Answered step by step

Verified Expert Solution

Question

1 Approved Answer

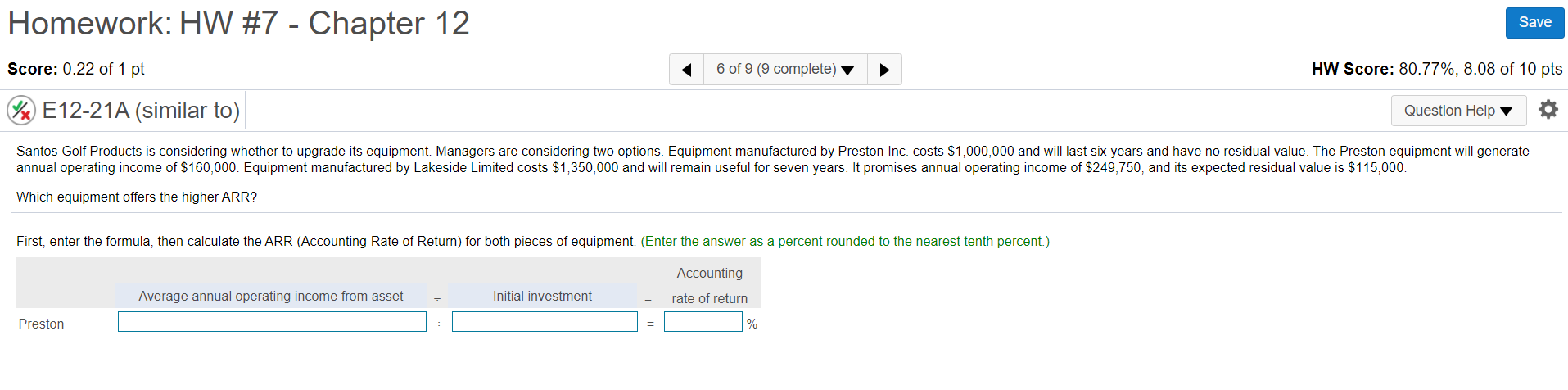

All parts please Homework: HW #7 - Chapter 12 Save Score: 0.22 of 1 pt 6 of 9 (9 complete) HW Score: 80.77%, 8.08 of

All parts please

Homework: HW #7 - Chapter 12 Save Score: 0.22 of 1 pt 6 of 9 (9 complete) HW Score: 80.77%, 8.08 of 10 pts E12-21A (similar to) Question Help Santos Golf Products is considering whether to upgrade its equipment. Managers are considering two options. Equipment manufactured by Preston Inc. costs $1,000,000 and will last six years and have no residual value. The Preston equipment will generate annual operating income of $160,000. Equipment manufactured by Lakeside Limited costs $1,350,000 and will remain useful for seven years. It promises annual operating income of $249,750, and its expected residual value is $115,000. Which equipment offers the higher ARR? First, enter the formula, then calculate the ARR (Accounting Rate of Return) for both pieces of equipment. (Enter the answer as a percent rounded to the nearest tenth percent.) Accounting Average annual operating income from asset Initial investment rate of return Preston %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started