Answered step by step

Verified Expert Solution

Question

1 Approved Answer

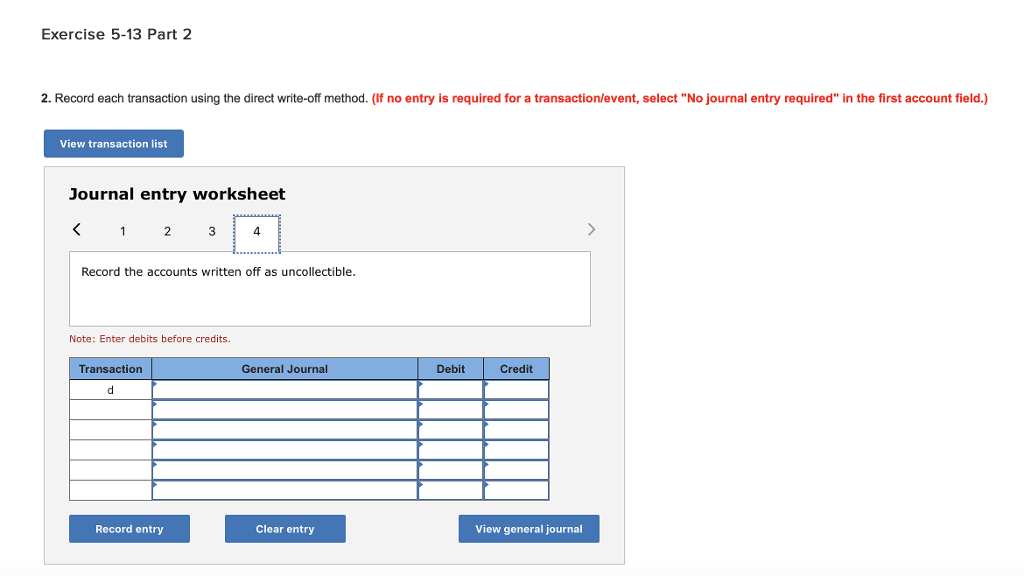

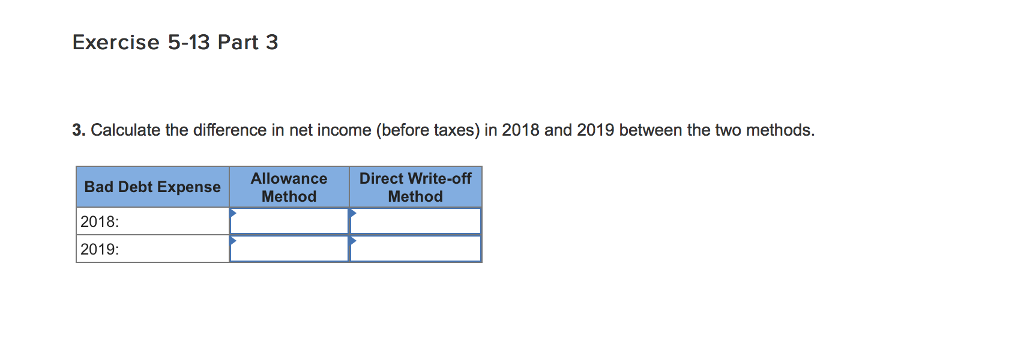

All one homework question based on the information in the top photo! thankyou! sorry for the bad pictures before!! Exercise 5-13 Compare the allowance method

All one homework question based on the information in the top photo! thankyou! sorry for the bad pictures before!!

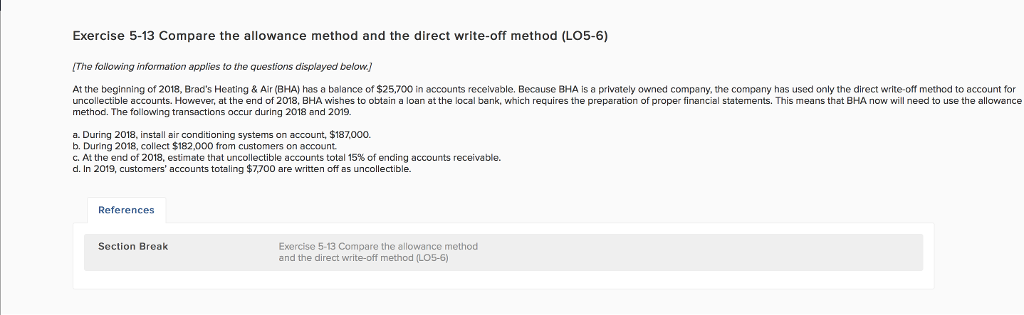

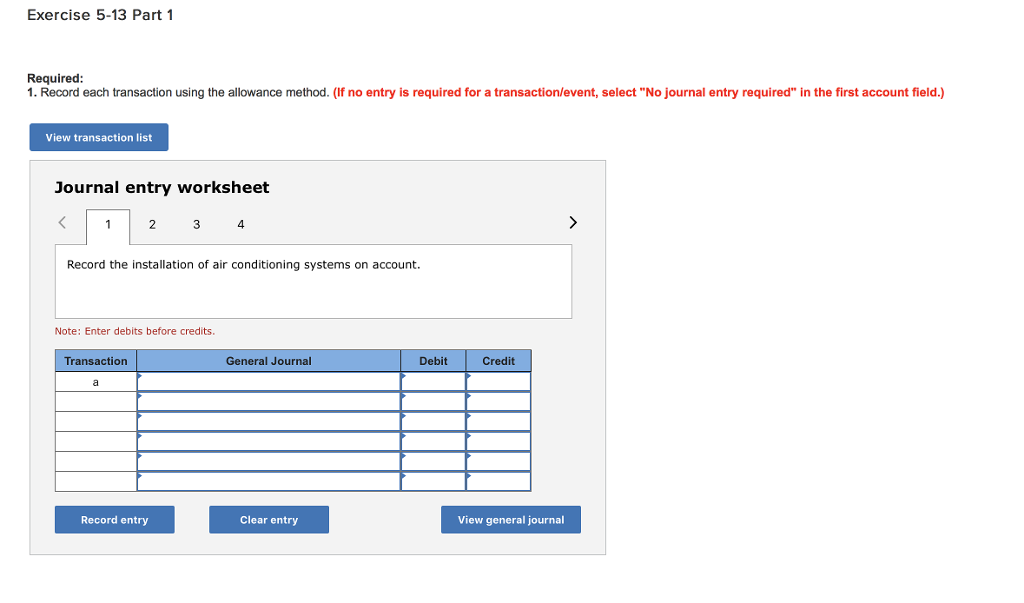

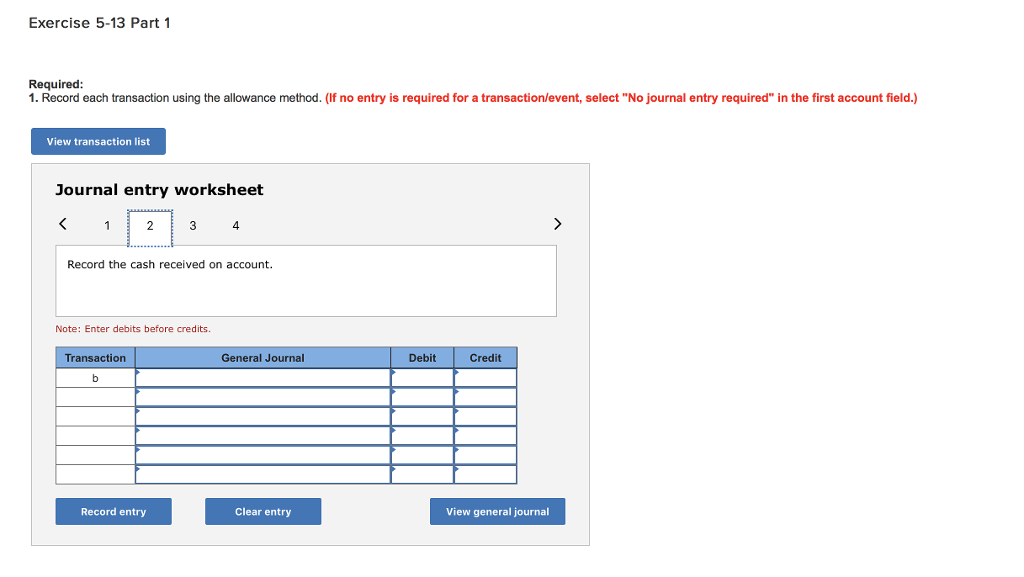

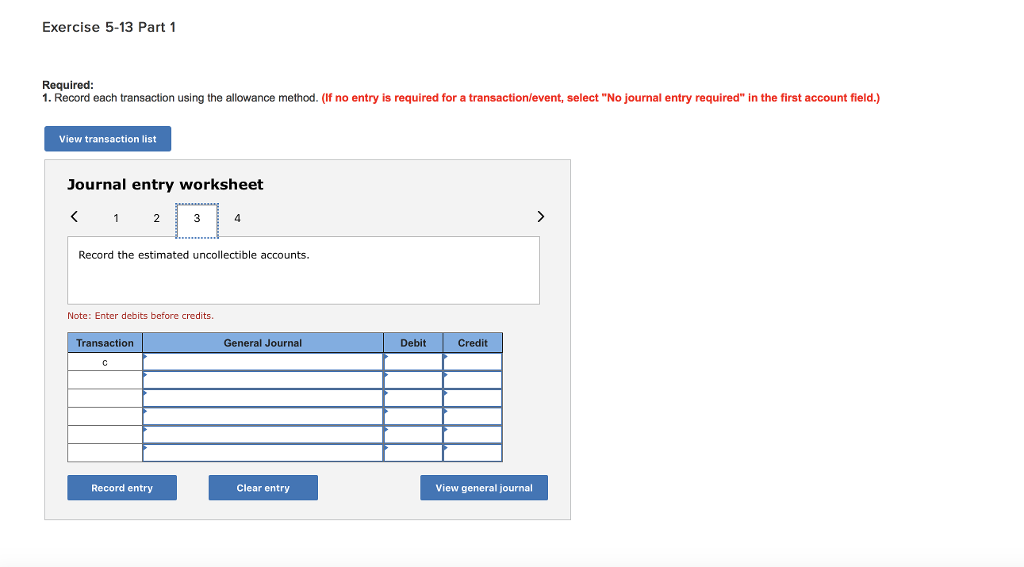

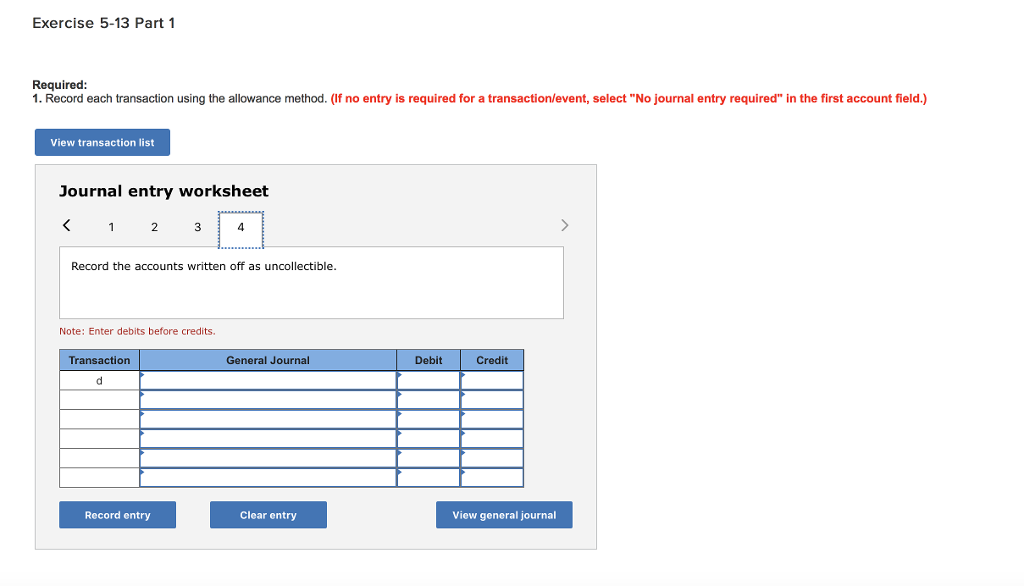

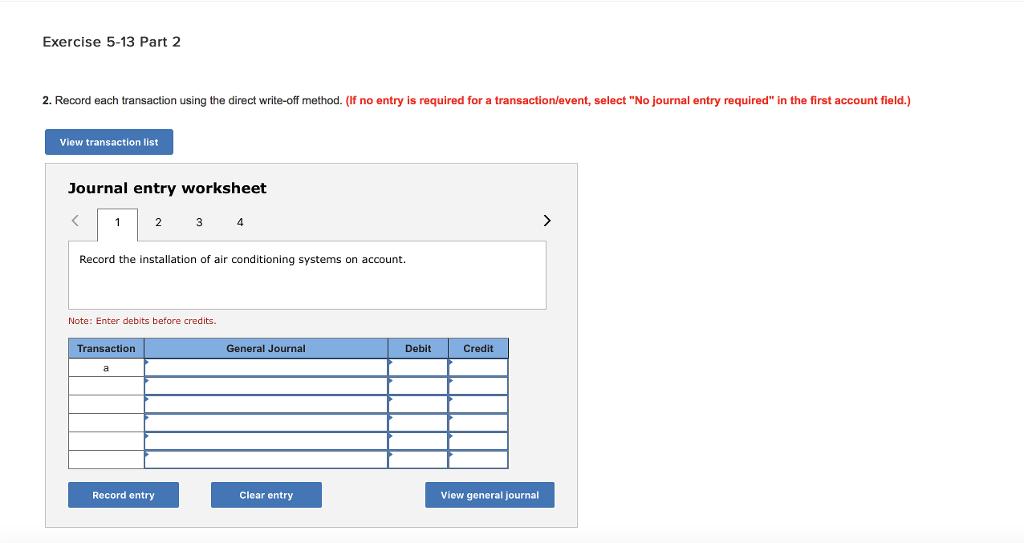

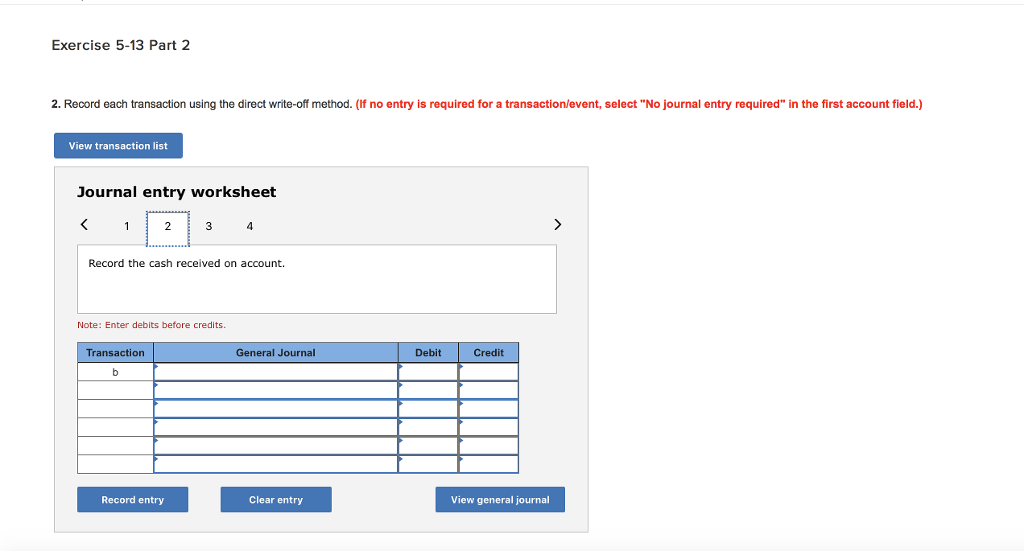

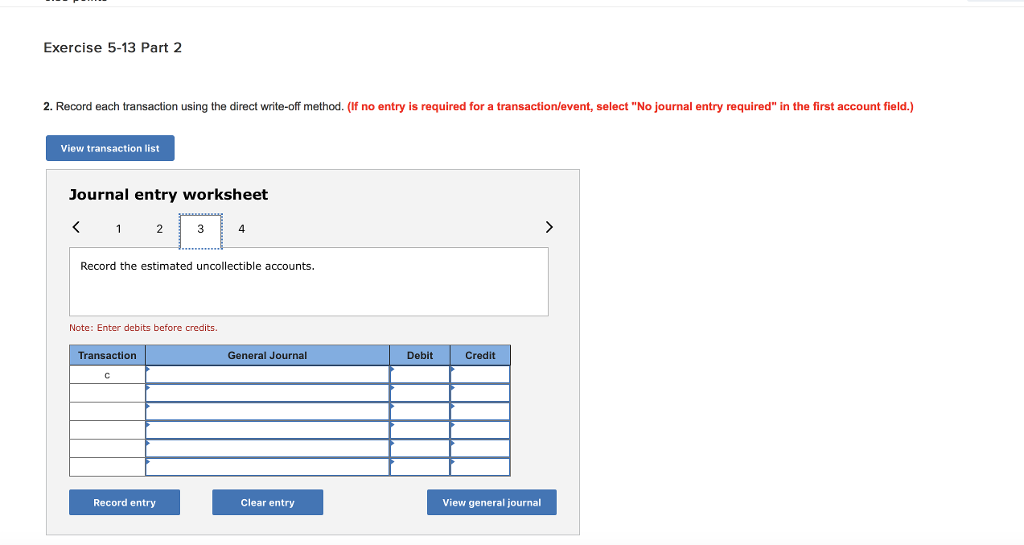

Exercise 5-13 Compare the allowance method and the direct write-off method (LO5-6) The following inforrnation applies to the questions displayed below At the beginning of 2018, Brad's Heating& Air (BHA) has a balance of $25,700 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2018, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2018 and 2019. a. During 2018, install air conditioning systems on account, $187,000. b. During 2018, collect $182,000 from customers on account. C. At the end of 2018, estimate that uncollectible accounts total 15% of ending accounts receivable. d. In 2019, customers' accounts totaling $7700 are written off as uncollectible. References Section Break Exercise 5-13 Compare the allowance method and the direct write-off method (LOS-6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started