Answered step by step

Verified Expert Solution

Question

1 Approved Answer

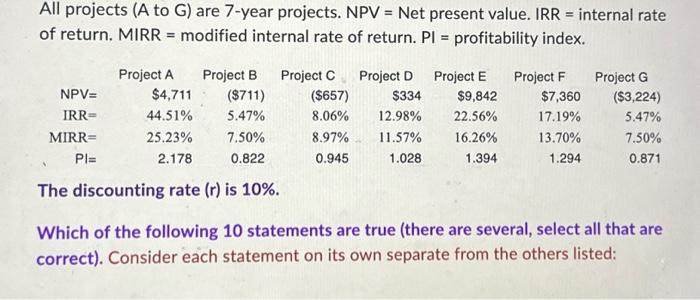

All projects (A to G) are 7-year projects. NPV = Net present value. IRR = internal rate modified internal rate of return. Pl= profitability index.

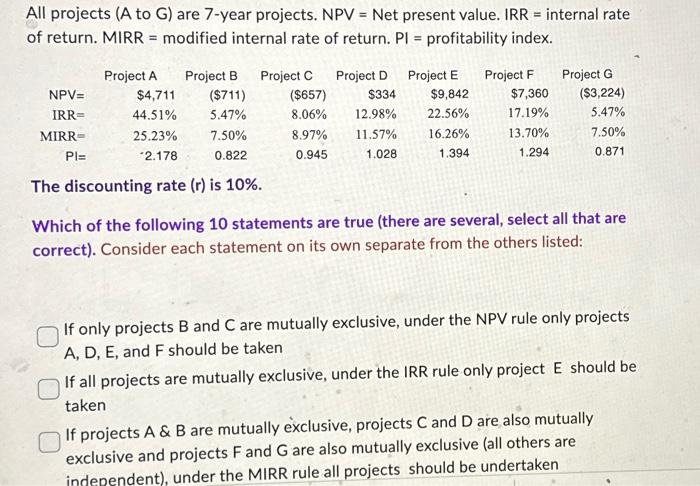

All projects (A to G) are 7-year projects. NPV = Net present value. IRR = internal rate modified internal rate of return. Pl= profitability index. of return. MIRR NPV= IRR= MIRR= Pl= Project A $4,711 44.51% 25.23% 2.178 Project B Project C ($711) 5.47% 7.50% 0.822 The discounting rate (r) is 10%. ($657) 8.06% 8.97% 0.945 Project D $334 12.98% 11.57% 1.028 Project E $9,842 22.56% 16.26% 1.394 Project F $7,360 17.19% 13.70% 1.294 Project G ($3,224) 5.47% 7.50% 0.871 Which of the following 10 statements are true (there are several, select all that are correct). Consider each statement on its own separate from the others listed:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started