Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all one problem Comprehensive Problem - Fred Silverman began a business called Silverman Accounting Service on March 1, 2022. You have just been hired as

all one problem

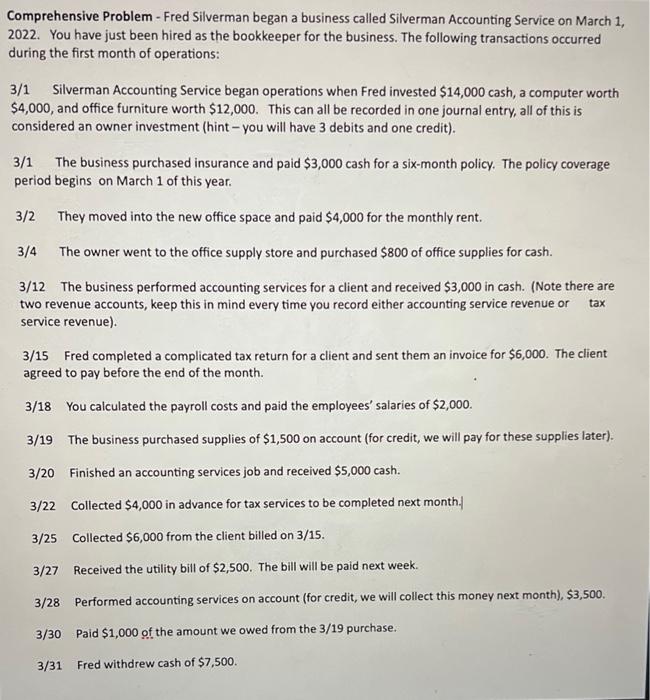

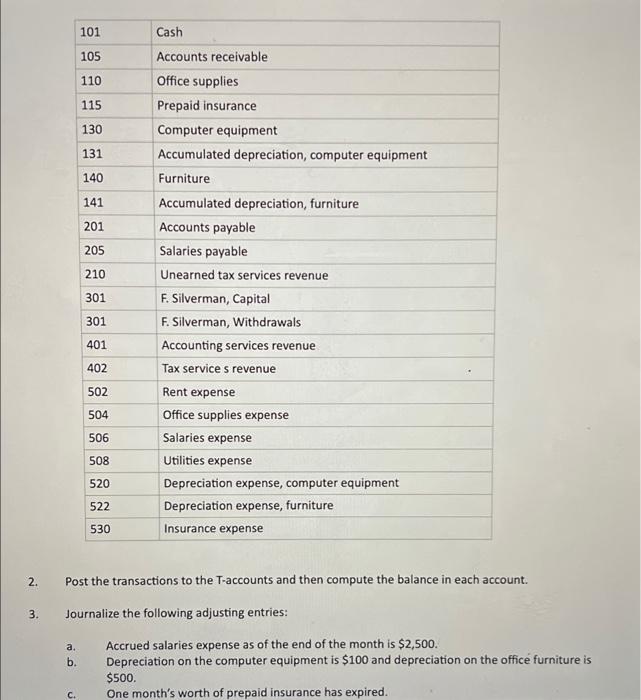

Comprehensive Problem - Fred Silverman began a business called Silverman Accounting Service on March 1, 2022. You have just been hired as the bookkeeper for the business. The following transactions occurred during the first month of operations: 3/1 Silverman Accounting Service began operations when Fred invested $14,000 cash, a computer worth $4,000, and office furniture worth $12,000. This can all be recorded in one journal entry, all of this is considered an owner investment (hint-you will have 3 debits and one credit). 3/1 The business purchased insurance and paid $3,000 cash for a six-month policy. The policy coverage period begins on March 1 of this year. 3/2 They moved into the new office space and paid $4,000 for the monthly rent. 3/4 The owner went to the office supply store and purchased $800 of office supplies for cash. 3/12 The business performed accounting services for a client and received $3,000 in cash. (Note there are two revenue accounts, keep this in mind every time you record either accounting service revenue or tax service revenue). 3/15 Fred completed a complicated tax return for a client and sent them an invoice for $6,000. The client agreed to pay before the end of the month. 3/18 You calculated the payroll costs and paid the employees' salaries of $2,000. 3/19 The business purchased supplies of $1,500 on account (for credit, we will pay for these supplies later). 3/20 Finished an accounting services job and received $5,000 cash. 3/22 Collected $4,000 in advance for tax services to be completed next month. 3/25 Collected $6,000 from the client billed on 3/15. 3/27 Received the utility bill of $2,500. The bill will be paid next week. 3/28 Performed accounting services on account (for credit, we will collect this money next month), $3,500. 3/30 Paid $1,000 of the amount we owed from the 3/19 purchase. 3/31 Fred withdrew cash of $7,500. 101 Cash 105 Accounts receivable 110 Office supplies 115 Prepaid insurance 130 Computer equipment 131 Accumulated depreciation, computer equipment 140 Furniture 141 Accumulated depreciation, furniture 201 Accounts payable 205 Salaries payable 210 Unearned tax services revenue 301 F.Silverman, Capital 301 F.Silverman, Withdrawals 401 Accounting services revenue 402 Tax service s revenue 502 Rent expense 504 Office supplies expense 506 Salaries expense 508 Utilities expense 520 Depreciation expense, computer equipment 522 Depreciation expense, furniture 530 Insurance expense 2. Post the transactions to the T-accounts and then compute the balance in each account. 3. Journalize the following adjusting entries: a. Accrued salaries expense as of the end of the month is $2,500. b. Depreciation on the computer equipment is $100 and depreciation on the office furniture is $500. One month's worth of prepaid insurance has expired. C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started