Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All parts please! 9. Foolish Fran waited to start saving for her retirement until she was 45 at which point she began putting a monthly

All parts please!

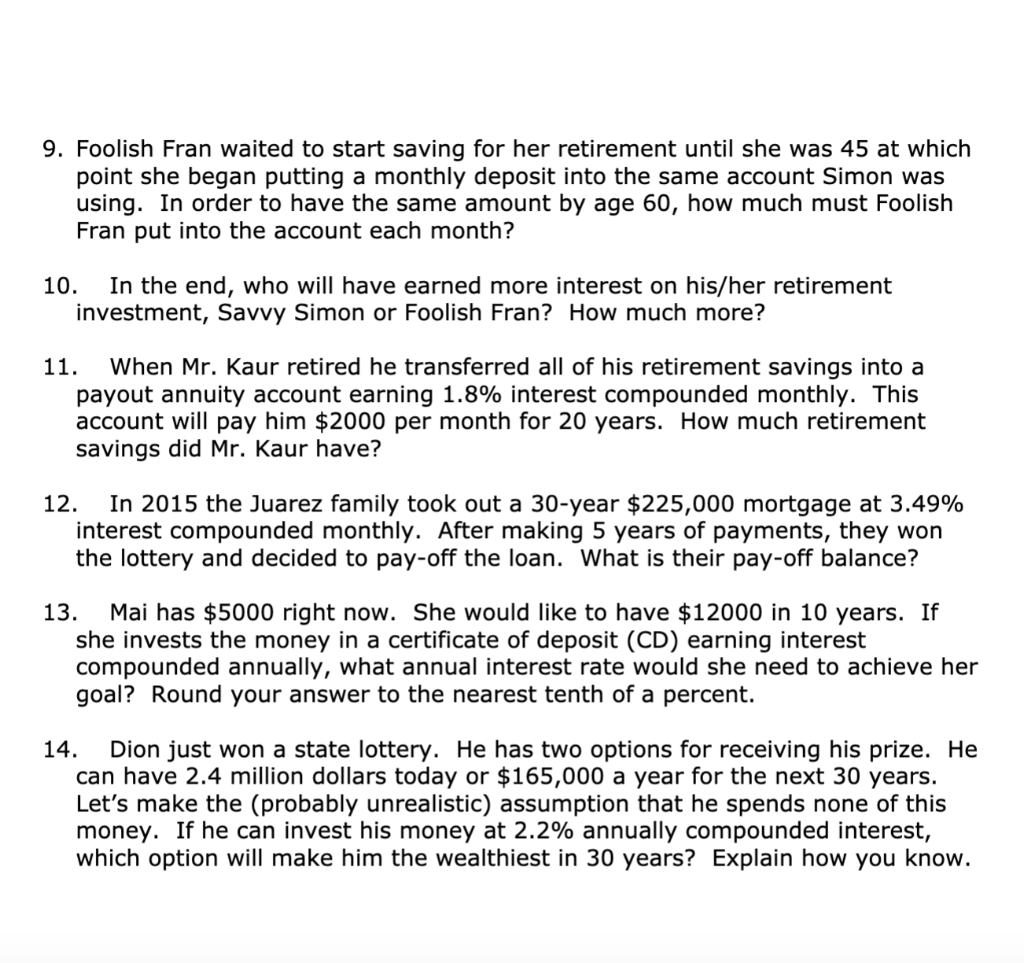

9. Foolish Fran waited to start saving for her retirement until she was 45 at which point she began putting a monthly deposit into the same account Simon was using. In order to have the same amount by age 60, how much must Foolish Fran put into the account each month? 10. In the end, who will have earned more interest on his/her retirement investment, Savvy Simon or Foolish Fran? How much more? 11. When Mr. Kaur retired he transferred all of his retirement savings into a payout annuity account earning 1.8% interest compounded monthly. This account will pay him $2000 per month for 20 years. How much retirement savings did Mr. Kaur have? 12. In 2015 the Juarez family took out a 30-year $225,000 mortgage at 3.49% interest compounded monthly. After making 5 years of payments, they won the lottery and decided to pay-off the loan. What is their pay-off balance? 13. Mai has $5000 right now. She would like to have $12000 in 10 years. If she invests the money in a certificate of deposit (CD) earning interest compounded annually, what annual interest rate would she need to achieve her goal? Round your answer to the nearest tenth of a percent. 14. Dion just won a state lottery. He has two options for receiving his prize. He can have 2.4 million dollars today or $165,000 a year for the next 30 years. Let's make the (probably unrealistic) assumption that he spends none of this money. If he can invest his money at 2.2% annually compounded interest, which option will make him the wealthiest in 30 years? Explain how you know. 9. Foolish Fran waited to start saving for her retirement until she was 45 at which point she began putting a monthly deposit into the same account Simon was using. In order to have the same amount by age 60, how much must Foolish Fran put into the account each month? 10. In the end, who will have earned more interest on his/her retirement investment, Savvy Simon or Foolish Fran? How much more? 11. When Mr. Kaur retired he transferred all of his retirement savings into a payout annuity account earning 1.8% interest compounded monthly. This account will pay him $2000 per month for 20 years. How much retirement savings did Mr. Kaur have? 12. In 2015 the Juarez family took out a 30-year $225,000 mortgage at 3.49% interest compounded monthly. After making 5 years of payments, they won the lottery and decided to pay-off the loan. What is their pay-off balance? 13. Mai has $5000 right now. She would like to have $12000 in 10 years. If she invests the money in a certificate of deposit (CD) earning interest compounded annually, what annual interest rate would she need to achieve her goal? Round your answer to the nearest tenth of a percent. 14. Dion just won a state lottery. He has two options for receiving his prize. He can have 2.4 million dollars today or $165,000 a year for the next 30 years. Let's make the (probably unrealistic) assumption that he spends none of this money. If he can invest his money at 2.2% annually compounded interest, which option will make him the wealthiest in 30 years? Explain how you knowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started