Answered step by step

Verified Expert Solution

Question

1 Approved Answer

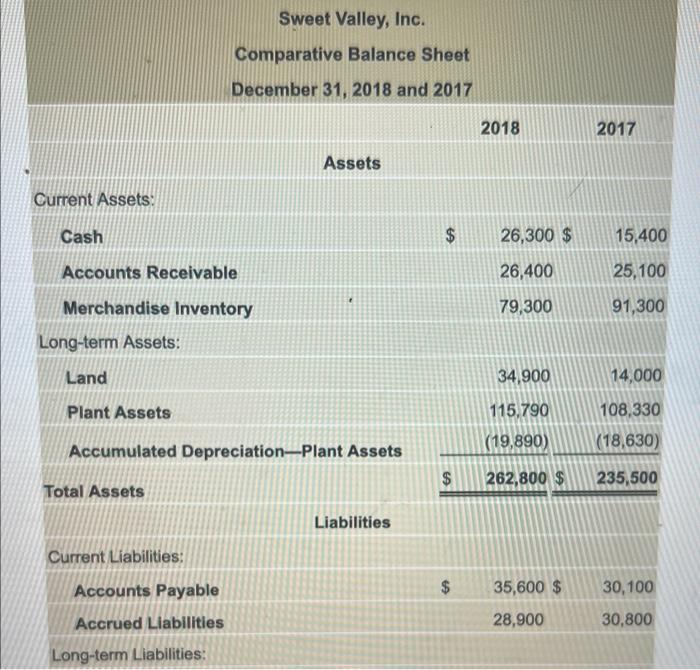

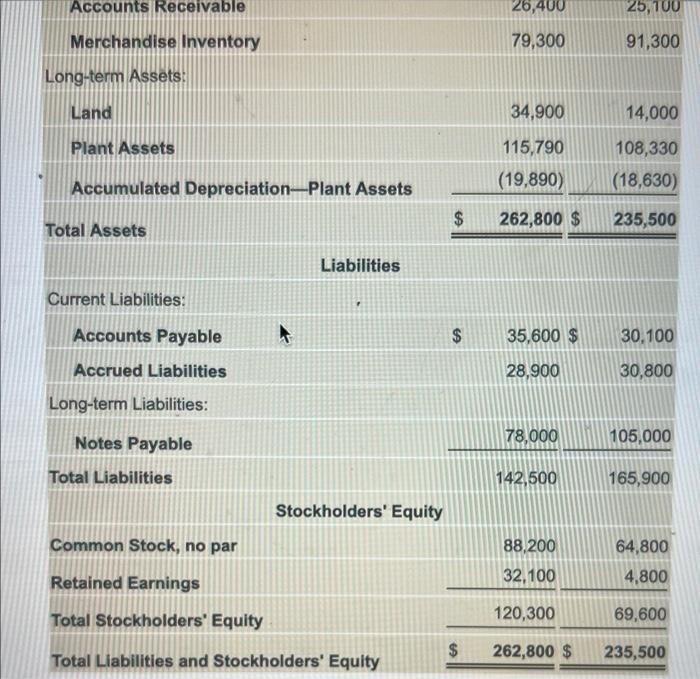

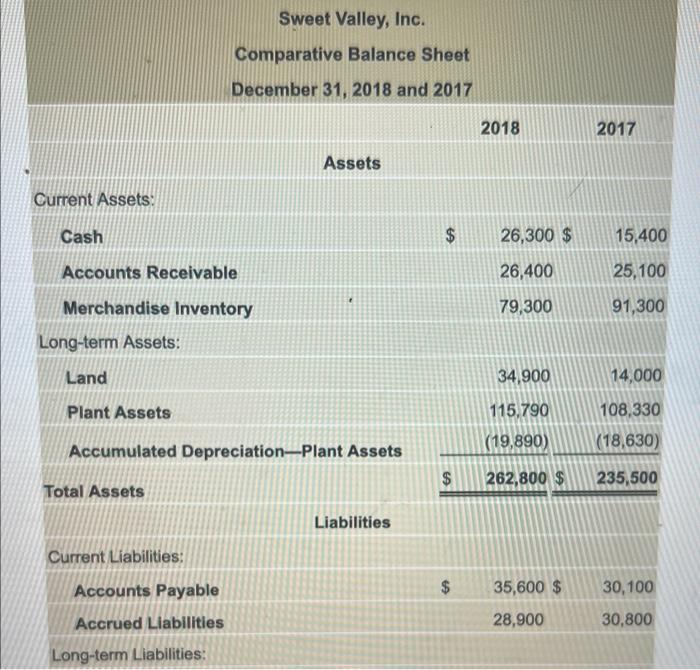

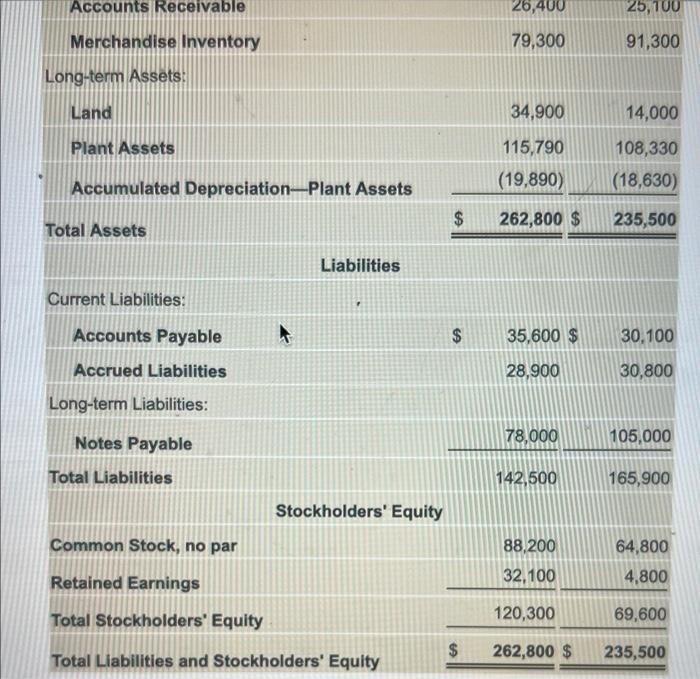

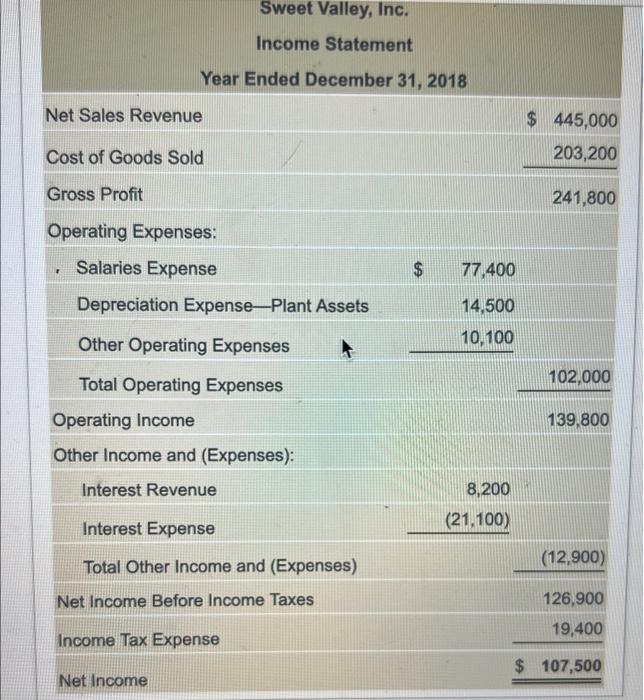

all of this is one question. will give a thumbs up! Sweet Valley, Inc. Comparative Balance Sheet December 31, 2018 and 2017 20182017 Assets Current

all of this is one question. will give a thumbs up!

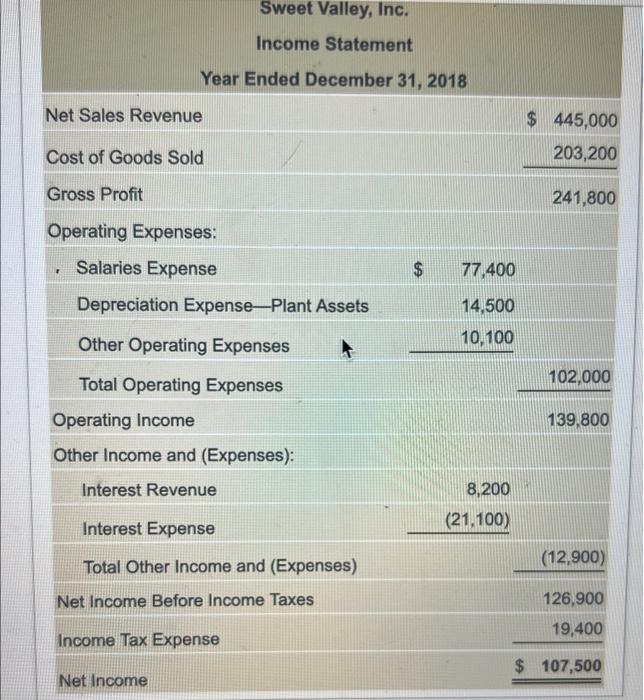

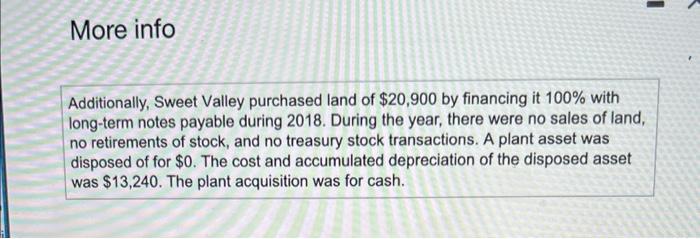

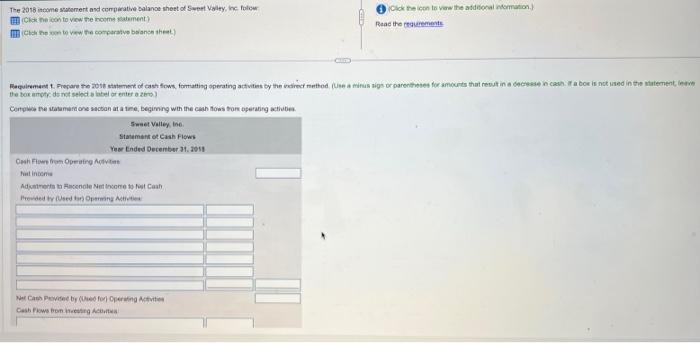

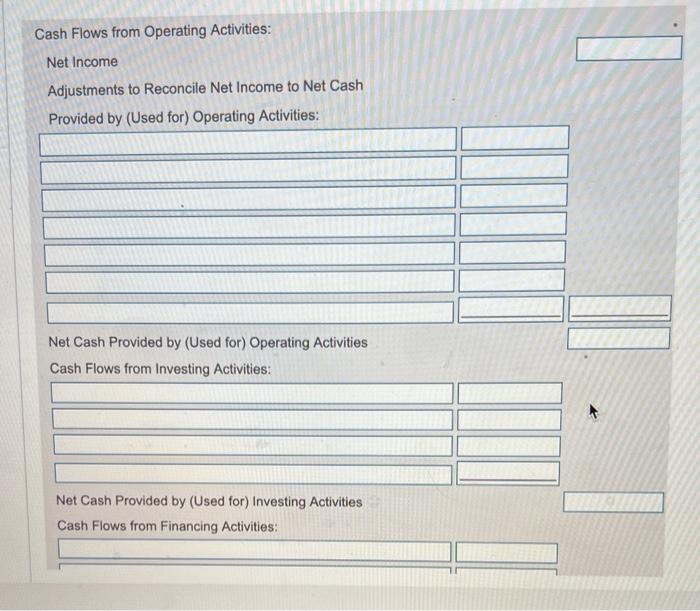

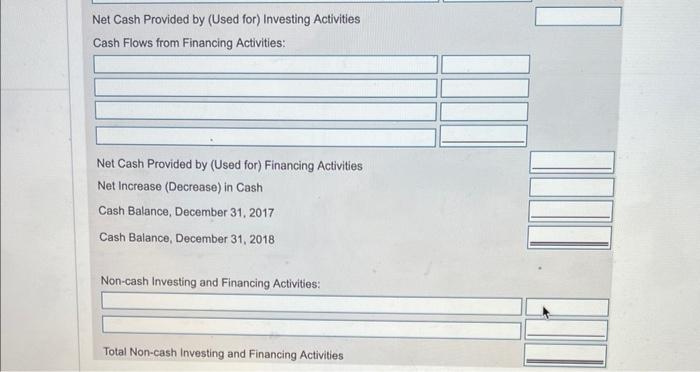

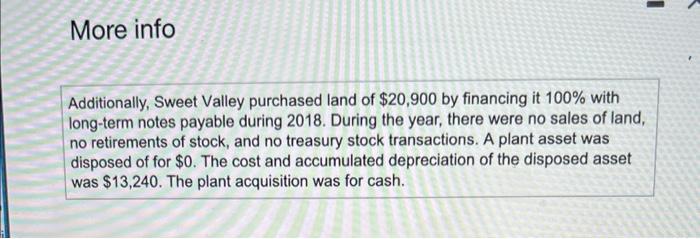

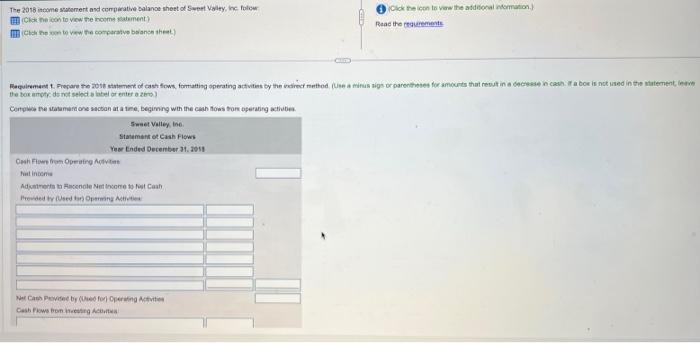

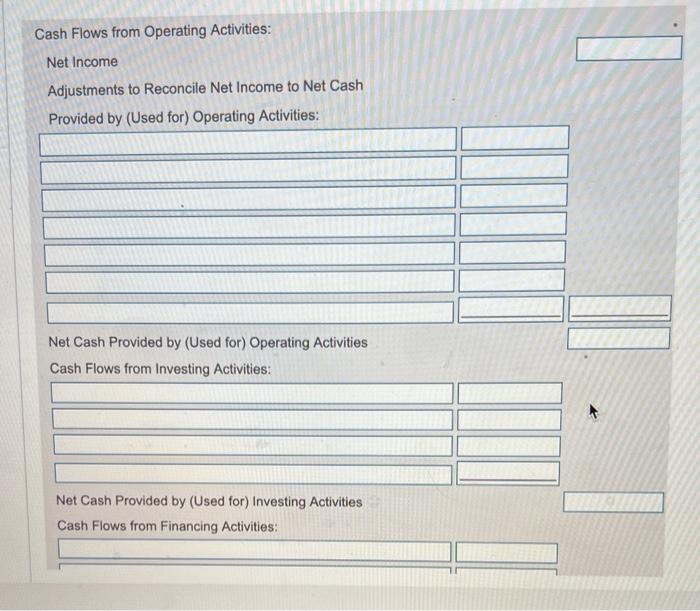

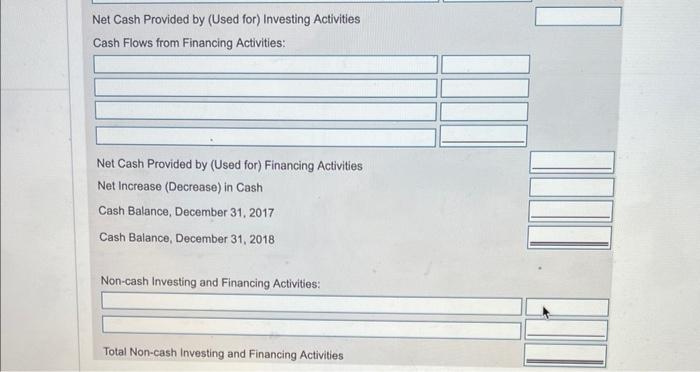

Sweet Valley, Inc. Comparative Balance Sheet December 31, 2018 and 2017 20182017 Assets Current Assets: Cash Accounts Receivable Merchandise Inventory $26,40079,30026,300$25,10091,30015,400 Long-term Assets: Land Plant Assets Accumulated Depreciation-Plant Assets Total Assets Liabilities Current Liabilities: Accounts Payable Accrued Llabilities \begin{tabular}{cc|c} $35,600$ & 30,100 \\ & 28,900 & 30,800 \\ \hline \end{tabular} Long-term Liabilities: Merchandise Inventory 79,30091,300 Long-term Assets: Liabilities Current Liabilities: Accounts Payable Accrued Liabilities \begin{tabular}{rrr|r} $ & 35,600$ & 30,100 \\ 28,900 & 30,800 \end{tabular} Long-term Liabilities: Notes Payable Total Liabilities \begin{tabular}{rr|} 78,000 & 105,000 \\ \hline 142,500 & 165,900 \end{tabular} Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity \begin{tabular}{rrr} \hline 88,200 & 64,800 \\ 32,100 & 4,800 \\ \hline 120,300 & 69,600 \\ \hline 262,800 & $235,500 \\ \hline \end{tabular} Sweet Valley, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit 241,800 Operating Expenses: \begin{tabular}{lrr} - Salaries Expense & $ & 77,400 \\ \hline Depreciation Expense-Plant Assets & 14,500 \\ \hline Other Operating Expenses & 10,100 \\ \hline Total Operating Expenses & & 102,000 \\ \hline Operating Income & 139,800 \end{tabular} Other Income and (Expenses): Interest Revenue 8,200 \begin{tabular}{lrr} & Interest Expense & (21,100) \\ \hline Total Other Income and (Expenses) & (12,900) \\ \hline Net income Before Income Taxes & 126,900 \\ Income Tax Expense & 19,400 \\ \hline Net Income & $107,500 \\ \hline \end{tabular} More info Additionally, Sweet Valley purchased land of $20,900 by financing it 100% with long-term notes payable during 2018. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $13,240. The plant acquisition was for cash. The 2018 itrome sabenert asd cempirative balanos sheet of Sweet Volry, he folcow (Clok he con to vow the addeforal momuasion.) (Clak he icon to vicw the nosma kalernent] [Ctely the oin to vaw the comperatye bsianon thet.) Reac the rrauarements Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Requirement 2. How will what you leamed in this problem help you evaluate an investment? A. Leam how operating activities, investing activities, and financing activities generate cash receipts and cash pmyments B. Leam how to predict future cash fows, evaluate management decitions, and predict the ability of the company fo pay their debes and dividends C. Both A and 8 D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started