* All parts are required* req a, Req b1, req b2, req c

Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1, 2021, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his sons land is $310,000 with a basis of $290,000.

Required:

a. Calculate Carltons realized and recognized gain or loss from the exchange with his son and on Carltons subsequent sale of the land to a real estate agent on July 19, 2022, for $378,500.

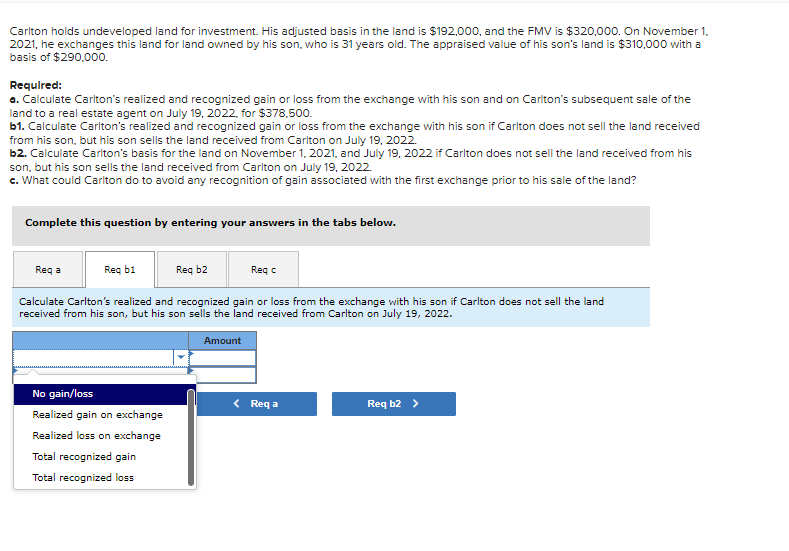

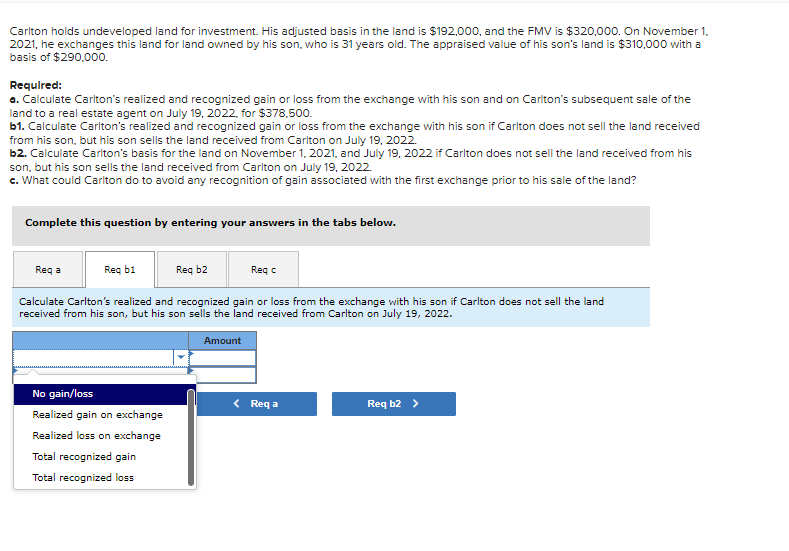

b1. Calculate Carltons realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2022.

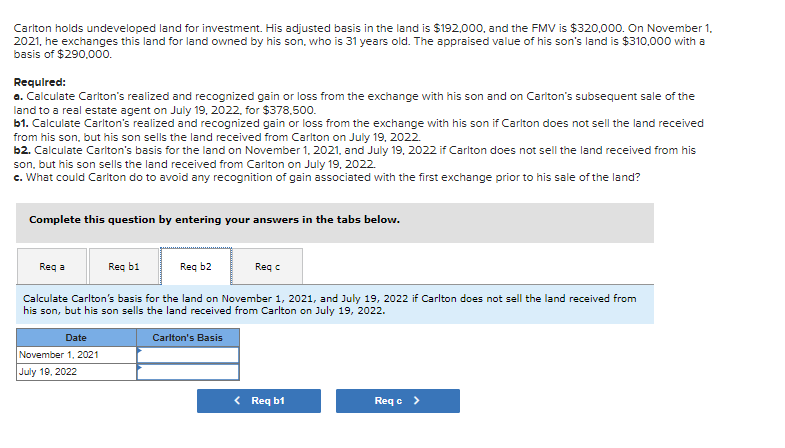

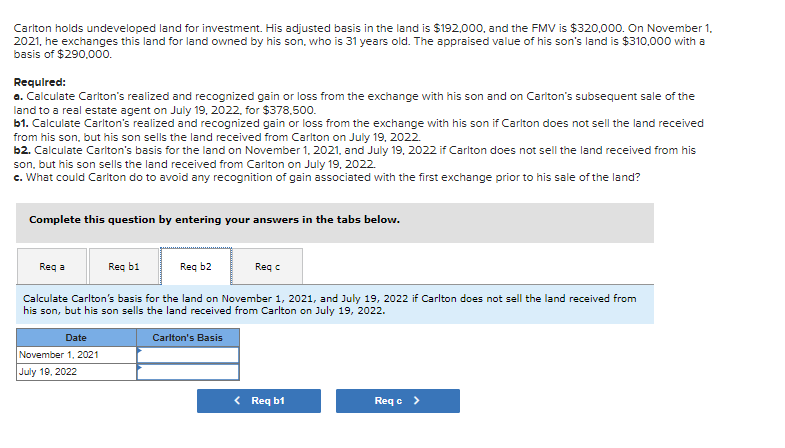

b2. Calculate Carltons basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2022.

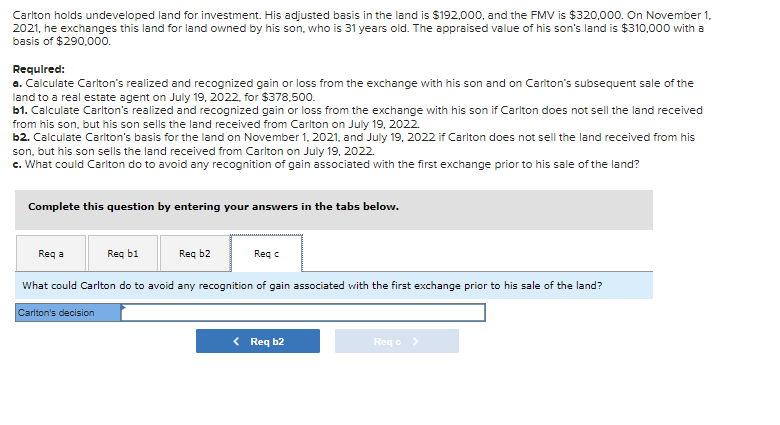

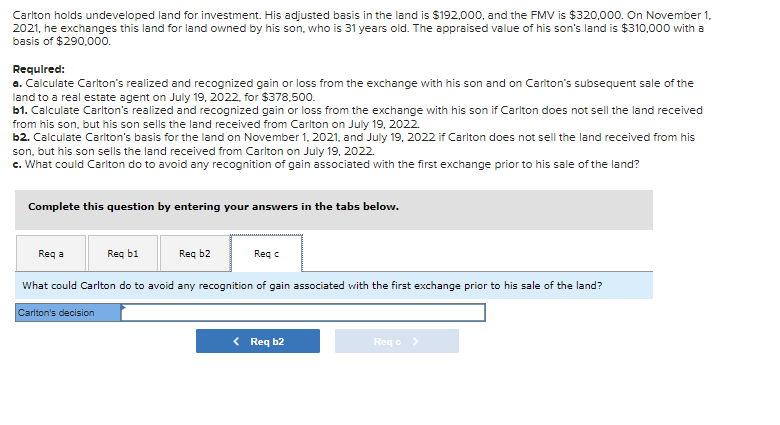

c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land?

Calculate Carltons realized and recognized gain or loss from the exchange with his son and on Carltons subsequent sale of the land to a real estate agent on July 19, 2022, for $378,500.

a.

b.

Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1 . 2021, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: o. Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022. b2. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022. c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2022. Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1 . 2021 , he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: a. Calculate Cariton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19,2022. b2. Calculate Cariton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19,2022. c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19,2022. Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1. 2021, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: a. Calculate Cariton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022 . b2. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19,2022. e. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1 . 2021, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: o. Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022. b2. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022. c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2022. Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1 . 2021 , he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: a. Calculate Cariton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19,2022. b2. Calculate Cariton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19,2022. c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19,2022. Carlton holds undeveloped land for investment. His adjusted basis in the land is $192,000, and the FMV is $320,000. On November 1. 2021, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $310,000 with a basis of $290,000. Required: a. Calculate Cariton's realized and recognized gain or loss from the exchange with his son and on Cariton's subsequent sale of the land to a real estate agent on July 19,2022 , for $378,500. b1. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Cariton on July 19, 2022 . b2. Calculate Carlton's basis for the land on November 1, 2021, and July 19, 2022 if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19,2022. e. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land? Complete this question by entering your answers in the tabs below