all one question just matching!!! thank you!!! itll help a lot especially since i dont have enough funds for the book!!!

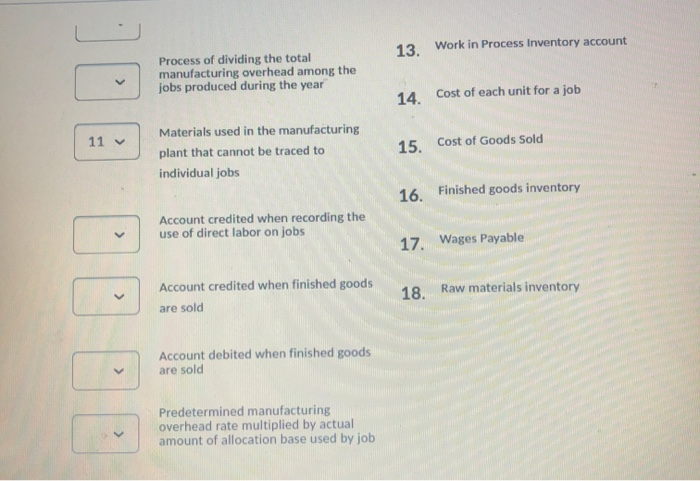

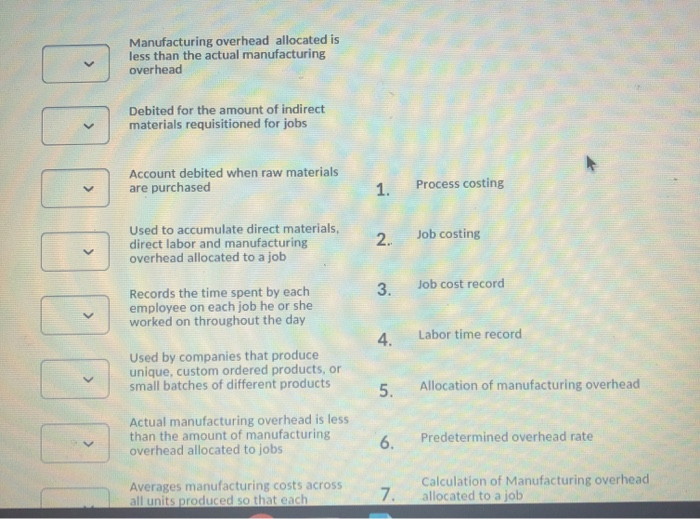

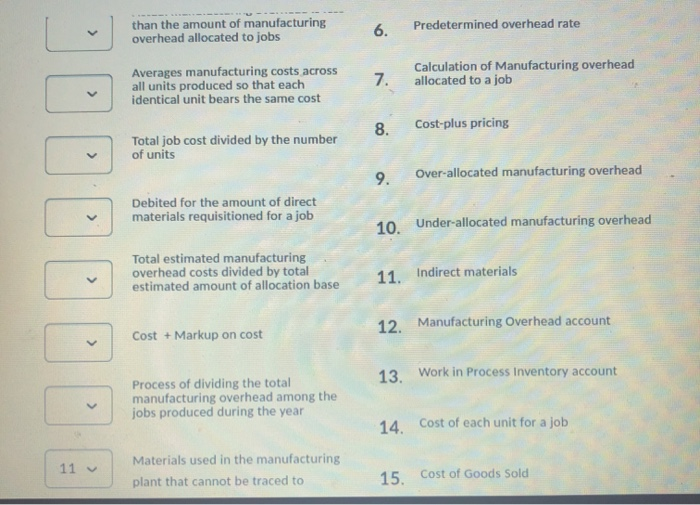

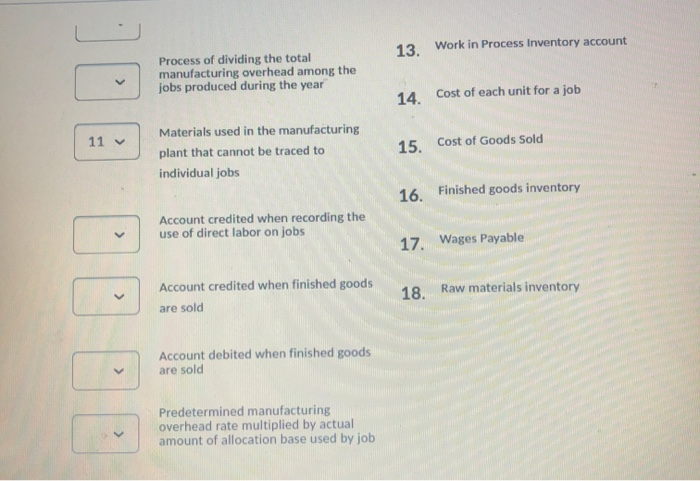

Manufacturing overhead allocated is less than the actual manufacturing overhead Debited for the amount of indirect materials requisitioned for jobs Account debited when raw materials are purchased 1 Process costing 2 Job costing DODDODD Used to accumulate direct materials, direct labor and manufacturing overhead allocated to a job 3. Job cost record Records the time spent by each employee on each job he or she worked on throughout the day Labor time record Used by companies that produce unique, custom ordered products, or small batches of different products 5. Allocation of manufacturing overhead Actual manufacturing overhead is less than the amount of manufacturing overhead allocated to jobs 6. Predetermined overhead rate Averages manufacturing costs across all units produced so that each 7. Calculation of Manufacturing overhead allocated to a job than the amount of manufacturing overhead allocated to jobs 6. Predetermined overhead rate Averages manufacturing costs across all units produced so that each identical unit bears the same cost Calculation of Manufacturing overhead allocated to a job Cost-plus pricing Total job cost divided by the number of units Over-allocated manufacturing overhead Debited for the amount of direct materials requisitioned for a job 10 Under-allocated manufacturing overhead Total estimated manufacturing overhead costs divided by total estimated amount of allocation base 11. Indirect materials 12. Manufacturing Overhead account Cost + Markup on cost 13 Work in Process Inventory account Process of dividing the total manufacturing overhead among the jobs produced during the year 14. Cost of each unit for a job 11 v Materials used in the manufacturing plant that cannot be traced to 15. Cost of Goods Sold 13. Work in Process Inventory account Process of dividing the total manufacturing overhead among the jobs produced during the year 14. Cost of each unit for a job 11 v Materials used in the manufacturing plant that cannot be traced to individual jobs 15. Cost of Goods Sold 16. Finished goods inventory Account credited when recording the use of direct labor on jobs los 17. Wages Payable 18. Raw materials inventory Account credited when finished goods are sold Account debited when finished goods are sold Predetermined manufacturing overhead rate multiplied by actual amount of allocation base used by job

all one question just matching!!! thank you!!! itll help a lot especially since i dont have enough funds for the book!!!

all one question just matching!!! thank you!!! itll help a lot especially since i dont have enough funds for the book!!!