all provided information is included

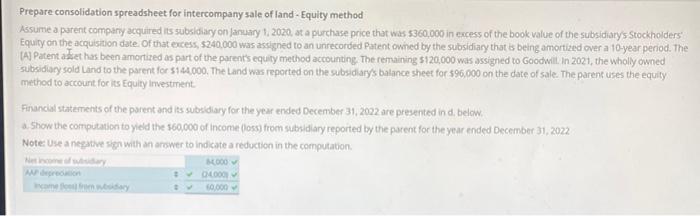

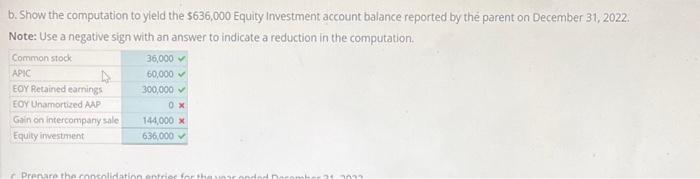

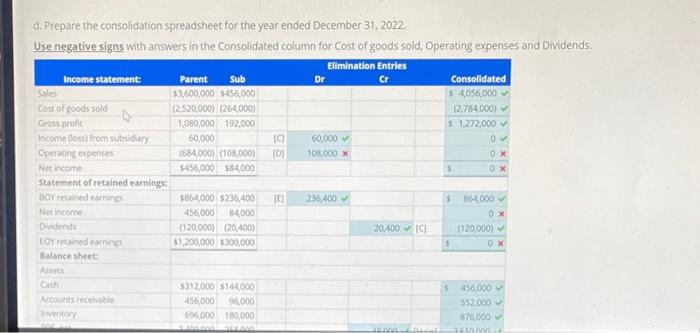

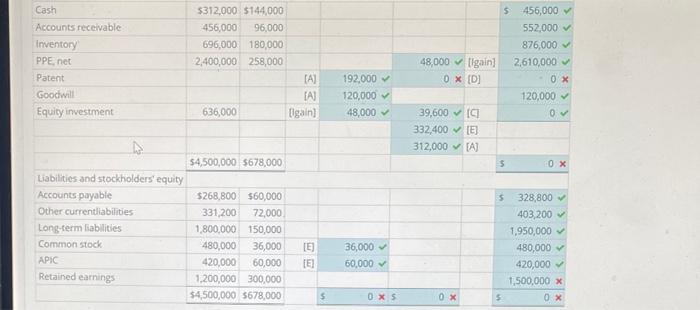

Prepare consolidation spreadsheet for intercompany sale of land- Equity method Assume a parent compary acquired its subsidiary on /anuary 1, 2020, at a purchase price that was 5360,000 in eacess of the book value of the subsidiary/s Stockholders: Equity on the acquistion date Of that excess, 5240,000 was askigned to an unrecorded Patent owned by the subsidiany that is being amortized over a 10 -year period. The (A) Patent aset has been amortized as part of the parent's equity method accounting. The remaining $120,000 was assigned to Goodwili, In 2021 , the wholly owned. subsidiary sold Land to the parent for $144000. The Land was reported on the subsidary's balance sheet for $96,000 on the date of sale. The parent uses the equity method to account for its Equity irvestinent Financial statements of the parent and its subsidiary for the year ended December 31, 2022 are presented in d. below. a. Show the corrputation to yidd the 160,000 of income (loss) from subsidiary reported by the parent for the year ended December 31,2022 Note: Use a negative sigh with an arower to ind cate a reduction in the computabion: b. Show the computation to yleld the $636,000 Equity Investment account balance reported by the parent on December 31,2022. Note: Use a negative sign with an answer to indicate a reduction in the computation. c. Prepare the consolidation entries for the year ended December 31, 2022. d. Prepare the consolidation spreadsheet for the year ended December 31,2022. Use negative signs with answers in the Consolidated column for cost of goods sold, Operating expenses and Dividends. Prepare consolidation spreadsheet for intercompany sale of land- Equity method Assume a parent compary acquired its subsidiary on /anuary 1, 2020, at a purchase price that was 5360,000 in eacess of the book value of the subsidiary/s Stockholders: Equity on the acquistion date Of that excess, 5240,000 was askigned to an unrecorded Patent owned by the subsidiany that is being amortized over a 10 -year period. The (A) Patent aset has been amortized as part of the parent's equity method accounting. The remaining $120,000 was assigned to Goodwili, In 2021 , the wholly owned. subsidiary sold Land to the parent for $144000. The Land was reported on the subsidary's balance sheet for $96,000 on the date of sale. The parent uses the equity method to account for its Equity irvestinent Financial statements of the parent and its subsidiary for the year ended December 31, 2022 are presented in d. below. a. Show the corrputation to yidd the 160,000 of income (loss) from subsidiary reported by the parent for the year ended December 31,2022 Note: Use a negative sigh with an arower to ind cate a reduction in the computabion: b. Show the computation to yleld the $636,000 Equity Investment account balance reported by the parent on December 31,2022. Note: Use a negative sign with an answer to indicate a reduction in the computation. c. Prepare the consolidation entries for the year ended December 31, 2022. d. Prepare the consolidation spreadsheet for the year ended December 31,2022. Use negative signs with answers in the Consolidated column for cost of goods sold, Operating expenses and Dividends