Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all parts would be appreciated More info Jan 3 Traded in equipment with accumulated depreciation of $65,000 (cost of $140,000) for similar new equipment with

all parts would be appreciated

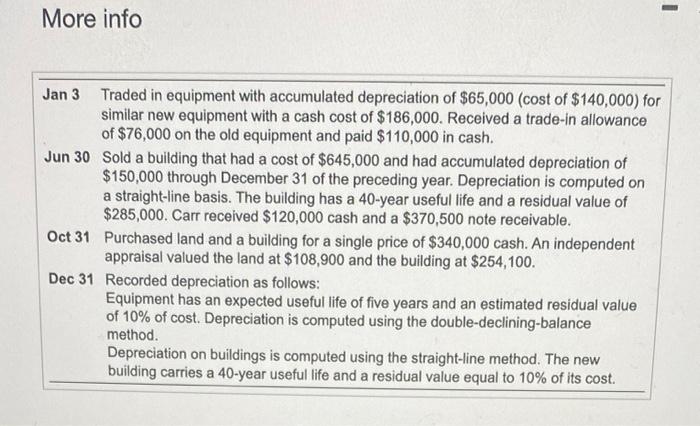

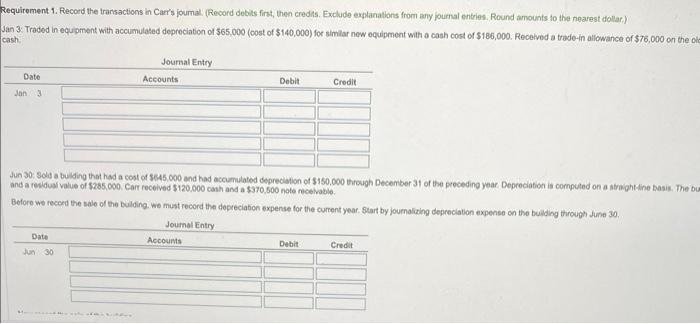

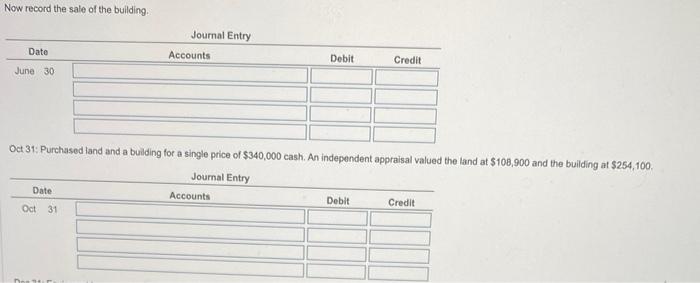

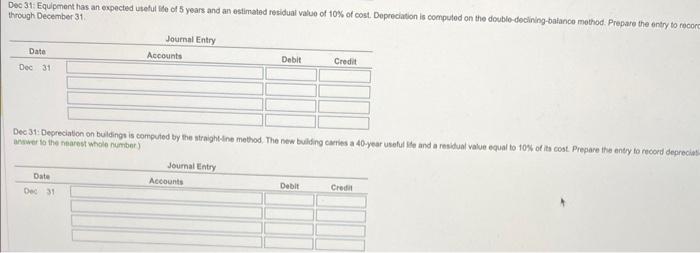

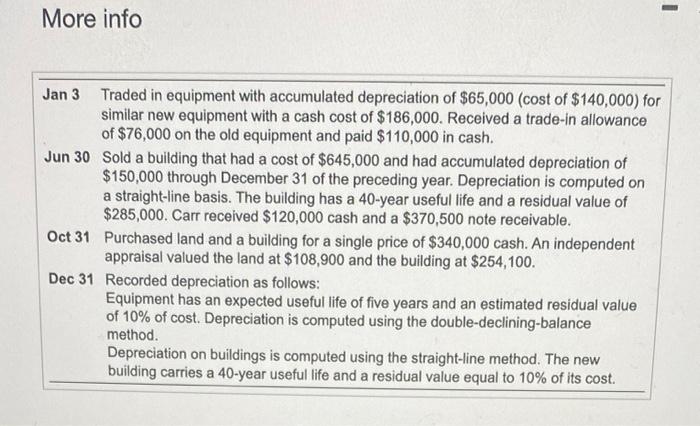

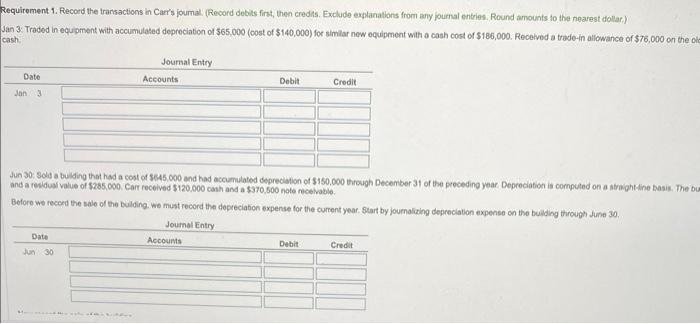

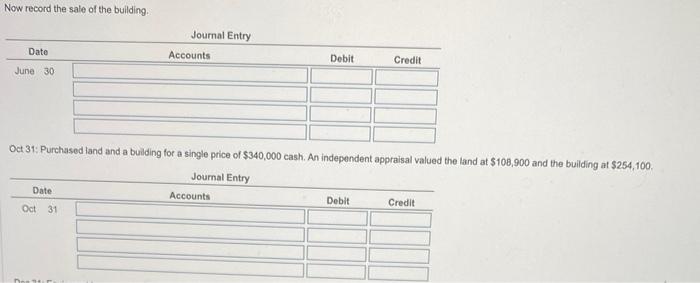

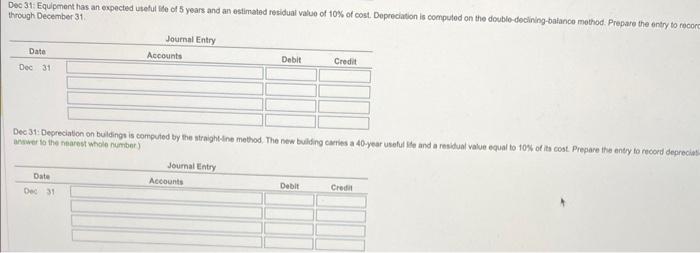

More info Jan 3 Traded in equipment with accumulated depreciation of $65,000 (cost of $140,000) for similar new equipment with a cash cost of $186,000. Received a trade-in allowance of $76,000 on the old equipment and paid $110,000 in cash. Jun 30 Sold a building that had a cost of $645,000 and had accumulated depreciation of $150,000 through December 31 of the preceding year. Depreciation is computed on a straight-line basis. The building has a 40year useful life and a residual value of $285,000. Carr received $120,000 cash and a $370,500 note receivable. Oct 31 Purchased land and a building for a single price of $340,000 cash. An independent appraisal valued the land at $108,900 and the building at $254,100. Dec 31 Recorded depreciation as follows: Equipment has an expected useful life of five years and an estimated residual value of 10% of cost. Depreciation is computed using the double-declining-balance method. Depreciation on buildings is computed using the straight-line method. The new building carries a 40 -year useful life and a residual value equal to 10% of its cost. absh. Jun 30: Soli a bulding that had a cost of $645.000 and had accumulated depreciaion of $150,000 through Decenber 31 of the proceding year Depreciation is compuled on a straight-Ane basis. The bu and a residual value of $285.000. Cart recelved $120.000 canh and a $370.500 note neelvable. Before we recoed the sale of the Bulding. We must record the depreciation expense for the current year. Start by journalizing depreciation expenso on the buliding through June 30 . Now record the sale of the building. through December 31. anwwer to the nearnst whole nimber)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started