Answered step by step

Verified Expert Solution

Question

1 Approved Answer

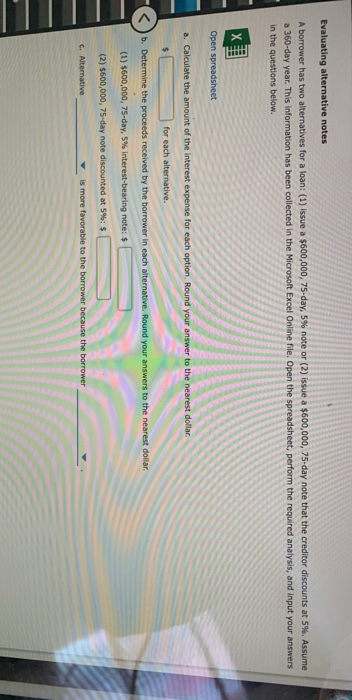

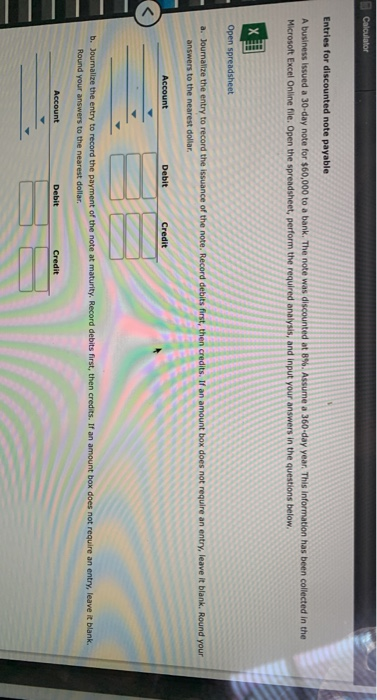

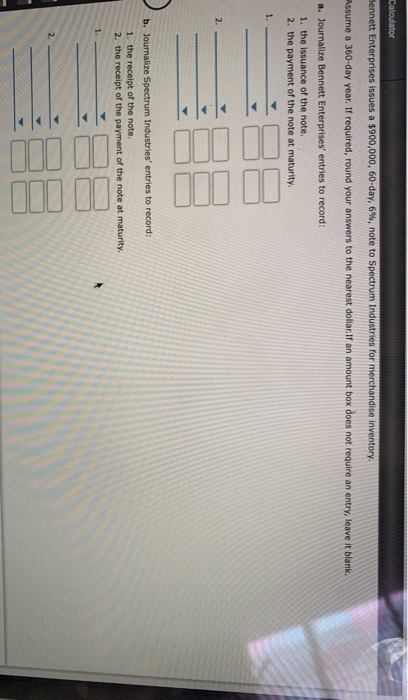

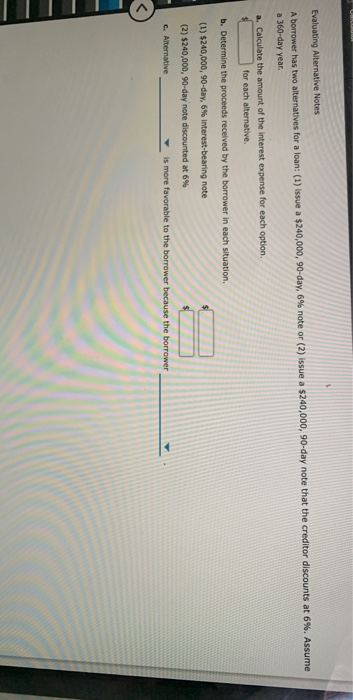

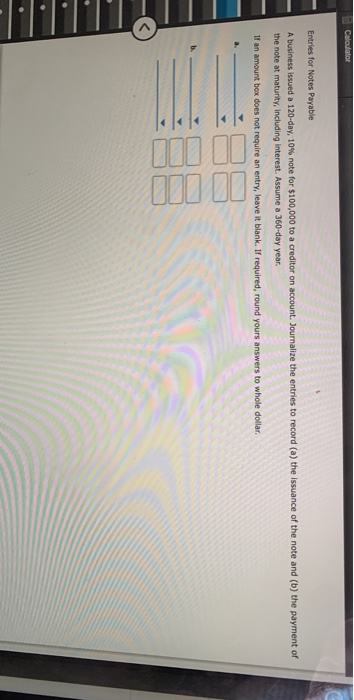

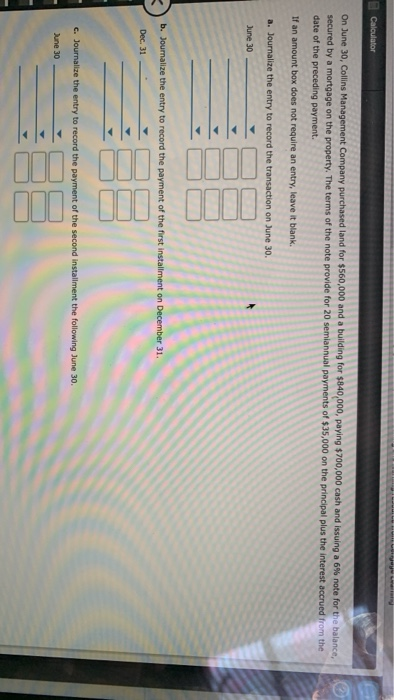

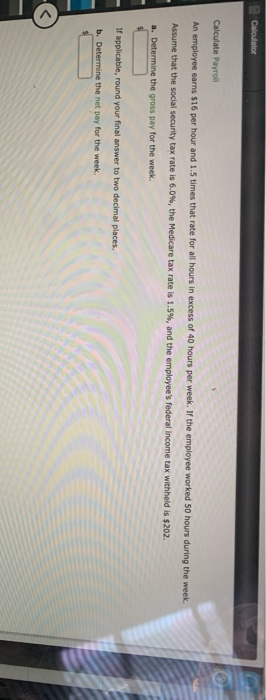

all of them!!!! Evaluating alternative notes A borrower has two alternatives for a loan: (1) issue a $600,000, 75-day, 5% note or (2) issue a

all of them!!!!

Evaluating alternative notes A borrower has two alternatives for a loan: (1) issue a $600,000, 75-day, 5% note or (2) issue a $600,000, 75-day note that the creditor discounts at 5%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Calculate the amount of the interest expense for each option. Round your answer to the nearest dollar. for each alternative. b. Determine the proceeds received by the borrower in each alternative. Round your answers to the nearest dollar (1) $600,000, 75-day, 5% interest-bearing note: $ (2) $600,000, 75-day note discounted at 5%:$ C. Alternative is more favorable to the borrower because the borrower Calculator Entries for discounted note payable A business issued a 30-day note for $60,000 to a bank. The note was discounted at 8%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below Open spreadsheet its first, then credits. If an amount box does not require an entry, leave it blank. Round your a. Journalize the entry to record the issuance of the note. Record answers to the nearest dollar Account Debit Credit b. Journalize the entry to record the payment of the note at maturity. Record debits first, then credits. If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar Account Debit Credit Calculator Sennett Enterprises issues a $900,000, 60-day, 6%, note to Spectrum Industries for merchandise inventory Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity, Evaluating Alternative Notes A borrower has two alternatives for a loant (1) issue a $240,000, 90-day, 6% note or (2) issue a $240,000, 90-day note that the creditor discounts at 6%. Assume 360-day year .. Calculate the amount of the interest expense for each option for each alternative b. Determine the proceeds received by the borrower in each situation (1) 5240,000, 90-day, 6% Interest-bearing note (2) $240,000, 90-day note discounted at 6% is more favorable to the borrowe c. Alternative Calculator Entries for Notes Payable A business issued a 120-day, 10% note for $100,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year If an amount box does not require an entry, leave it blank. If required, round your answers to whole dollar Calculator On June 30, Collins Management Company purchased land for $560,000 and a building for $840,000, paying $700,000 cash and issuing a 6% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $35,000 on the principal plus the interest accrued from the date of the preceding payment. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the transaction on June 30. June 30 b. Journalize the entry to record the payment of the first installment on December 31 Dec. 31 C. Journalize the entry to record the payment of the second installment the following June 30, June 30 Calculator Calculate Payroll An employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 50 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $202. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week. Evaluating alternative notes A borrower has two alternatives for a loan: (1) issue a $600,000, 75-day, 5% note or (2) issue a $600,000, 75-day note that the creditor discounts at 5%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Calculate the amount of the interest expense for each option. Round your answer to the nearest dollar. for each alternative. b. Determine the proceeds received by the borrower in each alternative. Round your answers to the nearest dollar (1) $600,000, 75-day, 5% interest-bearing note: $ (2) $600,000, 75-day note discounted at 5%:$ C. Alternative is more favorable to the borrower because the borrower Calculator Entries for discounted note payable A business issued a 30-day note for $60,000 to a bank. The note was discounted at 8%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below Open spreadsheet its first, then credits. If an amount box does not require an entry, leave it blank. Round your a. Journalize the entry to record the issuance of the note. Record answers to the nearest dollar Account Debit Credit b. Journalize the entry to record the payment of the note at maturity. Record debits first, then credits. If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar Account Debit Credit Calculator Sennett Enterprises issues a $900,000, 60-day, 6%, note to Spectrum Industries for merchandise inventory Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity, Evaluating Alternative Notes A borrower has two alternatives for a loant (1) issue a $240,000, 90-day, 6% note or (2) issue a $240,000, 90-day note that the creditor discounts at 6%. Assume 360-day year .. Calculate the amount of the interest expense for each option for each alternative b. Determine the proceeds received by the borrower in each situation (1) 5240,000, 90-day, 6% Interest-bearing note (2) $240,000, 90-day note discounted at 6% is more favorable to the borrowe c. Alternative Calculator Entries for Notes Payable A business issued a 120-day, 10% note for $100,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year If an amount box does not require an entry, leave it blank. If required, round your answers to whole dollar Calculator On June 30, Collins Management Company purchased land for $560,000 and a building for $840,000, paying $700,000 cash and issuing a 6% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $35,000 on the principal plus the interest accrued from the date of the preceding payment. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the transaction on June 30. June 30 b. Journalize the entry to record the payment of the first installment on December 31 Dec. 31 C. Journalize the entry to record the payment of the second installment the following June 30, June 30 Calculator Calculate Payroll An employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 50 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $202. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started