Answered step by step

Verified Expert Solution

Question

1 Approved Answer

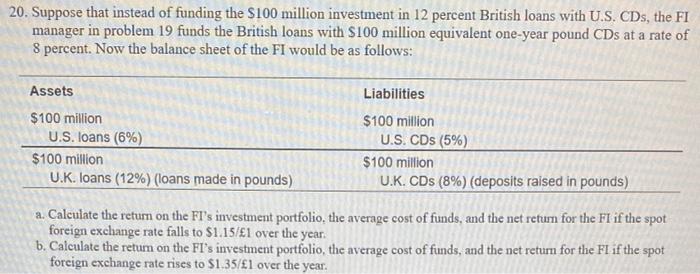

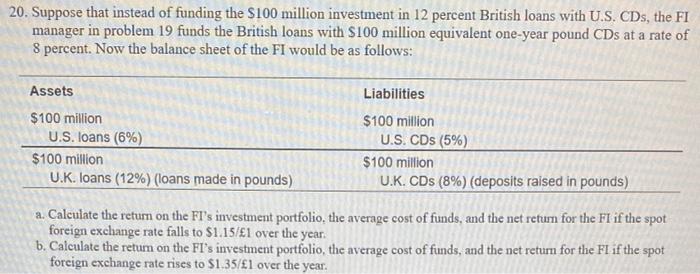

all parts, A & B 20. Suppose that instead of funding the $100 million investment in 12 percent British loans with U.S. CDs, the FI

all parts, A & B

20. Suppose that instead of funding the $100 million investment in 12 percent British loans with U.S. CDs, the FI manager in problem 19 funds the British loans with $100 million equivalent one-year pound CDs at a rate of 8 percent. Now the balance sheet of the FI would be as follows: a. Calculate the retum on the FI's investment portfolio, the average cost of funds, and the net retum for the FI if the spot foreign exchange rate falls to $1.15/1 over the year. b. Calculate the retum on the FI's investment portfolio, the average cost of funds, and the net return for the FI if the spot foreign exchange rate rises to $1.35/1 over the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started