Question

All question information has been provided as before. Required (a) - (d) (a) Briefly explain the five-step process in the revenue recognition for Tai Fei

All question information has been provided as before.

Required (a) - (d)

(a) Briefly explain the five-step process in the revenue recognition for Tai Fei Limited under HKFRS 15 Revenue from Contracts with Customers. (7 marks)

(b) Prepare the accounting treatment for the sale of the computers and the related cost of goods sold on 16 April 2019 and the return of the computers on 24 April 2019. (11 marks)

(c) On 30 April 2019, if Tai Fei believed the original estimate of the total return was still correct; explain how to account for expected returns at 30 April 2019 with appropriate accounting treatment. (2 marks) (d) On 31 May 2019, prepare the journal entries for the following situation if:

(i) 7 more computers were returned. (6 marks) (ii) 3 more computers were returned. (2 marks) (iii) No more computers were returned. (2 marks)

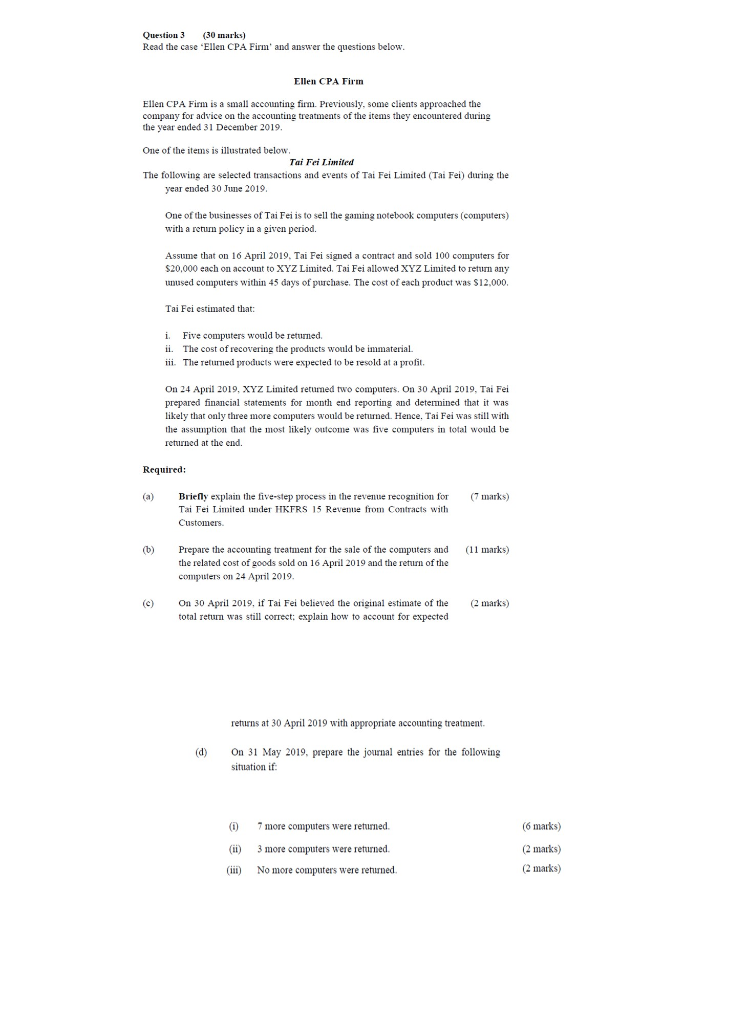

Read the case 'Ellen CPA Firm' and answer the questions below.

Ellen CPA Firm

Ellen CPA Firm is a small accounting firm. Previously, some clients approached the company for advice on the accounting treatments of the items they encountered during the year ended 31 December 2019.

One of the items is illustrated below.

Tai Fei Limited The following are selected transactions and events of Tai Fei Limited (Tai Fei) during the year ended 30 June 2019.

One of the businesses of Tai Fei is to sell the gaming notebook computers (computers) with a return policy in a given period.

Assume that on 16 April 2019, Tai Fei signed a contract and sold 100 computers for $20,000 each on account to XYZ Limited. Tai Fei allowed XYZ Limited to return any unused computers within 45 days of purchase. The cost of each product was $12,000.

Tai Fei estimated that:

i. Five computers would be returned. ii. The cost of recovering the products would be immaterial. iii. The returned products were expected to be resold at a profit.

On 24 April 2019, XYZ Limited returned two computers. On 30 April 2019, Tai Fei prepared financial statements for month end reporting and determined that it was likely that only three more computers would be returned. Hence, Tai Fei was still with the assumption that the most likely outcome was five computers in total would be returned at the end.

Required: (a) Briefly explain the five-step process in the revenue recognition for Tai Fei Limited under HKFRS 15 Revenue from Contracts with Customers. (7 marks)

(b) Prepare the accounting treatment for the sale of the computers and the related cost of goods sold on 16 April 2019 and the return of the computers on 24 April 2019. (11 marks)

(c) On 30 April 2019, if Tai Fei believed the original estimate of the total return was still correct; explain how to account for expected returns at 30 April 2019 with appropriate accounting treatment. (2 marks) (d) On 31 May 2019, prepare the journal entries for the following situation if:

(i) 7 more computers were returned. (6 marks) (ii) 3 more computers were returned. (2 marks) (iii) No more computers were returned. (2 marks)

Question 3 (30 marks) Read the case 'Ellen CPA Firm' and answer the questions below. Ellen CPA Firen Ellen CPA Firm is a small accounting firm. Previously, some clients approached the company for advice on the accounting treatments of the items they encountered during the year ended 31 December 2019. One of the items is illustrated below. Tai Fei Limited The following are selected transactions and events of Tai Fei Limited (Tai Fei) during the year ended 30 June 2019. One of the businesses of Tai Fei is to sell the gaming notebook computers (computers) with a return policy in a given period. Assume that on 16 April 2019. Tai Fei signed a contract and sold 100 computers for $20,000 each on account to XYZ Limited. Tai Fei allowed XYZ Limited to return any unused computers within 45 days of purchase. The cost of each product was $12,000. Tai Fei estimated that: i. Five computers would be returned ii. The cost of recovering the products would be immaterial. ini. The returned products were expected to be resold at a profit On 24 April 2019, XYZ Limited retumed two computers. On 30 April 2019, Tai Fei prepared financial statements for month end reporting and determined that it was likely that only three more computers would be returned. Hence. Tai Fei was still with the assumption that the most likely outcome was five computers in total would be returned at the end. Required: (7 marks) Briefly explain the five-step process in the revenue recognition for Tai Tei Limited under HKFRS 15 Revenue from Contracts with Customers. (b) (11 marks) Prepare the accounting treatment for the sale of the computers and the related cost of goods sold on 16 April 2019 and the return of the computers on 24 April 2019. (2 marks) On 30 April 2019, if Tai Fei believed the onginal estimate of the total retum was still correct: explain how to account for expected returns at 30 April 2019 with appropriate accounting treatment On 31 May 2019. prepare the journal entries for the following situation if: 0 7 more computers were returned. (6 marks) (ii) 3 more computers were returned. (2 marks) (iii) No more computers were returned. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started