Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All problem needs anwsers. PROBLEM #1: (total of 55 pts) A, B, and C (all individuals) form a general partnership in which they each have

All problem needs anwsers.

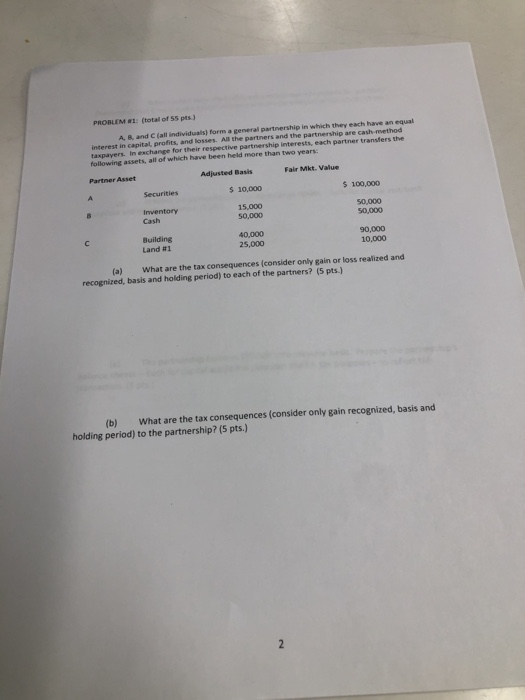

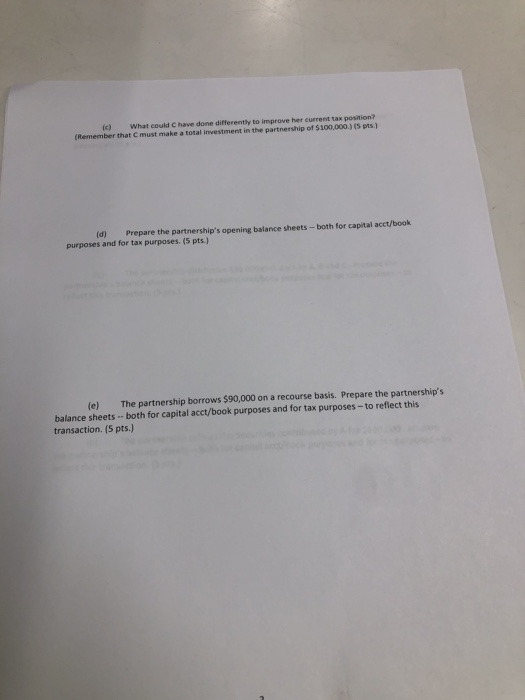

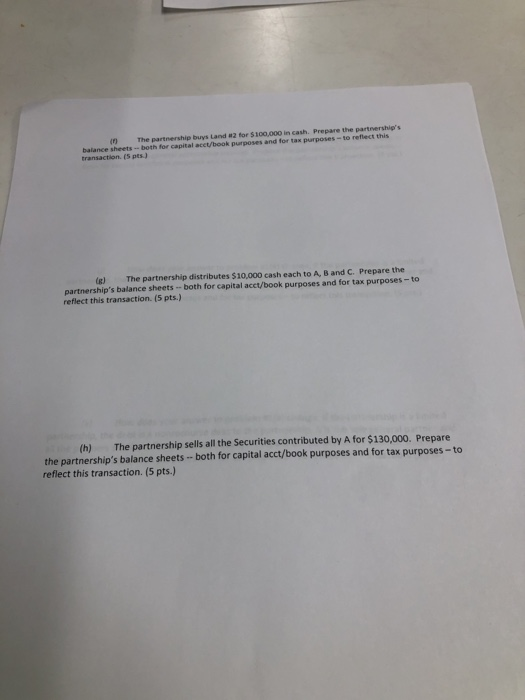

PROBLEM #1: (total of 55 pts) A, B, and C (all individuals) form a general partnership in which they each have an equal interest in capital, profits, and losses. All the partners and the partnership are cash-method taxpayers. In exchange for their respective partnership interests, each partner transfers the following assets, all of which have been held more than two years Fair Mkt. Value Adjusted Basis Partner Asset $ 10,000 100,000 Securities A 50,000 50,000 Inventory Cash 15,000 50,000 40,000 25,000 Building 90,000 10,000 C Land #1 (a) What are the tax consequences (consider only gain or loss realizedd and recognized, basis and holding period) to each of the partners? (5 pts.) What are the tax consequences (consider only gain recognized, basis and (b) holding period) to the partnership? (5 pts.) 2 What could C have done differently to improve her current tax position? (Remember that C must make a total investment in the partnership of $100,000.) (5 pts) (c) (d) Prepare the partnership's opening balance sheets- both for capital acct/book purposes and for tax purposes. (5 pts.) The partnership borrows $90,000 on a recourse basis. Prepare the partnership's (e) balance sheets-- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) Prepare the partnership's The partnership buys Land #2 for $100,000 in cash. balance sheets-both for capital acct/book purposes and for tax purposes-to reflect this transaction, (5 pts) The partnership distributes $10,000 cash each to A, B and C. Prepare the (g) partnership's balance sheets- both for capital acct/book purposes and for tax purposes--to reflect this transaction. (5 pts.) The partnership sells all the Securities contributed by A for $130,000. Prepare (h) the partnership's balance sheets- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) When Land #2 has a value of $190,000, the assets and capital accounts are restated to current value, and new partner D contributes $130,000 cash to the partnership in exchange for a 25 % general partnership interest. Prepare the partnersship's balance sheets both for capital acct/book purposes and for tax purposes-to reflect this transaction. (S pts) (0 problem # 1(e) change, if the partnership is a limited partnership, the debt is still a recourse debt to the partnership, A is the sole general partner and all the partners share profits and losses equally? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) How does your answer How does your answer to problem #1(e) change, if the partnership is a limited partnership, the debt is a nonrecourse debt to the partnership, A is the sole general partner and all the partners share profits and losses equally? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes-to reflect this transaction. (5 pts.) (k) PROBLEM #2: (4 pts.) In the partnership context, what is meant by the terms "inside basis" and "outside basis"? PROBLEM #3: ( total of 16 pts.) (a) Which IRC section deals with the deductibility of organization and syndication expenses ofa partnership? (2 pts.) (b) Give an example of an organizational expense of a partnership. (2 pts.) Give an example of a syndication expense of a partnership. (2 pts.) (c) (d) A partnership incurs $52,000 in organizational expenses and $100,000 in syndication expenses on July 1, 2011. What amount can the partnership deduct relating to these expenses in 2011? (10 pts.) PROBLEM 4: (total of 25 pts.) Cis offered a capital interest in a partnership whose sole asset is a commercial bulding with a fair market value of $1,000,000 and an adjusted basis of $200,000. The building has been depreciated on the straight line method. A and 8 each have $100,000 outside bases in their respective partnership interests. A and 8 share profits and losses equally. C has performed real estate management services for the partnership over the past year and has agreed to perform additional services in the future. (a) What are the tax consequences to C and to the partnership (i.e., A and B) if in year one C receives a 25 % capital interest in the partnership as compensation for his management services over the past year? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes-to reflect this transaction. A set of partnership balance sheets should reflect the position before C gets her capital interest and a set of partnership balance sheets should reflect the position after C gets her capital interest. (18 pts.) (b) Under Rev, Proc. 93-27, what are the tax consequences to C and to the partnership (i.e., A and B) if in year one C instead receives a 25 % profits interest in the partnership as compensation for his managementt services over the past vear? C will hold the profits interest for more than 3 years. (7 pts.) PROBLEM #1: (total of 55 pts) A, B, and C (all individuals) form a general partnership in which they each have an equal interest in capital, profits, and losses. All the partners and the partnership are cash-method taxpayers. In exchange for their respective partnership interests, each partner transfers the following assets, all of which have been held more than two years Fair Mkt. Value Adjusted Basis Partner Asset $ 10,000 100,000 Securities A 50,000 50,000 Inventory Cash 15,000 50,000 40,000 25,000 Building 90,000 10,000 C Land #1 (a) What are the tax consequences (consider only gain or loss realizedd and recognized, basis and holding period) to each of the partners? (5 pts.) What are the tax consequences (consider only gain recognized, basis and (b) holding period) to the partnership? (5 pts.) 2 What could C have done differently to improve her current tax position? (Remember that C must make a total investment in the partnership of $100,000.) (5 pts) (c) (d) Prepare the partnership's opening balance sheets- both for capital acct/book purposes and for tax purposes. (5 pts.) The partnership borrows $90,000 on a recourse basis. Prepare the partnership's (e) balance sheets-- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) Prepare the partnership's The partnership buys Land #2 for $100,000 in cash. balance sheets-both for capital acct/book purposes and for tax purposes-to reflect this transaction, (5 pts) The partnership distributes $10,000 cash each to A, B and C. Prepare the (g) partnership's balance sheets- both for capital acct/book purposes and for tax purposes--to reflect this transaction. (5 pts.) The partnership sells all the Securities contributed by A for $130,000. Prepare (h) the partnership's balance sheets- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) When Land #2 has a value of $190,000, the assets and capital accounts are restated to current value, and new partner D contributes $130,000 cash to the partnership in exchange for a 25 % general partnership interest. Prepare the partnersship's balance sheets both for capital acct/book purposes and for tax purposes-to reflect this transaction. (S pts) (0 problem # 1(e) change, if the partnership is a limited partnership, the debt is still a recourse debt to the partnership, A is the sole general partner and all the partners share profits and losses equally? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes- to reflect this transaction. (5 pts.) How does your answer How does your answer to problem #1(e) change, if the partnership is a limited partnership, the debt is a nonrecourse debt to the partnership, A is the sole general partner and all the partners share profits and losses equally? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes-to reflect this transaction. (5 pts.) (k) PROBLEM #2: (4 pts.) In the partnership context, what is meant by the terms "inside basis" and "outside basis"? PROBLEM #3: ( total of 16 pts.) (a) Which IRC section deals with the deductibility of organization and syndication expenses ofa partnership? (2 pts.) (b) Give an example of an organizational expense of a partnership. (2 pts.) Give an example of a syndication expense of a partnership. (2 pts.) (c) (d) A partnership incurs $52,000 in organizational expenses and $100,000 in syndication expenses on July 1, 2011. What amount can the partnership deduct relating to these expenses in 2011? (10 pts.) PROBLEM 4: (total of 25 pts.) Cis offered a capital interest in a partnership whose sole asset is a commercial bulding with a fair market value of $1,000,000 and an adjusted basis of $200,000. The building has been depreciated on the straight line method. A and 8 each have $100,000 outside bases in their respective partnership interests. A and 8 share profits and losses equally. C has performed real estate management services for the partnership over the past year and has agreed to perform additional services in the future. (a) What are the tax consequences to C and to the partnership (i.e., A and B) if in year one C receives a 25 % capital interest in the partnership as compensation for his management services over the past year? Prepare the partnership's balance sheets- both for capital acct/book purposes and for tax purposes-to reflect this transaction. A set of partnership balance sheets should reflect the position before C gets her capital interest and a set of partnership balance sheets should reflect the position after C gets her capital interest. (18 pts.) (b) Under Rev, Proc. 93-27, what are the tax consequences to C and to the partnership (i.e., A and B) if in year one C instead receives a 25 % profits interest in the partnership as compensation for his managementt services over the past vear? C will hold the profits interest for more than 3 years. (7 pts.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started