Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all one question!!! answer both parts for thumbs up!!!! Times Corporation, whose tax rate is 35%, has two sources of funds: long-term debt with a

all one question!!! answer both parts for thumbs up!!!!

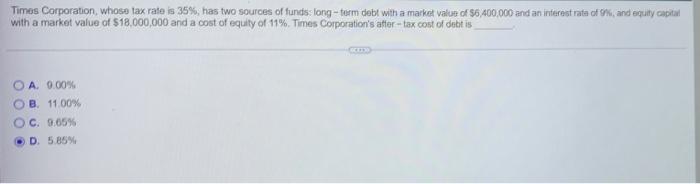

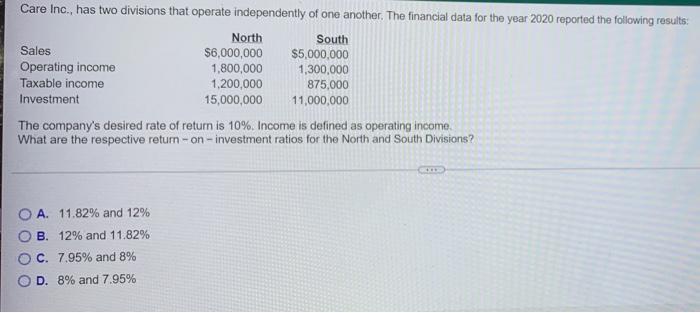

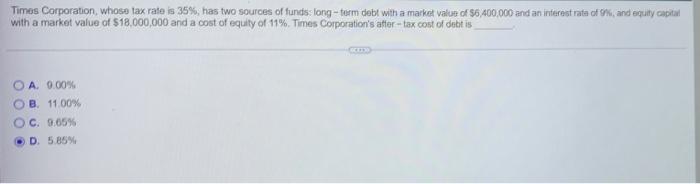

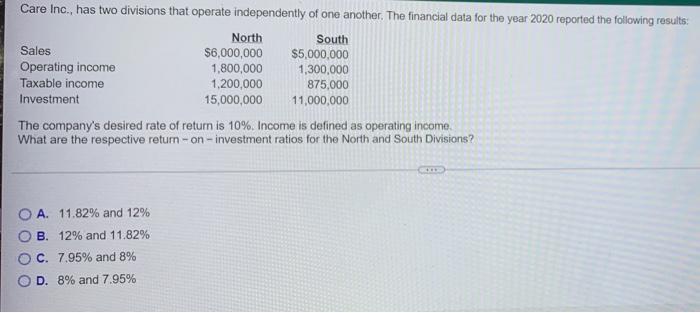

Times Corporation, whose tax rate is 35%, has two sources of funds: long-term debt with a market value of $6,400,000 and an interest rate of 9%, and equity capital with a market value of $18,000,000 and a cost of equity of 11%. Times Corporation's after-tax cost of debt is KU OA. 0.00% B. 11.00% C. 9.65 % D. 5.85 % Care Inc., has two divisions that operate independently of one another. The financial data for the year 2020 reported the following results: North South Sales $5,000,000 $6,000,000 1,800,000 Operating income 1,300,000 Taxable income 1,200,000 875,000 Investment 15,000,000 11,000,000 The company's desired rate of return is 10%. Income is defined as operating income. What are the respective return-on-investment ratios for the North and South Divisions? Comme A. 11.82% and 12% B. 12% and 11.82% C. 7.95% and 8% D. 8% and 7.95%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started