Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all questions ASAP PLZ 43. A city maintains a defined contribution plan to which it agrees to contribute 6 percent of employee wages and salaries.

all questions ASAP PLZ

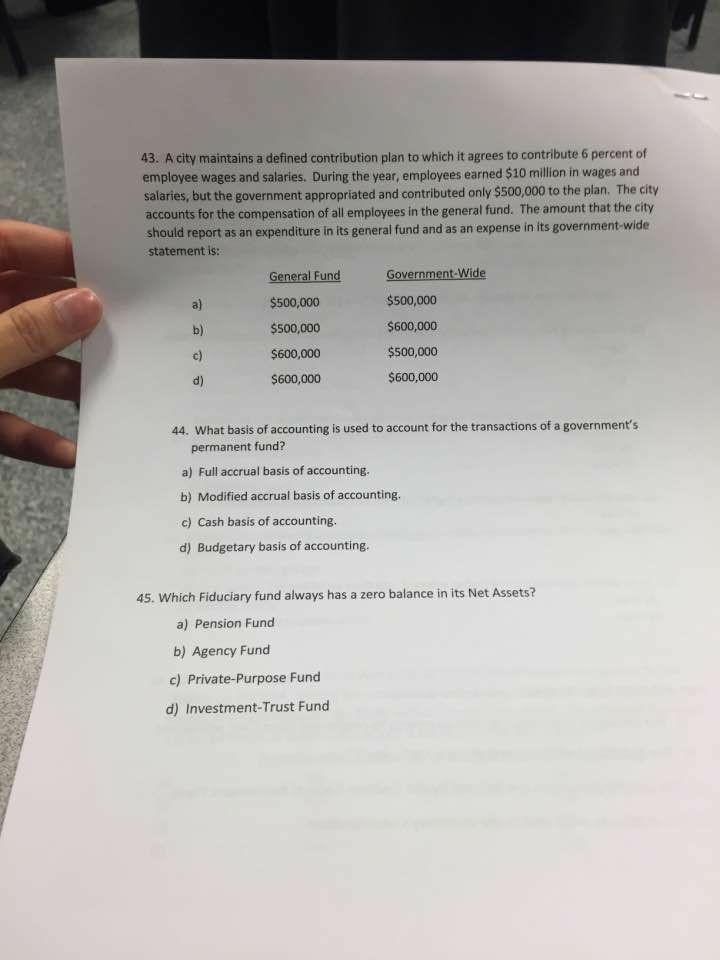

43. A city maintains a defined contribution plan to which it agrees to contribute 6 percent of employee wages and salaries. During the year, employees earned $10 million in wages and salaries, but the government appropriated and contributed only $500,000 to the plan. The city accounts for the compensation of all employees in the general fund. The amount that the city should report as an expenditure in its general fund and as an expense in its government-wide statement is: a) b) c) d) General Fund $500,000 $500,000 $600,000 $600,000 Government-Wide $500,000 $600,000 $500,000 $600,000 44. What basis of accounting is used to account for the transactions of a government's permanent fund? a) Full accrual basis of accounting. b) Modified accrual basis of accounting. c) Cash basis of accounting. d) Budgetary basis of accounting 45. Which Fiduciary fund always has a zero balance in its Net Assets? a) Pension Fund b) Agency Fund c) Private-Purpose Fund d) Investment-Trust FundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started