All of these are connected

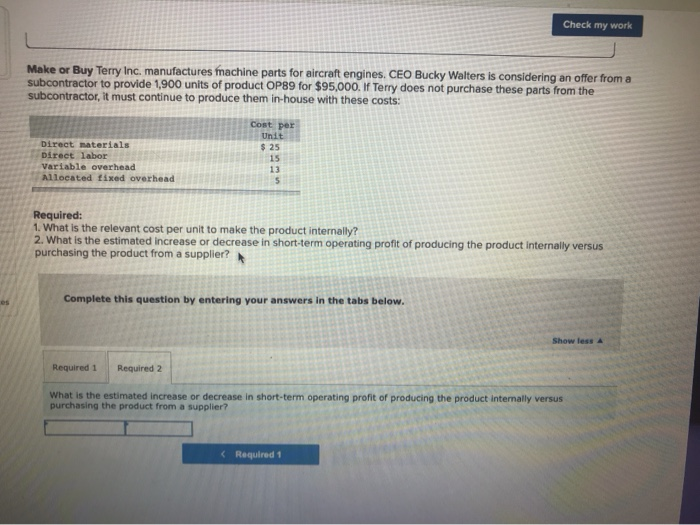

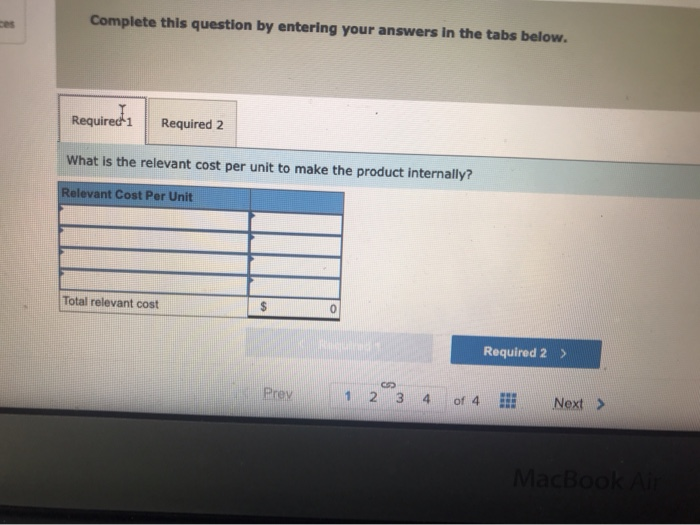

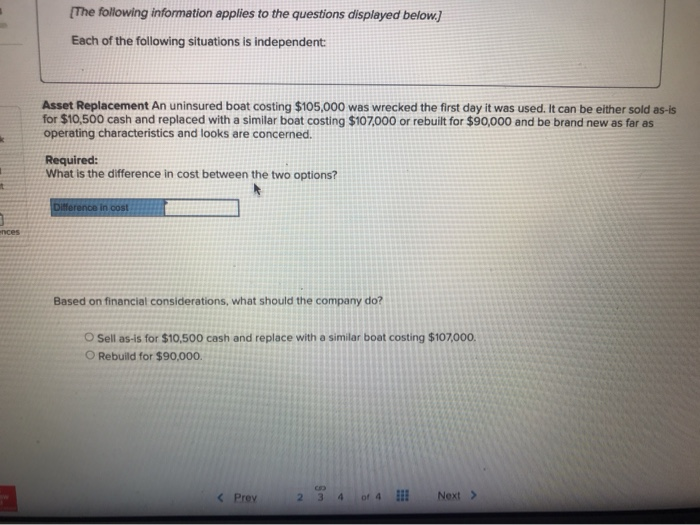

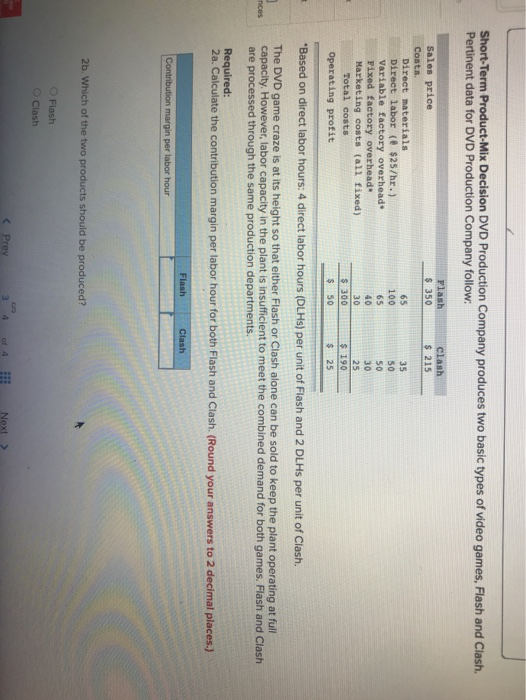

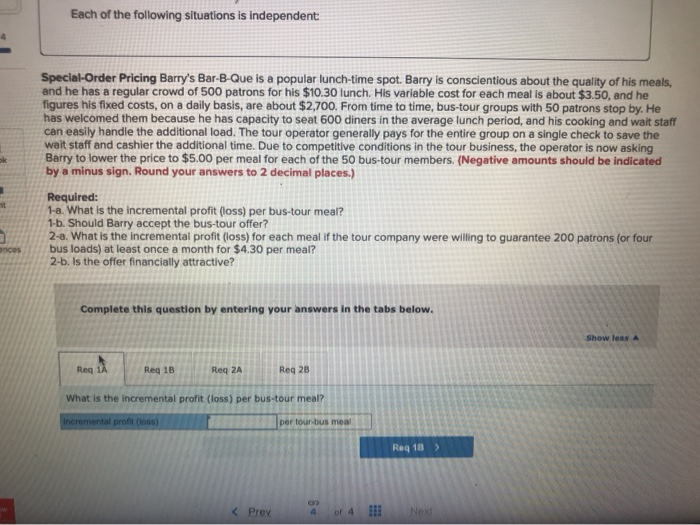

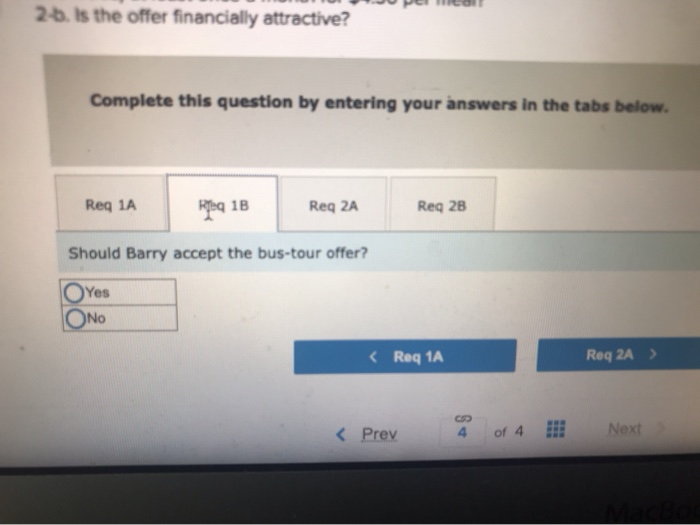

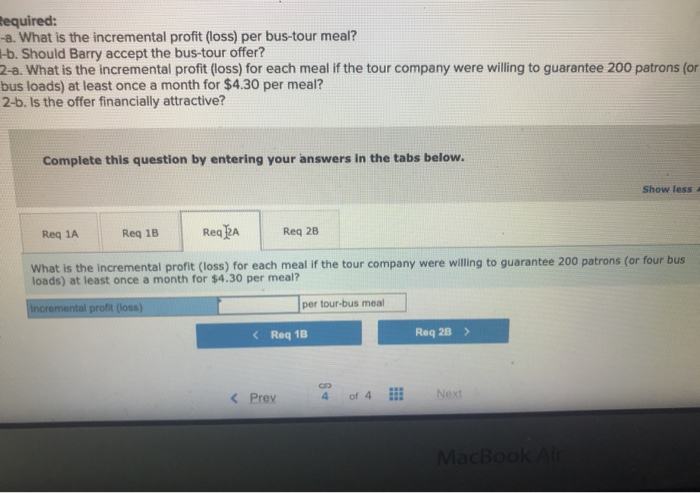

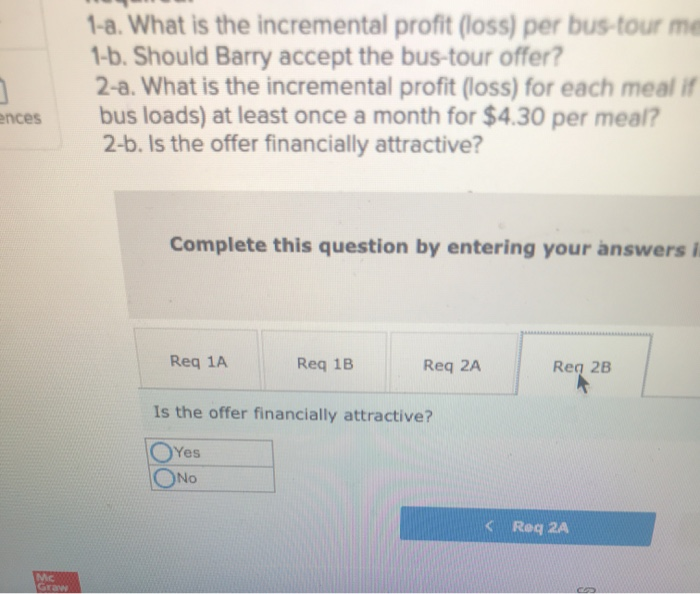

Check my work Make or Buy Terry Inc. manufactures machine parts for aircraft engines. CEO Bucky Walters is considering an offer from a subcontractor to provide 1,900 units of product OP89 for $95,000. If Terry does not purchase these parts from the subcontractor, it must continue to produce them in-house with these costs: Direct materials Direct labor Variable overhead Allocated fixed overhead Cost per Unit $ 25 15 13 $ Required: 1. What is the relevant cost per unit to make the product internally? 2. What is the estimated Increase or decrease in short-term operating profit of producing the product internally versus purchasing the product from a supplier? es Complete this question by entering your answers in the tabs below. Show less Required 1 Required 2 What is the estimated increase or decrease in short-term operating profit of producing the product internally versus purchasing the product from a supplier? Prev 1 2 3 4 of 4 Next > MacBook [The following information applies to the questions displayed below.) Each of the following situations is independent: Asset Replacement An uninsured boat costing $105,000 was wrecked the first day it was used. It can be either sold as is for $10,500 cash and replaced with a similar boat costing $107.000 or rebuilt for $90,000 and be brand new as far as operating characteristics and looks are concerned. Required: What is the difference in cost between the two options? Difference in cost ences Based on financial considerations, what should the company do? Sell as-is for $10,500 cash and replace with a similar boat costing $107,000. O Rebuild for $90,000 Short-Term Product-Mix Decision DVD Production Company produces two basic types of video games, Flash and Clash. Pertinent data for DVD Production Company follow: Flash $ 350 Clash $ 215 Sales price Costs. Direct materials Direct labor (e $25/hr.) Variable factory overhead Fixed factory overhead Marketing costs (all fixed) Total costs Operating profit 65 100 65 40 30 $ 300 $ 50 35 50 50 30 25 $ 190 $ 25 nices *Based on direct labor hours: 4 direct labor hours (DLHs) per unit of Flash and 2 DLHs per unit of Clash. The DVD game craze is at its height so that either Flash or Clash alone can be sold to keep the plant operating at full capacity. However, labor capacity in the plant is insufficient to meet the combined demand for both games. Flash and Clash are processed through the same production departments. Required: 2a. Calculate the contribution margin per labor hour for both Flash and Clash. (Round your answers to 2 decimal places.) Flash Clash Contribution margin per labor hour 2b. Which of the two products should be produced? Flash Clash 9