Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All parts to one question. PLEASE ANSWER ALL, PLEASE & THANK YOU a PL Lumber stock is expected to return 20% in a booming economy,

All parts to one question. PLEASE ANSWER ALL, PLEASE & THANK YOU

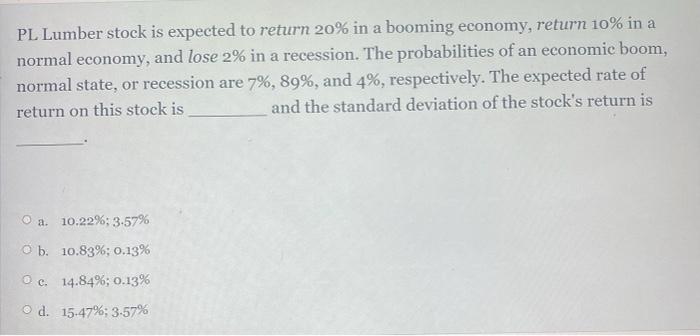

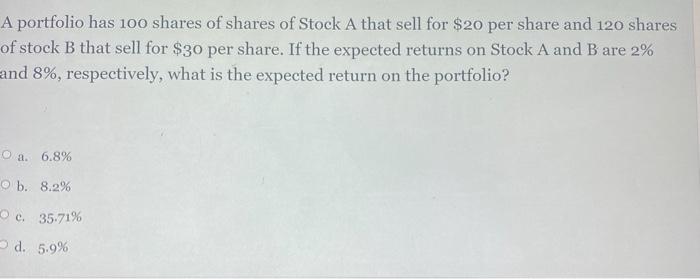

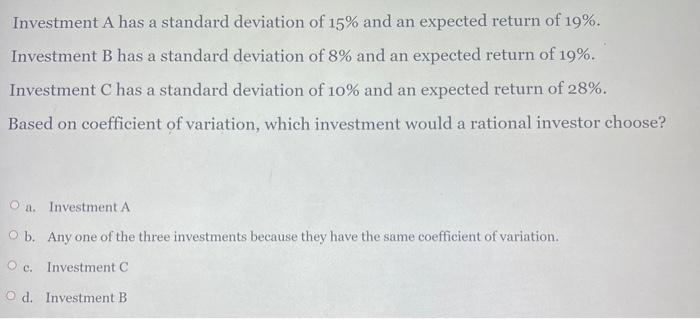

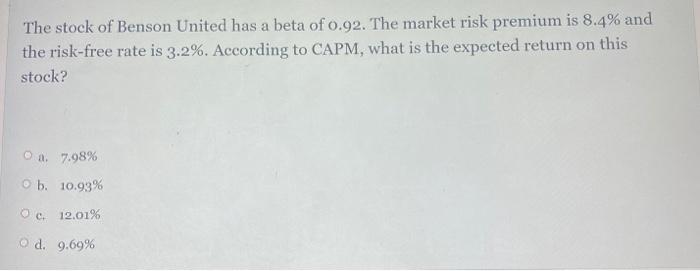

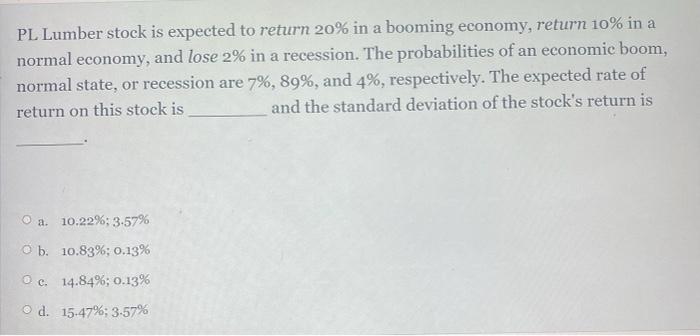

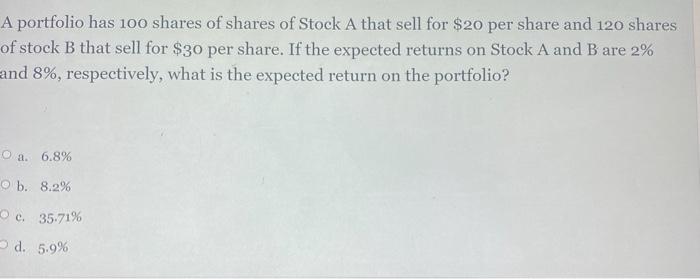

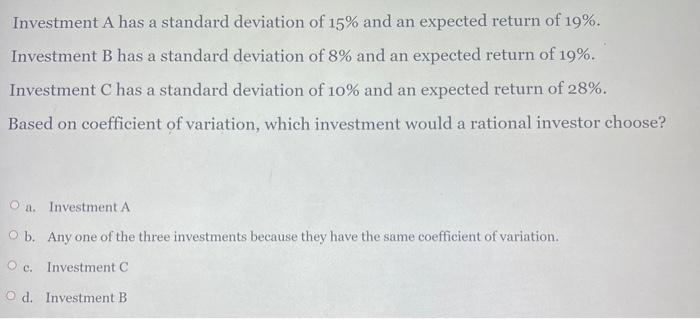

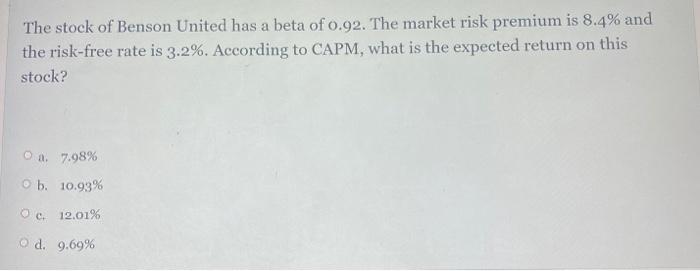

a PL Lumber stock is expected to return 20% in a booming economy, return 10% in a normal economy, and lose 2% in a recession. The probabilities of an economic boom, normal state, or recession are 7%, 89%, and 4%, respectively. The expected rate of return on this stock is and the standard deviation of the stock's return is a. 10.22%; 3.57% O b. 10.83%; 0.13% Oc. 14.84%; 0.13% d. 15.47%; 3-57% A portfolio has 100 shares of shares of Stock A that sell for $20 per share and 120 shares of stock B that sell for $30 per share. If the expected returns on Stock A and B are 2% aand 8%, respectively, what is the expected return on the portfolio? O a. 6.8% ob. 8.2% c. 35.71% d. 5.9% Investment A has a standard deviation of 15% and an expected return of 19%. Investment B has a standard deviation of 8% and an expected return of 19%. Investment C has a standard deviation of 10% and an expected return of 28%. Based on coefficient of variation, which investment would a rational investor choose? a O a. Investment A Ob. Any one of the three investments because they have the same coefficient of variation. Oc: Investment C Od Investment B The stock of Benson United has a beta of 0.92. The market risk premium is 8.4% and the risk-free rate is 3.2%. According to CAPM, what is the expected return on this stock? Ca 7.98% b. 10.93% Oc12.01% d. 9.69%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started