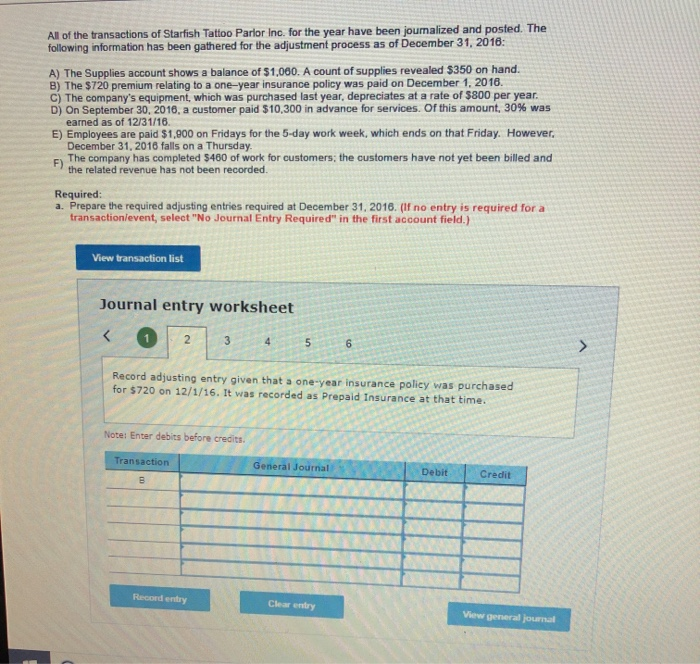

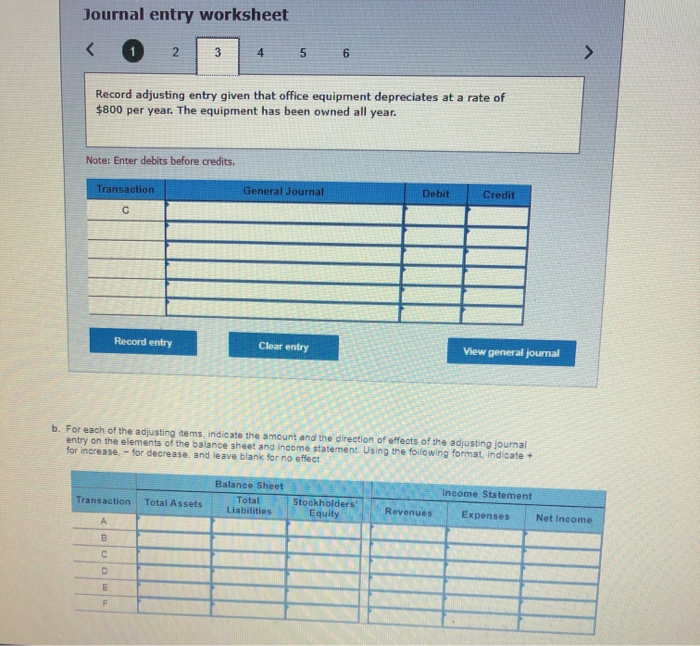

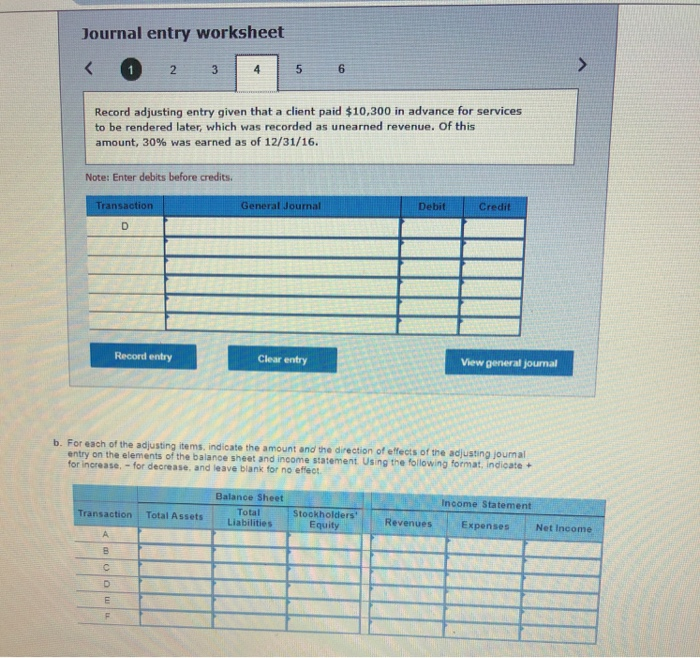

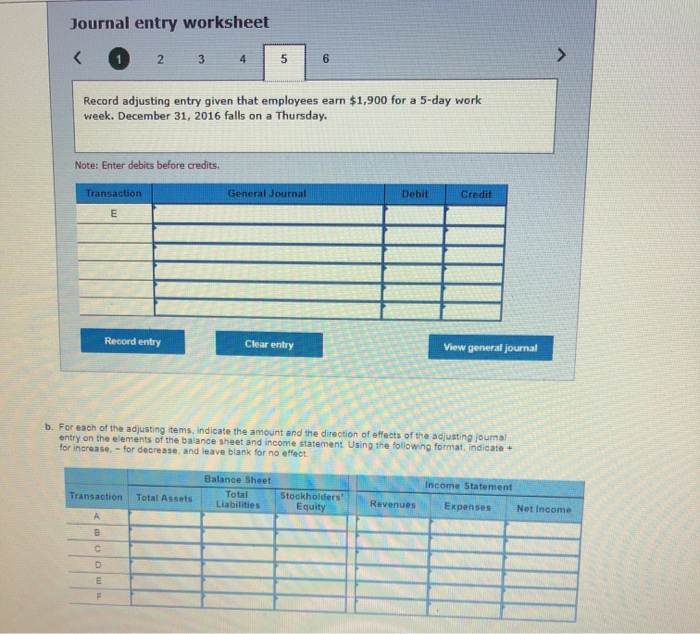

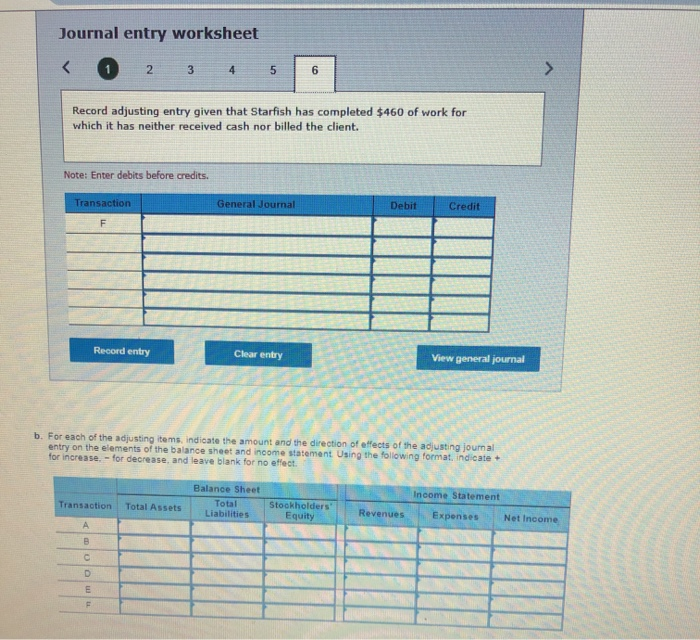

All of the transactions of Starfish Tattoo Parlor inc. for the year have been jounalized and posted. The following information has been gathered for the adjustment process as of December 31, 2018 A) The Supplies account shows a balance of $1,000. A count of supplies revealed $350 on hand B) The $720 premium relating to a one-year insurance policy was paid on December 1, 2016. C) The company's equipment, which was purchased last year, depreciates at a rate of $800 per year D) On September 30, 2016, a customer paid $10,300 in advance for services Of this amount, 30 % was earned as of 12/31/16. E) Employees are paid $1,900 on Fridays for the 5-day work week, which ends on that Friday. However December 31, 2016 falls on a Thursday. The company has completed $460 of work for customers: the customers have not yet been billed and F) the related revenue has not been recorded. Required: a. Prepare the required adjusting entries required at December 31, 2016. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet K 2 3 4 5 6 Record adjusting entry given that a one-year insurance policy for $720 on 12/1/16. It was recorded as Prepaid Insurance at that time. was purchased Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet 6 4 2 Record adjusting entry given that office equipment depreciates at a rate of $800 per year. The equipment has been owned all year. Note: Enter debits before credits. Credit Debit General Journal Transaction C Record entry Clear entry View general journal b. For each of the adjusting items, indicate the amount and the direction of effects of the adjusting journal entry on the elements of the balance sheet and income statement Using the foilowing format, indicate+ for increase- for decrease, and leave blank for no effect Balance Sheet income Statement Stockholders Equity Total Transaction Total Assets Revenues Expenses Net Income Liabilities A E Journal entry worksheet 6 4 5 3 2 Record adjusting entry given that a client paid $10,300 in advance for services to be rendered later, which amount, 30% was earned as of 12/31/16. was recorded as unearned revenue. Of this Note: Enter debits before credits. Credit Debit General Journal Transaction D Record entry View general jounal Clear entry b. For each of the adjusting items, indicate the amount and the direction of effects of the adjusting joumal entry on the elements of the balance sheet and income statement Using the following format, indicate+ for increase, -for decrease, and leave blank for no effect Balance Sheet Income Statement Total Liabilities Stockholders Transaction Total Assets Revenues Expenses Net Income Equity A c Journal entry worksheet K 4 5 6 3 Record adjusting entry given that employees week. December 31, 2016 falls on a Thursday. earn $1,900 for a 5-day work Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal b. For each of the adjusting items, indicate the amount and the direction of effects of the adjusting joum entry on the elements of the balance sheet and income statement Using the following format, indicate+ for increase,-for decrease, and leave blank for no effect Balance Sheet Income Statement Stockholders Equity Transaction Total Liabilities Total Assets Revenues Expenses Net Income A Journal entry worksheet 6 3 5 2 4 Record adjusting entry given that Starfish has completed $460 of work for which it has neither received cash nor billed the client. Note: Enter debits before credits. Debit Credit General Jounal Transaction Clear entry Record entry View general journal b. For each of the adjusting items, indicate the amount and the direction of effects of the adiusting joumal entry on the elements of the balance sheet and income statement Using the following format, indicate + for increase.-for decrease, and leave blank for no effect Balance Sheet Income Statement Stockholders Equity Total Transaction Total Assets Revenues Expenses Net Income Liabilities A