Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All projects are risky and have the same risk. The expected cash flow in one year for each project is given (which is the

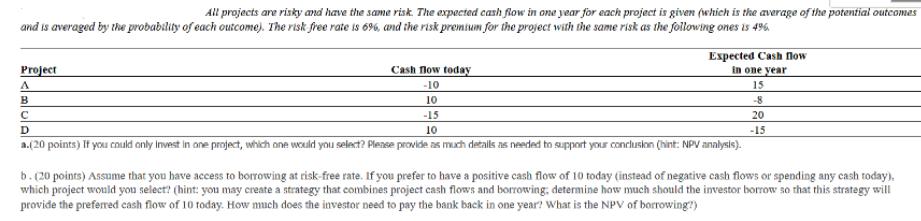

All projects are risky and have the same risk. The expected cash flow in one year for each project is given (which is the average of the potential outcomes and is averaged by the probability of each outcome). The risk free rate is 6%, and the risk premium for the project with the same risk as the following ones is 496. Expected Cash flow Project A B C Cash flow today -10 10 in one year 15 -8 D -15 10 20 -15 a.(20 points) If you could only Invest in one project, which one would you select? Please provide as much details as needed to support your conclusion (hint: NPV analysis). b. (20 points) Assume that you have access to borrowing at risk-free rate. If you prefer to have a positive cash flow of 10 today (instead of negative cash flows or spending any cash today). which project would you select? (hint: you may create a strategy that combines project cash flows and borrowing; determine how much should the investor borrow so that this strategy will provide the preferred cash flow of 10 today. How much does the investor need to pay the bank back in one year? What is the NPV of borrowing?)

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Project Selection and NPV Analysis a Selecting the Project with Highest NPV Since you can only invest in one project well use the Net Present Value NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started