Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ALL ONE QUESTION. PLEASE ANSWER ALL PARTS. thank you for solving! You need a new car and the dealer has offered you a price of

ALL ONE QUESTION. PLEASE ANSWER ALL PARTS. thank you for solving!

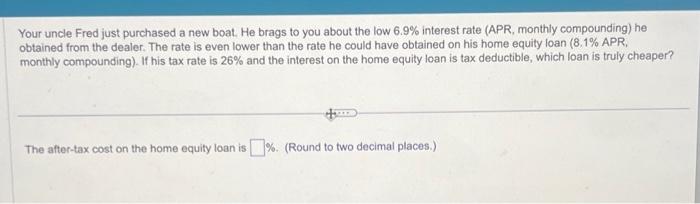

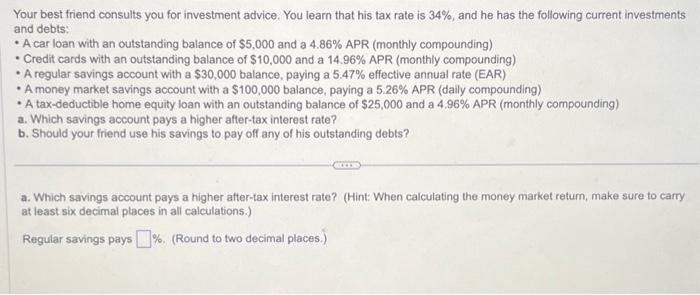

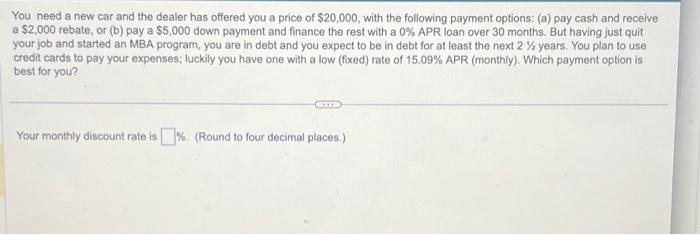

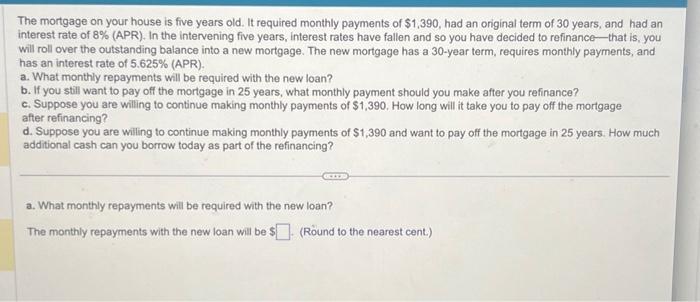

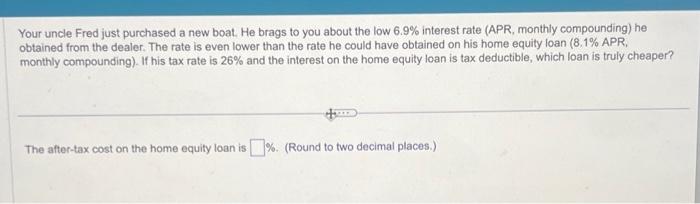

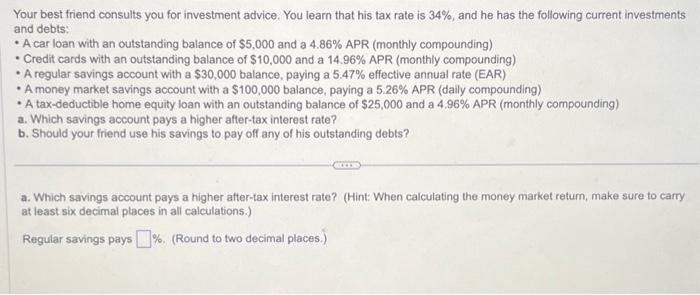

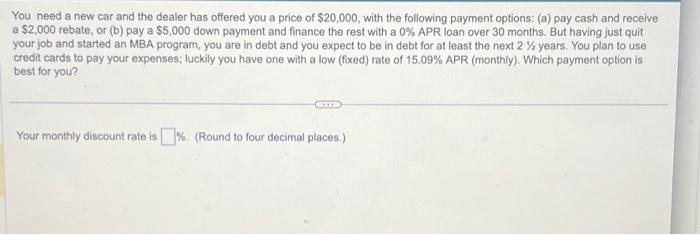

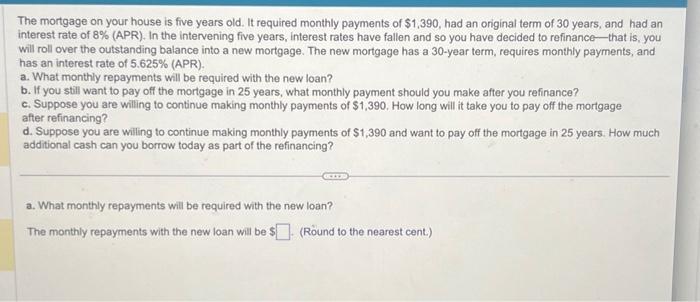

You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2,000 rebate, or (b) pay a $5,000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 21/2 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15.09% APR (monthly). Which payment option is best for you? Your monthly discount rate is \%. (Round to four decimal places.) Your uncle Fred just purchased a new boat. He brags to you about the low 6.9% interest rate (APR, monthly compounding) he obtained from the dealer. The rate is even lower than the rate he could have obtained on his home equity loan (8.1% APR, monthly compounding). If his tax rate is 26% and the interest on the home equity loan is tax deductible, which loan is truly cheaper? The after-tax cost on the home equity loan is \%. (Round to two decimal places.) The mortgage on your house is five years old. It required monthly payments of $1,390, had an original term of 30 years, and had an interest rate of 8% (APR). In the intervening five years, interest rates have fallen and so you have decided to refinance-that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 30 -year term, requires monthly payments, and has an interest rate of 5.625% (APR). a. What monthly repayments will be required with the new loan? b. If you still want to pay off the mortgage in 25 years, what monthly payment should you make after you refinance? c. Suppose you are willing to continue making monthly payments of $1,390. How long will it take you to pay off the mortgage after refinancing? d. Suppose you are willing to continue making monthly payments of $1,390 and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the refinancing? a. What monthly repayments will be required with the new loan? The monthly repayments with the new loan will bes (Round to the nearest cent.) Your best friend consults you for investment advice. You learn that his tax rate is 34%, and he has the following current investments and debts: - A car loan with an outstanding balance of $5,000 and a 4.86% APR (monthly compounding) - Credit cards with an outstanding balance of $10,000 and a 14.96% APR (monthly compounding) - A regular savings account with a $30,000 balance, paying a 5.47% effective annual rate (EAR) - A money market savings account with a $100,000 balance, paying a 5.26% APR (daily compounding) - A tax-deductible home equity loan with an outstanding balance of $25,000 and a 4.96% APR (monthly compounding) a. Which savings account pays a higher after-tax interest rate? b. Should your friend use his savings to pay off any of his outstanding debts? a. Which savings account pays a higher after-tax interest rate? (Hint: When calculating the money market return, make sure to carry at least six decimal places in all calculations.) Regular savings pays %. (Round to two decimal places.)

You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2,000 rebate, or (b) pay a $5,000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 21/2 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15.09% APR (monthly). Which payment option is best for you? Your monthly discount rate is \%. (Round to four decimal places.) Your uncle Fred just purchased a new boat. He brags to you about the low 6.9% interest rate (APR, monthly compounding) he obtained from the dealer. The rate is even lower than the rate he could have obtained on his home equity loan (8.1% APR, monthly compounding). If his tax rate is 26% and the interest on the home equity loan is tax deductible, which loan is truly cheaper? The after-tax cost on the home equity loan is \%. (Round to two decimal places.) The mortgage on your house is five years old. It required monthly payments of $1,390, had an original term of 30 years, and had an interest rate of 8% (APR). In the intervening five years, interest rates have fallen and so you have decided to refinance-that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 30 -year term, requires monthly payments, and has an interest rate of 5.625% (APR). a. What monthly repayments will be required with the new loan? b. If you still want to pay off the mortgage in 25 years, what monthly payment should you make after you refinance? c. Suppose you are willing to continue making monthly payments of $1,390. How long will it take you to pay off the mortgage after refinancing? d. Suppose you are willing to continue making monthly payments of $1,390 and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the refinancing? a. What monthly repayments will be required with the new loan? The monthly repayments with the new loan will bes (Round to the nearest cent.) Your best friend consults you for investment advice. You learn that his tax rate is 34%, and he has the following current investments and debts: - A car loan with an outstanding balance of $5,000 and a 4.86% APR (monthly compounding) - Credit cards with an outstanding balance of $10,000 and a 14.96% APR (monthly compounding) - A regular savings account with a $30,000 balance, paying a 5.47% effective annual rate (EAR) - A money market savings account with a $100,000 balance, paying a 5.26% APR (daily compounding) - A tax-deductible home equity loan with an outstanding balance of $25,000 and a 4.96% APR (monthly compounding) a. Which savings account pays a higher after-tax interest rate? b. Should your friend use his savings to pay off any of his outstanding debts? a. Which savings account pays a higher after-tax interest rate? (Hint: When calculating the money market return, make sure to carry at least six decimal places in all calculations.) Regular savings pays %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started