Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A+L+L Project #11 Bank Reconciliation Preview of Chapter At the end of each month, Fido receives a bank statement from its bank. This bank

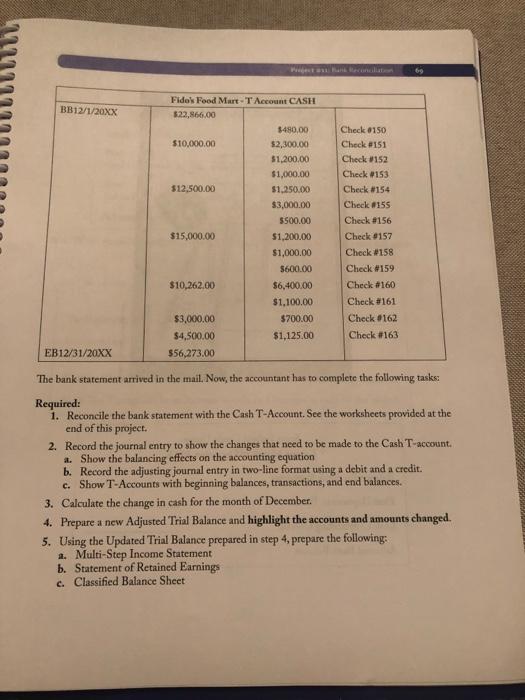

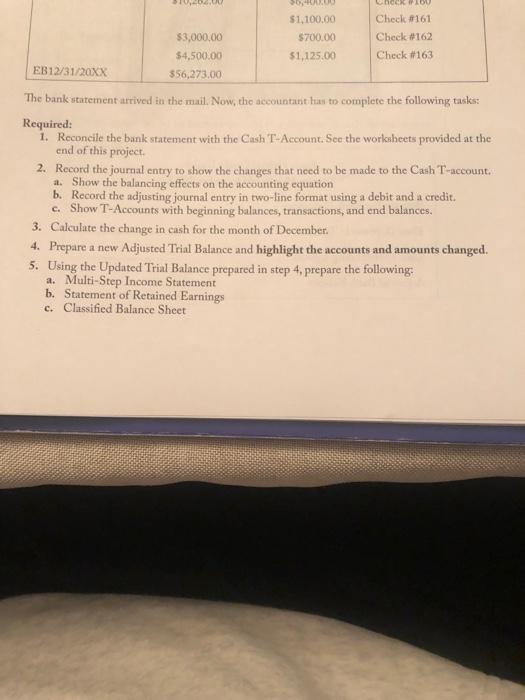

A+L+L Project #11 Bank Reconciliation Preview of Chapter At the end of each month, Fido receives a bank statement from its bank. This bank statement shows the information that the bank has processed from the beginning of the month to the end of the month. The accountant must "reconcile" the bank statement details to Fido's accounting records. To do this, the accountant reviews Fido's Cash ledger account to determine where the bank statement and Fido's Cash ledger account do not agree. Most often these differences are expected on a monthly basis. For instance, many banks charge a monthly service fee. This fee would not be recorded on the company's books until the monthly bank statement arrives, because the company would not know the amount of the charge until that time. The accountant prepares worksheets to show this recon ciliation, then makes a journal entry to record transaction that may need to be recorded on Fido's Cash ledger account. The accountant should always keep a watchful eye for any transactions that are not the company's responsibility. In those cases, the accountant would contact the bank and ask for a correction of the bank error. Fido's does not have any bank errors in this project. All differences between the bank and the books need to be recorded. The "change is cash" is always calculated by referencing the beginning of the period bosk balance to the end of the period reconciled book balance. Students often confuse this as the change between the recon- ciled and unreconciled balance. The change is the change for the entire accounting period. Again, that is the beginning of the month balance com- pared to the reconciled end of the month balance. Note: The financial statement prepared for this project are needed for the remaining pro- jects. No further financial statement will be prepared. Record Closing Journal Entries Prepar Financial Statements Prepare Postclosing Tra Balance Prepare Adjusted Tra Balance Analyze and Recond Journal Entries Record Adjusting Journal Enties Post to Ledger Accounts County of Laurs K. Bars and Ans Ere Prepare Unaduated Trial Balance 67 BALANCE LAST STATEMENT Date Statement of Account $22,866.00 12/1/20XX 12/3/20XX Check #150 12/7/20XX Check #151 12/9/20XX Check #154 12/12/20XX Check #152 12/16/20XX Check #153 SCOTS FEDERAL CREDIT UNION Checks Cleared 12/17/20XX Check #155 12/18/20XX Check #156 1 12/19/20XX Check #157. 12/20/20XX Check #158 12/24/20XX 12/28/20XX Check #160 12/31/20XX 111 Checks and Other Deposits and Debits Other Credits No. Total No. Total 12 $18,607,00 5 $48,762.00 Deposits Made $480.00 $2,300.00 $1,250,00 $1,200.00 $1,000.00 $3,000.00 $500.00 $1,200.00 $1,000.00 $6,400.00 $10,000.00 $12,500.00 $15,000.00 $10,262.00 Account Number 8900-14-124-106 Other Transactions NSF check EFT deposit Statement Date December 31, 20XX BALANCE THIS STATEMENT Stjc Bank Reconciliation $53,021.00 Daily Balance $22,866.00 $32,386.00 $30,086.00 $28,836.00 $40,136.00 $39,136.00 $36,136.00 $50,636.00 $49,436.00 $48,174.00 $59,436.00 $53,021.00 ($ 262) $1,000 Service Charge ($15) BB12/1/20XX EB12/31/20XX Fido's Food Mart-T Account CASH $22,866,00 $10,000.00 $12,500.00 $15,000.00 $10,262.00 $3,000.00 $4,500.00 $56,273.00 $480,00 $2,300.00 $1,200.00 $1,000.00 $1,250.00 $3,000.00 $500.00 $1,200.00 $1,000.00 $600.00 $6,400.00 $1,100.00 $700.00 $1,125.00 Check #150 Check #151 Check #152 Check #153 Check #154 Check #155 Check #156 Check #157 Check #158 Check #159 Check #160. Check #161 Check #162 Check #163 69 The bank statement arrived in the mail. Now, the accountant has to complete the following tasks: Required: 1. Reconcile the bank statement with the Cash T-Account. See the worksheets provided at the end of this project. 2. Record the journal entry to show the changes that need to be made to the Cash T-account. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Calculate the change in cash for the month of December. 4. Prepare a new Adjusted Trial Balance and highlight the accounts and amounts changed. 5. Using the Updated Trial Balance prepared in step 4, prepare the following: a. Multi-Step Income Statement b. Statement of Retained Earnings c. Classified Balance Sheet EB12/31/20XX $3,000,00 $4,500.00 $56,273.00 $6,4AXUD $1,100.00 $700.00 $1,125.00 $100 Check #161 Check #162 Check #163 The bank statement arrived in the mail. Now, the accountant has to complete the following tasks: Required: 1. Reconcile the bank statement with the Cash T-Account. See the worksheets provided at the end of this project. 2. Record the journal entry to show the changes that need to be made to the Cash T-account. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Calculate the change in cash for the month of December. 4. Prepare a new Adjusted Trial Balance and highlight the accounts and amounts changed. 5. Using the Updated Trial Balance prepared in step 4, prepare the following: a. Multi-Step Income Statement b. Statement of Retained Earnings c. Classified Balance Sheet

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Scots Federal Credit Union For the Month of December 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started