all parts plz

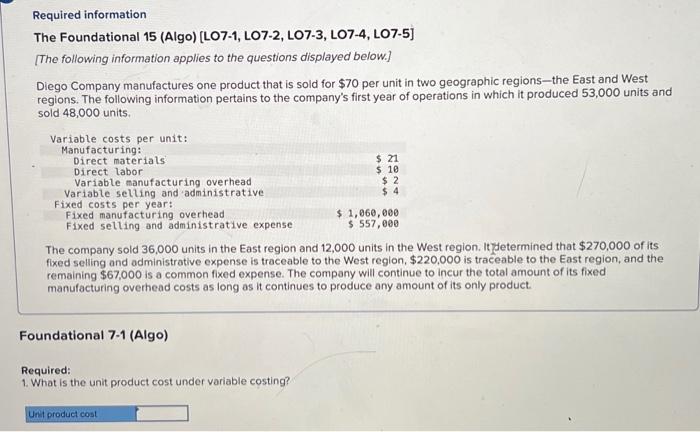

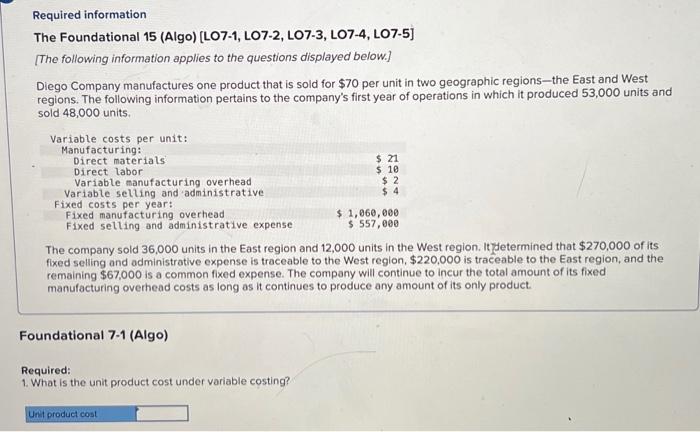

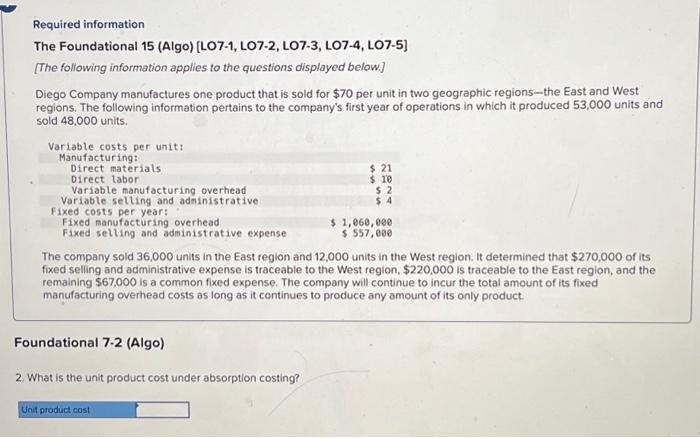

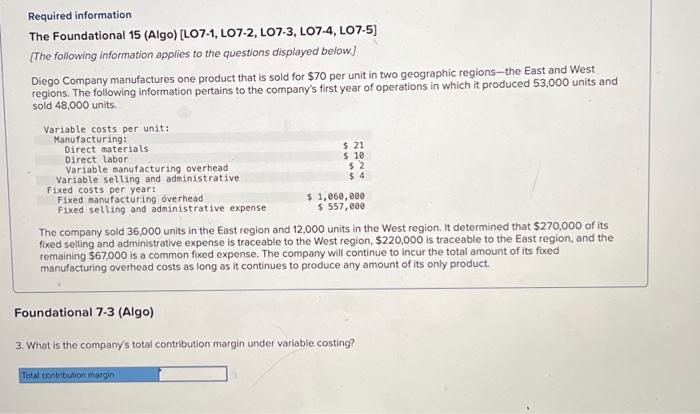

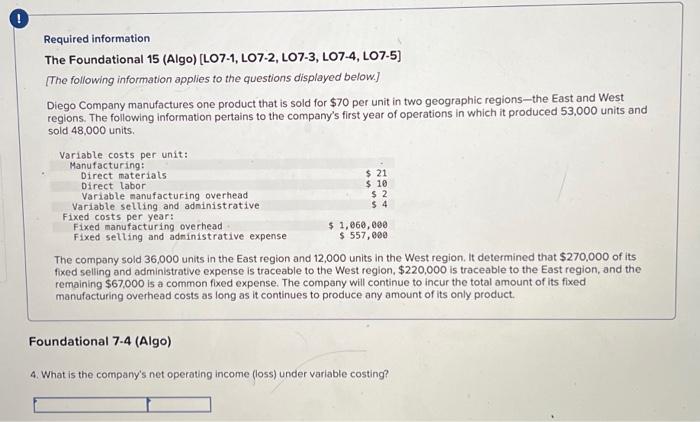

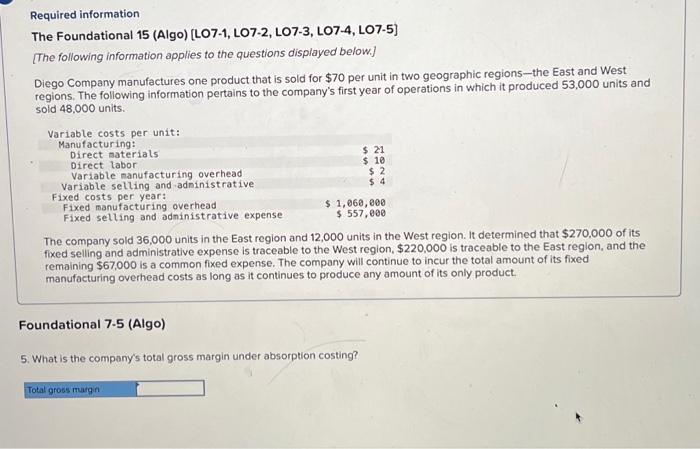

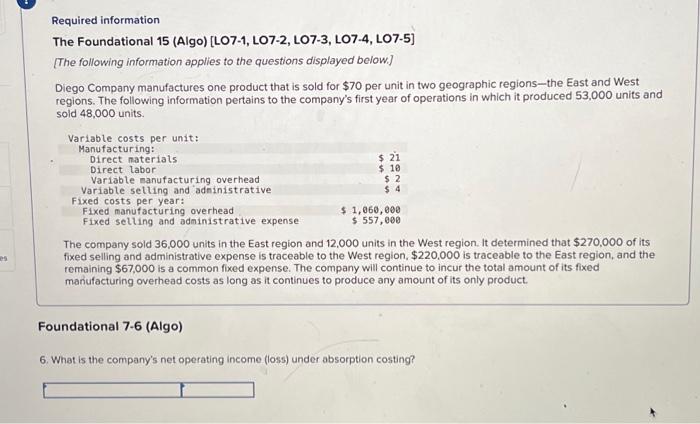

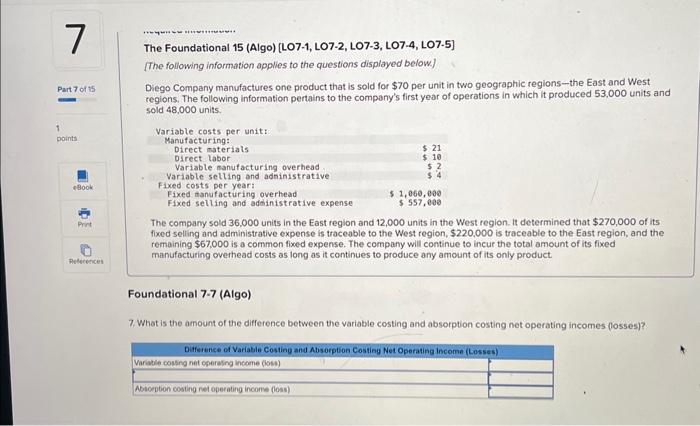

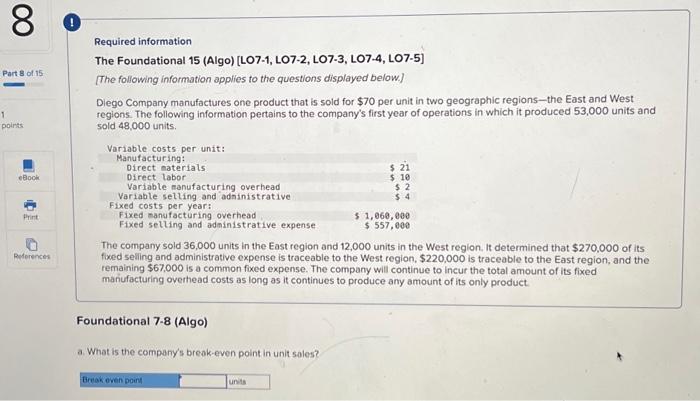

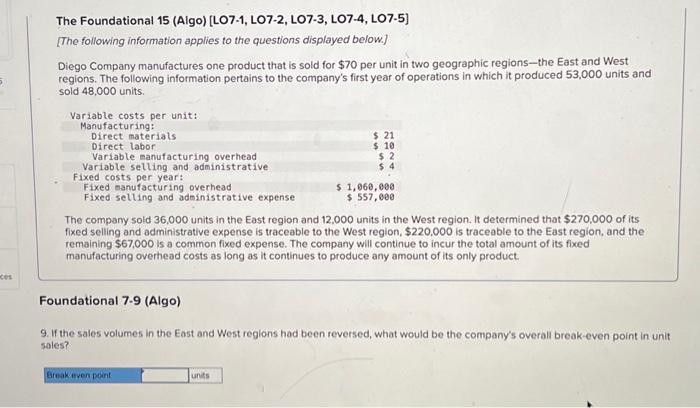

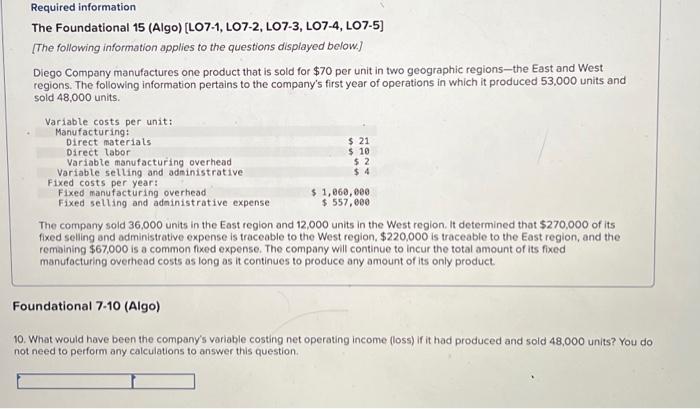

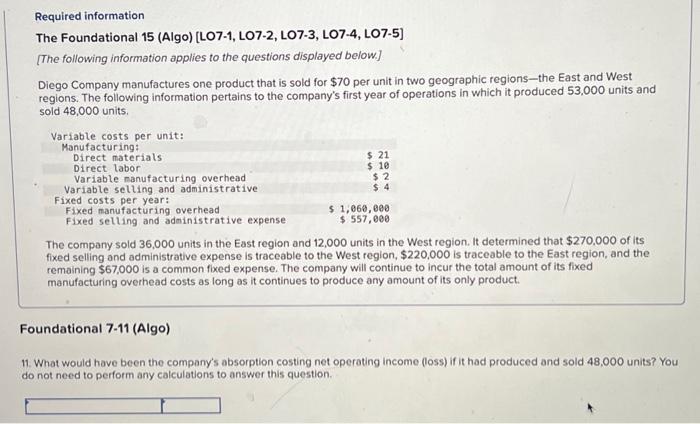

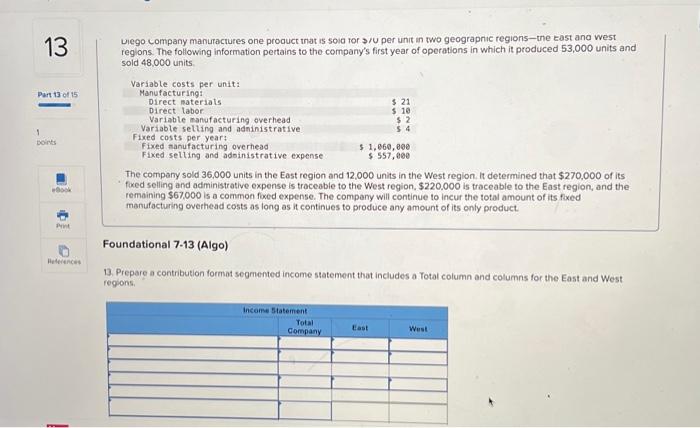

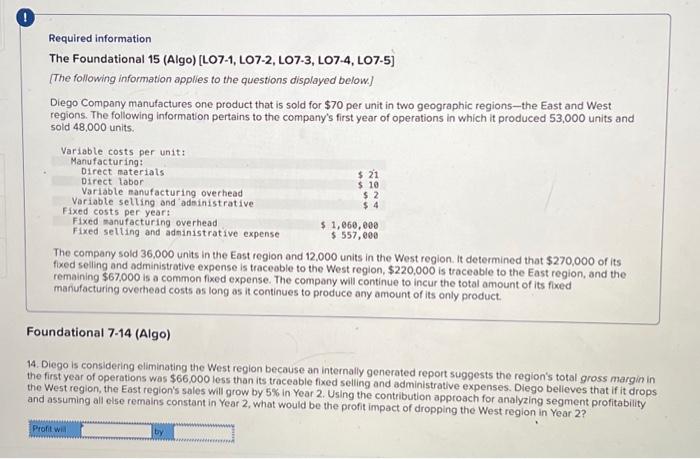

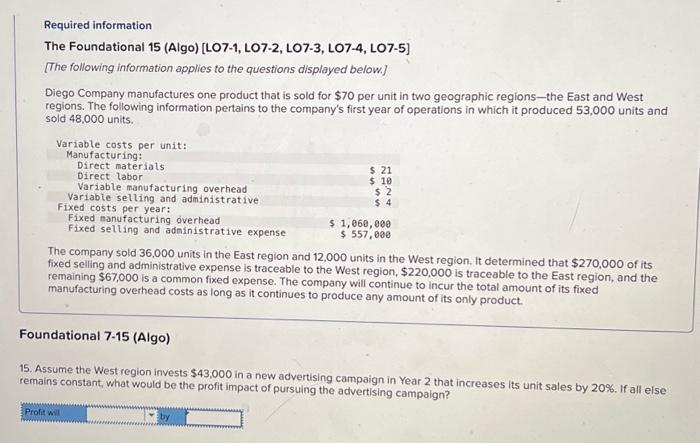

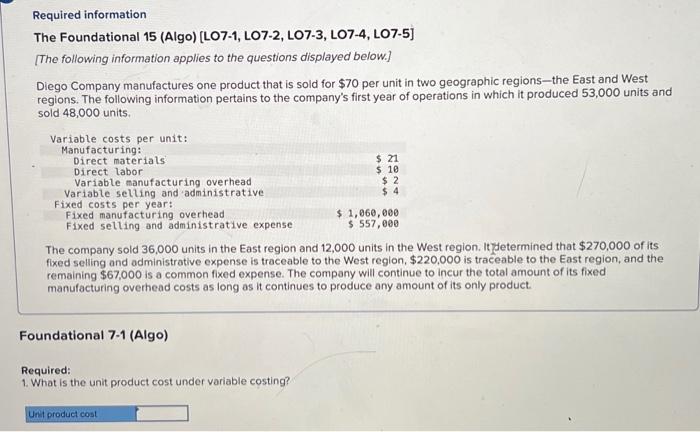

Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. Ityetermined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-1 (Algo) Required: 1. What is the unit product cost under variable costing? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.2 (Algo) 2. What is the unit product cost under absorption costing? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-3 (Algo) 3. What is the company's total contribution margin under variable costing? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.4 (Algo) 4. What is the company's net operating income (loss) under variable costing? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions - the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.5 (Algo) 5. What is the company's total gross margin under absorption costing? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.6 (Algo) 6. What is the company's net operating income (loss) under absorption costing? The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions - the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.7 (Algo) 7. What is the amount of the difference between the variable costing and absorption costing net operating incomes (losses)? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed seling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-8 (Algo) a. What is the company's break-even point in unit soles? The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7.9 (Algo) 9. If the sales volumes in the East and West regions had been reversed, what would be the company's overall break-even point in unit soles? The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions - the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common foxed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-10 (Algo) 10. What would have been the company's variable costing net operating income (loss) if it had produced and sold 48,000 units? You do not need to perform any calculations to answer this question. Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-11 (Algo) 11. What would have been the company's absorption costing net operating income (loss) if it had produced and sold 48,000 units? You do not need to perform any calculations to answer this question. regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its foxed selling and administrative expense is traceable to the West region, $220.000 is traceable to the East region, and the remaining $67,000 is a common fored expense. The compary will continue to incur the total amount of its foxed manufacturing overhead costs as long as it continues to produce any amount of its onfy product. Foundational 7.13 (Algo) 13. Prepare a contribution format segmented income statement that includes a Total column and columns for the East and West regions. Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceoble to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its foed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-14 (Algo) 14. Diego is considering eliminating the West region because an internally generated report suggests the region's total gross margin in he first year of operations was $66,000 less than its traceable fixed selling and administrative expenses. Diego belleves that if it drops he West region, the East region's sales will grow by 5% in Year 2. Using the contribution approach for analyzing segment profitability and assuming all else remains constant in Year 2 , what would be the profit impact of dropping the West region in Year 2 ? Required information The Foundational 15 (Algo) [LO7-1, LO7-2, LO7-3, LO7-4, LO7-5] [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $70 per unit in two geographic regions - the East and West regions. The following information pertains to the company's first year of operations in which it produced 53,000 units and sold 48,000 units. The company sold 36,000 units in the East region and 12,000 units in the West region. It determined that $270,000 of its fixed selling and administrative expense is traceable to the West region, $220,000 is traceable to the East region, and the remaining $67,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. Foundational 7-15 (Algo) 15. Assume the West region invests $43,000 in a new advertising campaign in Year 2 that increases its unit sales by 20%. If all eise remains constant, what would be the profit impact of pursuing the advertising campaign