Answered step by step

Verified Expert Solution

Question

1 Approved Answer

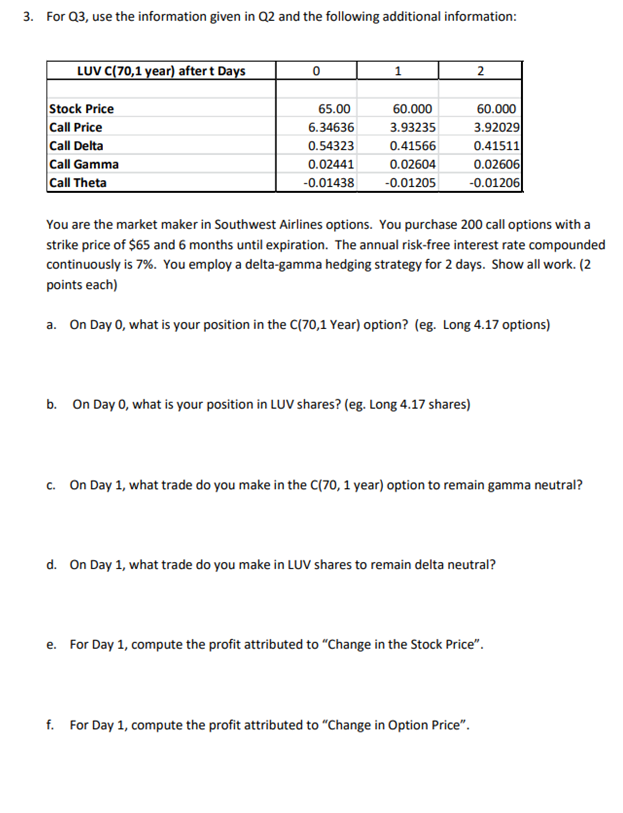

ALL parts A-M please 3. For Q3, use the information given in Q2 and the following additional information: You are the market maker in Southwest

ALL parts A-M please

ALL parts A-M please

3. For Q3, use the information given in Q2 and the following additional information: You are the market maker in Southwest Airlines options. You purchase 200 call options with a strike price of $65 and 6 months until expiration. The annual risk-free interest rate compounded continuously is 7\%. You employ a delta-gamma hedging strategy for 2 days. Show all work. (2 points each) a. On Day 0 , what is your position in the C(70,1 Year) option? (eg. Long 4.17 options) b. On Day 0 , what is your position in LUV shares? (eg. Long 4.17 shares) c. On Day 1 , what trade do you make in the C(70,1 year) option to remain gamma neutral? d. On Day 1, what trade do you make in LUV shares to remain delta neutral? e. For Day 1, compute the profit attributed to "Change in the Stock Price". f. For Day 1, compute the profit attributed to "Change in Option Price". g. For Day 1 , compute your total profit from delta-gamma hedging on Day 1. h. On Day 2, what trade do you make in the C(70,1 year) option to remain gamma neutrality? i. On Day 2, what trade do you make in LUV shares to remain delta neutrality? j. For Day 2, compute the profit attributed to "Change in the Stock Price". k. For Day 2, compute the profit attributed to "Change in Option Price". I. For Day 2, compute your total profit from delta-gamma hedging on Day 2. m. Using the Delta-Gamma-Theta approximation, estimate the Option price on Day 1 using the information given. (=$5.00 and h=1 day) 3. For Q3, use the information given in Q2 and the following additional information: You are the market maker in Southwest Airlines options. You purchase 200 call options with a strike price of $65 and 6 months until expiration. The annual risk-free interest rate compounded continuously is 7\%. You employ a delta-gamma hedging strategy for 2 days. Show all work. (2 points each) a. On Day 0 , what is your position in the C(70,1 Year) option? (eg. Long 4.17 options) b. On Day 0 , what is your position in LUV shares? (eg. Long 4.17 shares) c. On Day 1 , what trade do you make in the C(70,1 year) option to remain gamma neutral? d. On Day 1, what trade do you make in LUV shares to remain delta neutral? e. For Day 1, compute the profit attributed to "Change in the Stock Price". f. For Day 1, compute the profit attributed to "Change in Option Price". g. For Day 1 , compute your total profit from delta-gamma hedging on Day 1. h. On Day 2, what trade do you make in the C(70,1 year) option to remain gamma neutrality? i. On Day 2, what trade do you make in LUV shares to remain delta neutrality? j. For Day 2, compute the profit attributed to "Change in the Stock Price". k. For Day 2, compute the profit attributed to "Change in Option Price". I. For Day 2, compute your total profit from delta-gamma hedging on Day 2. m. Using the Delta-Gamma-Theta approximation, estimate the Option price on Day 1 using the information given. (=$5.00 and h=1 day)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started