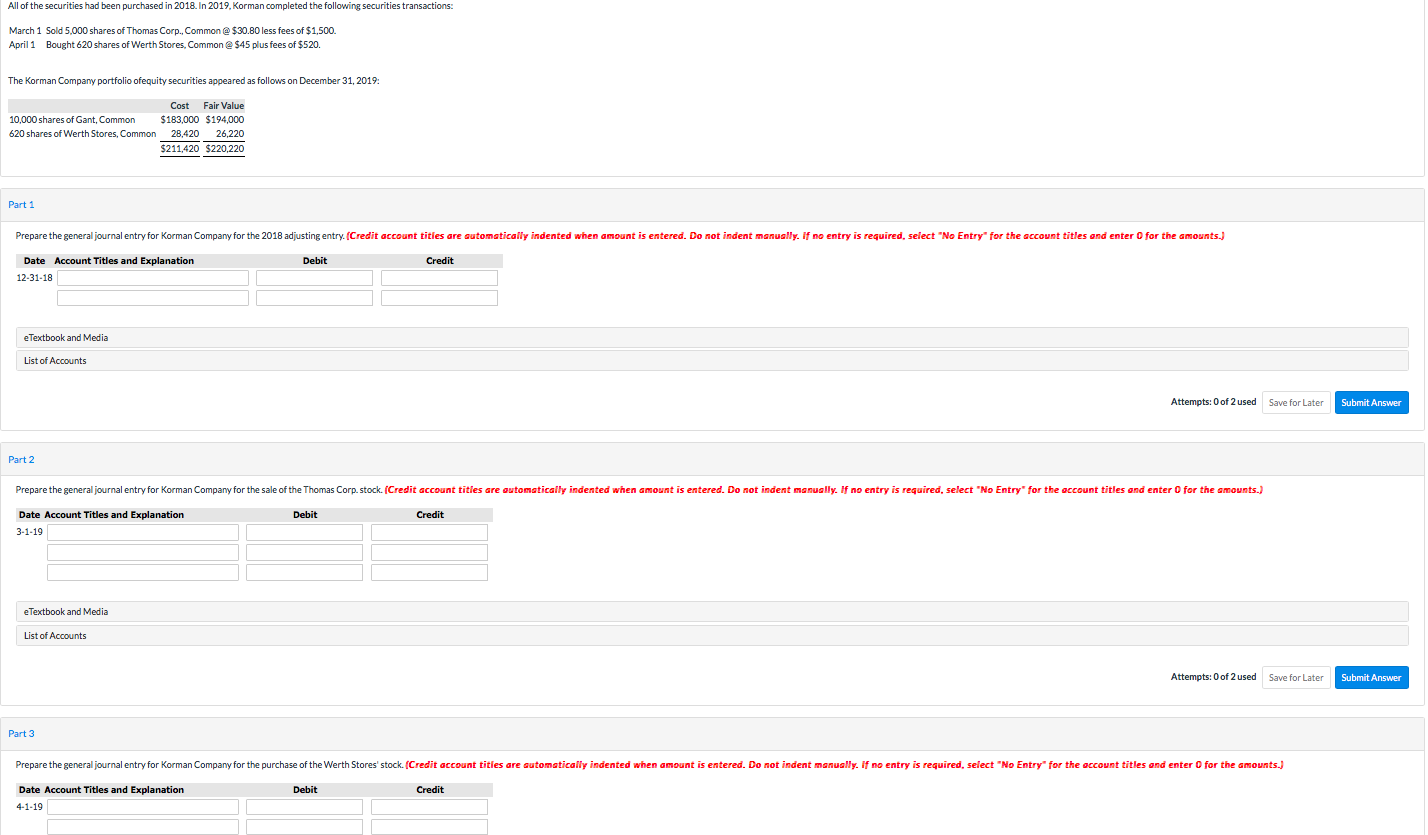

All of the securities had been purchased in 2018. In 2019. Korman completed the following securities transactions: March 1 Sold 5,000 shares of Thomas Corp., Common @ $30.80 less fees of $1,500. April 1 Bought 620 shares of Werth Stores. Common @ $45 plus fees of $520. The Korman Company portfolio ofequity securities appeared as follows on December 31, 2019: 10,000 shares of Gant, Common 620 shares of Werth Stores, Common Cost Fair Value $183,000 $194,000 28,420 26,220 $211,420 $220,220 Part 1 Prepare the general journal entry for Korman Company for the 2018 adjusting entry. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 12-31-18 eTextbook and Media List of Accounts Attempts: 0 of 2 used Save for Later Submit Answer Part 2 Prepare the general journal entry for Korman Company for the sale of the Thomas Corp.stock. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 3-1-19 e Textbook and Media List of Accounts Attempts: 0 of 2 used Save for Later Submit Answer Part 3 Prepare the general journal entry for Korman Company for the purchase of the Werth Stores stock. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 4-1-19 All of the securities had been purchased in 2018. In 2019. Korman completed the following securities transactions: March 1 Sold 5,000 shares of Thomas Corp., Common @ $30.80 less fees of $1,500. April 1 Bought 620 shares of Werth Stores. Common @ $45 plus fees of $520. The Korman Company portfolio ofequity securities appeared as follows on December 31, 2019: 10,000 shares of Gant, Common 620 shares of Werth Stores, Common Cost Fair Value $183,000 $194,000 28,420 26,220 $211,420 $220,220 Part 1 Prepare the general journal entry for Korman Company for the 2018 adjusting entry. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 12-31-18 eTextbook and Media List of Accounts Attempts: 0 of 2 used Save for Later Submit Answer Part 2 Prepare the general journal entry for Korman Company for the sale of the Thomas Corp.stock. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 3-1-19 e Textbook and Media List of Accounts Attempts: 0 of 2 used Save for Later Submit Answer Part 3 Prepare the general journal entry for Korman Company for the purchase of the Werth Stores stock. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 4-1-19