Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all parts. Change: Do not provide a formulation. 9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to

all parts. Change: Do not provide a formulation.

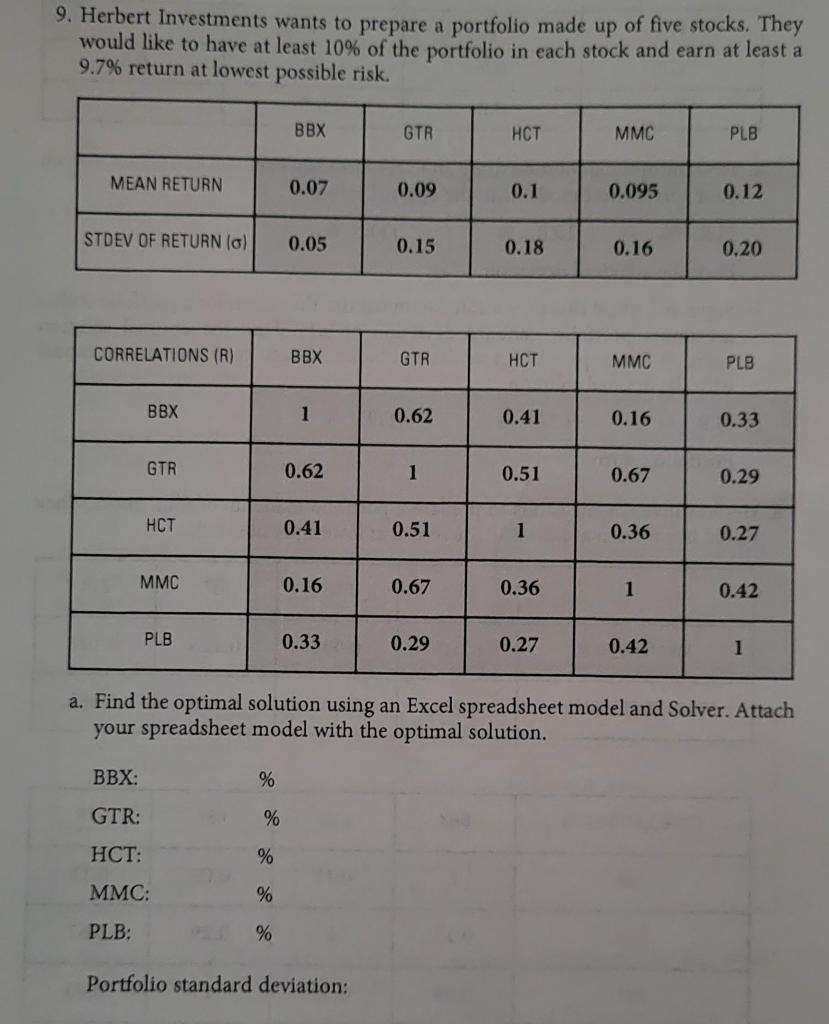

9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to have at least 10% of the portfolio in each stock and earn at least a 9.7% return at lowest possible risk. BBX GTR HCT MMC PLB MEAN RETURN 0.07 0.09 0.1 0.095 0.12 STDEV OF RETURN (0) 0.05 0.15 0.18 0.16 0.20 CORRELATIONS (R) BBX GTR HCT MMC PLB BBX 1 0.62 0.41 0.16 0.33 GTR 0.62 1 0.51 0.67 0.29 HCT 0.41 0.51 1 0.36 0.27 MMC 0.16 0.67 0.36 1 0.42 PLB 0.33 0.29 0.27 0.42 1 a. Find the optimal solution using an Excel spreadsheet model and Solver. Attach your spreadsheet model with the optimal solution. BBX: % GTR: % HCT: % MMC: % PLB: % Portfolio standard deviation: 9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to have at least 10% of the portfolio in each stock and earn at least a 9.7% return at lowest possible risk. BBX GTR HCT MMC PLB MEAN RETURN 0.07 0.09 0.1 0.095 0.12 STDEV OF RETURN (0) 0.05 0.15 0.18 0.16 0.20 CORRELATIONS (R) BBX GTR HCT MMC PLB BBX 1 0.62 0.41 0.16 0.33 GTR 0.62 1 0.51 0.67 0.29 HCT 0.41 0.51 1 0.36 0.27 MMC 0.16 0.67 0.36 1 0.42 PLB 0.33 0.29 0.27 0.42 1 a. Find the optimal solution using an Excel spreadsheet model and Solver. Attach your spreadsheet model with the optimal solution. BBX: % GTR: % HCT: % MMC: % PLB: % Portfolio standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started