Answered step by step

Verified Expert Solution

Question

1 Approved Answer

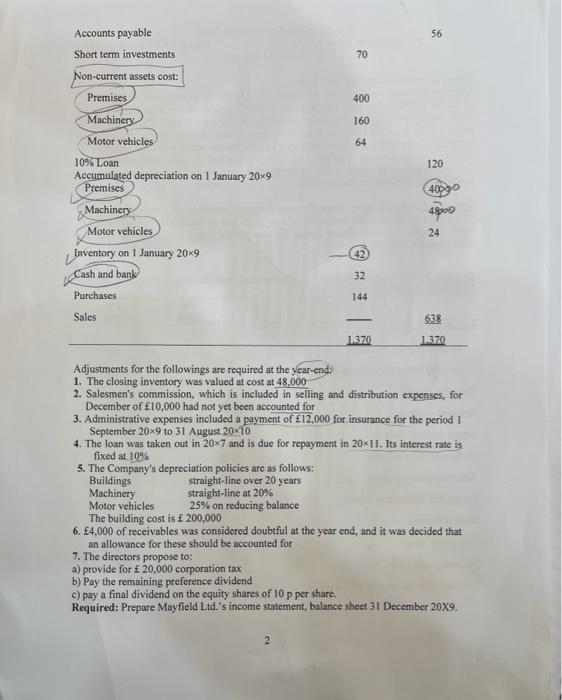

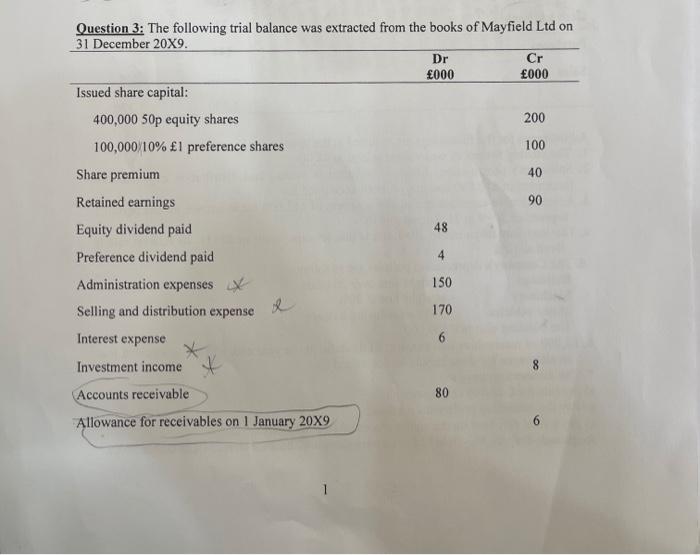

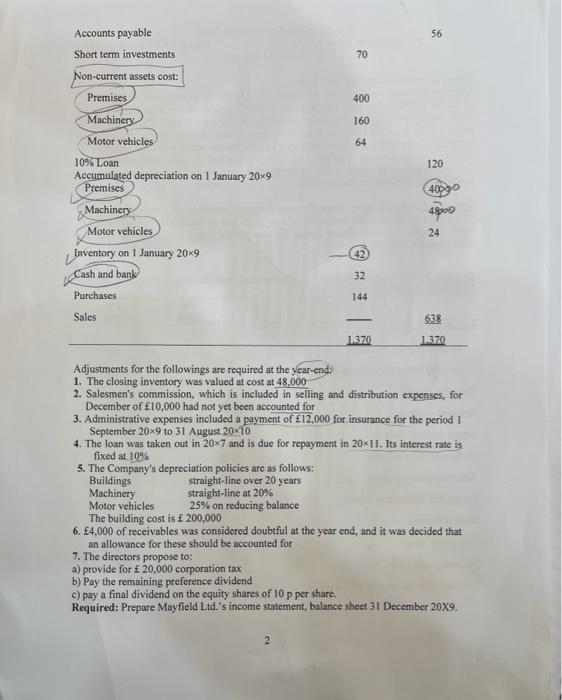

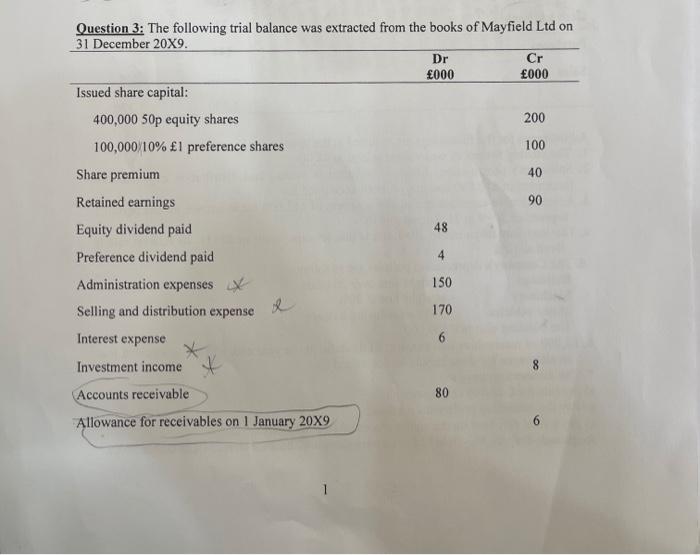

all question three please Accounts payable 56 Short term investments 70 400 10 160 Non-current assets cost: Premises Machinery Motor vehicles 10% Loan Accumulated depreciation

all question three please

Accounts payable 56 Short term investments 70 400 10 160 Non-current assets cost: Premises Machinery Motor vehicles 10% Loan Accumulated depreciation on 1 January 20x9 Premises 64 120 40290 Machinery 4300 Motor vehicles 24 42 Inventory on 1 January 20x9 Cash and bank Purchases 32 144 Sales 638 1.370 1.370 Adjustments for the followings are required at the year-end: 1. The closing inventory was valued at cost at 48,000 2. Salesmen's commission, which is included in selling and distribution expenses, for December of 10,000 had not yet been accounted for 3. Administrative expenses included a payment of 12,000 for insurance for the period I September 20x9 to 31 August 2010 4. The loan was taken out in 20x7 and is due for repayment in 2011. Its interest rate is fixed at 10% 5. The Company's depreciation policies are as follows: Buildings straight-line over 20 years Machinery straight-line at 20% Motor vehicles 25% on reducing balance The building cost is 200,000 6. 4,000 of receivables was considered doubtful at the year end, and it was decided that an allowance for these should be accounted for 7. The directors propose to: a) provide for 20,000 corporation tax b) Pay the remaining preference dividend c) pay a final dividend on the equity shares of 10 p per share. Required: Prepare Mayfield Ltd.'s income statement, balance sheet 31 December 20X9. 2 Question 3: The following trial balance was extracted from the books of Mayfield Ltd on 31 December 20X9. Dr Cr 000 000 Issued share capital: 400,000 50p equity shares 200 100,000/10% l preference shares 100 Share premium 40 Retained earnings 90 Equity dividend paid 48 Preference dividend paid 4 Administration expenses Selling and distribution expense 170 Interest expense 6 Investment income Accounts receivable 80 Allowance for receivables on 1 January 20X9 6 150 e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started