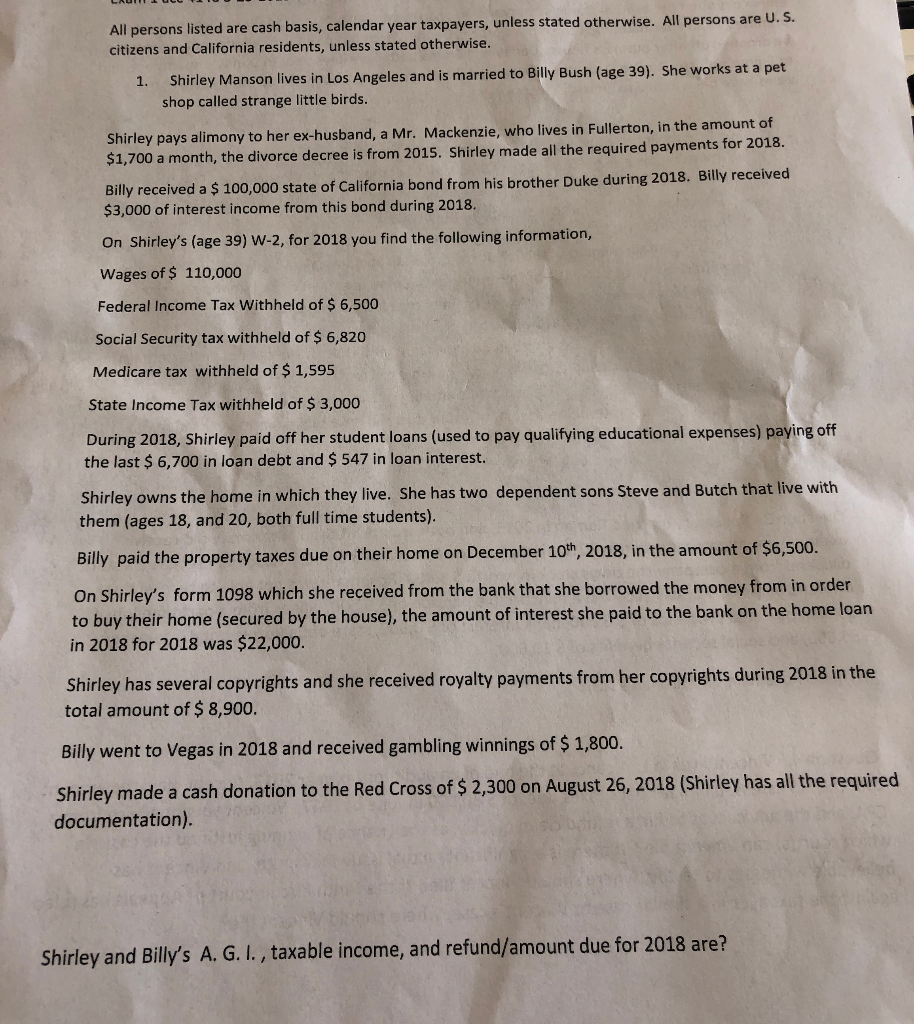

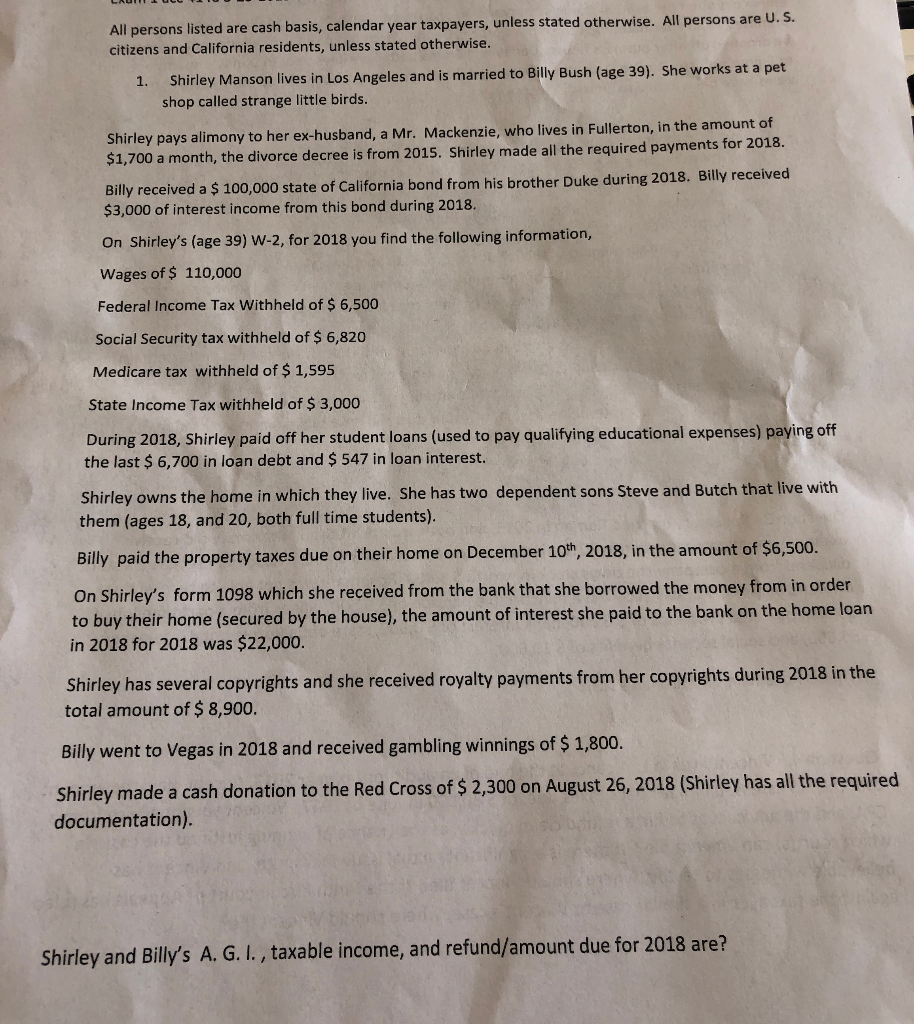

All persons listed are cash basis, calendar year taxpayers, unless stated otherwise. All persons are U.S. citizens and California residents, unless stated otherwise. Shirley Manson lives in Los Angeles and is married to Billy Bush (age 39). She works at a pet shop called strange little birds. 1. Shirley pays alimony to her ex-husband, a Mr. Mackenzie, who lives in Fullerton, in the amount of $1,700 a month, the divorce decree is from 2015. Shirley made all the required payments for 2018. Billy received a$ 100,000 state of California bond from his brother Duke during 2018. Billy received $3,000 of interest income from this bond during 2018. On Shirley's (age 39) W-2, for 2018 you find the following information, Wages of $ 110,000 Federal Income Tax Withheld of $ 6,500 Social Security tax withheld of $ 6,820 Medicare tax withheld of $ 1,595 State Income Tax withheld of $ 3,000 During 2018, Shirley paid off her student loans (used to pay qualifying educational expenses) paying off the last $ 6,700 in loan debt and $ 547 in loan interest. Shirley owns the home in which they live. She has two dependent sons Steve and Butch that live with them (ages 18, and 20, both full time students). Billy paid the property taxes due on their home on December 10th, 2018, in the amount of $6,500. On Shirley's form 1098 which she received from the bank that she borrowed the money from in order to buy their home (secured by the house), the amount of interest she paid to the bank on the home loan in 2018 for 2018 was $22,000. Shirley has several copyrights and she received royalty payments from her copyrights during 2018 in the total amount of $ 8,900. Billy went to Vegas in 2018 and received gambling winnings of $ 1,800. Shirley made a cash donation to the Red Cross of $ 2,300 on August 26, 2018 (Shirley has all the required documentation). Shirley and Billy's A. G. I., taxable income, and refund/amount due for 2018 are? All persons listed are cash basis, calendar year taxpayers, unless stated otherwise. All persons are U.S. citizens and California residents, unless stated otherwise. Shirley Manson lives in Los Angeles and is married to Billy Bush (age 39). She works at a pet shop called strange little birds. 1. Shirley pays alimony to her ex-husband, a Mr. Mackenzie, who lives in Fullerton, in the amount of $1,700 a month, the divorce decree is from 2015. Shirley made all the required payments for 2018. Billy received a$ 100,000 state of California bond from his brother Duke during 2018. Billy received $3,000 of interest income from this bond during 2018. On Shirley's (age 39) W-2, for 2018 you find the following information, Wages of $ 110,000 Federal Income Tax Withheld of $ 6,500 Social Security tax withheld of $ 6,820 Medicare tax withheld of $ 1,595 State Income Tax withheld of $ 3,000 During 2018, Shirley paid off her student loans (used to pay qualifying educational expenses) paying off the last $ 6,700 in loan debt and $ 547 in loan interest. Shirley owns the home in which they live. She has two dependent sons Steve and Butch that live with them (ages 18, and 20, both full time students). Billy paid the property taxes due on their home on December 10th, 2018, in the amount of $6,500. On Shirley's form 1098 which she received from the bank that she borrowed the money from in order to buy their home (secured by the house), the amount of interest she paid to the bank on the home loan in 2018 for 2018 was $22,000. Shirley has several copyrights and she received royalty payments from her copyrights during 2018 in the total amount of $ 8,900. Billy went to Vegas in 2018 and received gambling winnings of $ 1,800. Shirley made a cash donation to the Red Cross of $ 2,300 on August 26, 2018 (Shirley has all the required documentation). Shirley and Billy's A. G. I., taxable income, and refund/amount due for 2018 are