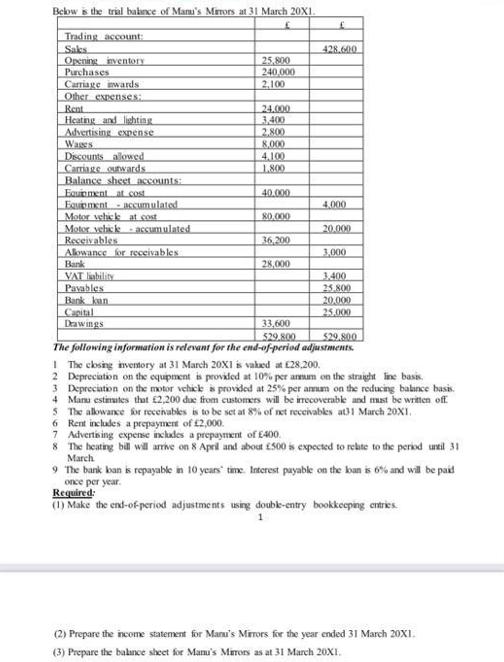

Below is the trial balance of Manu's Marors at 31 March 20X1. Trading account: Saks Opening inventory Purchases Carriage inwards Other expenses. Rent Heating

Below is the trial balance of Manu's Marors at 31 March 20X1. Trading account: Saks Opening inventory Purchases Carriage inwards Other expenses. Rent Heating and lighting Advertising expense Wages Discounts allowed Carriage outwards Balance sheet accounts: Equipment at cost Equipment accumulated Motor vehick at cost Motor vehick accumulated Receivables Allowance for receivables Bank VAT liability Pavables Bank kuan Capital Drawings 25,800 240.000 2,100 24.000 3,400 2.800 8.000 4.100 1.800 40.000 80.000 36,200 28,000 428.600 4.000 20.000 3,000 3.400 25.800 20,000 25.000 33,600 529.800 529.800 The following information is relevant for the end-of-period adjustments. 1 The closing inventory at 31 March 20XI is vaked at 28,200. 2 Depreciation on the equipment is provided at 10% per annum on the straight line basis. 3 Depreciation on the motor vehicle is provided at 25% per annum on the reducing balance basis. 4 Manu estimates that 2,200 due from customers will be irrecoverable and must be written off 5 The allowance for receivables is to be set at 8% of net receivables at31 March 20X1. 6 Rent includes a prepayment of 2,000. 7 Advertising expense includes a prepayment of 400. 8 The heating bill will arrive on 8 April and about 500 is expected to relate to the period until 31 March 9 The bank ban is repayable in 10 years' time. Interest payable on the loan is 6% and will be paid once per year. Required: (1) Make the end-of-period adjustments using double-entry bookkeeping entries. (2) Prepare the income statement for Manu's Mirrors for the year ended 31 March 20X1. (3) Prepare the balance sheet for Mani's Mirrors as at 31 March 20X1.

Step by Step Solution

3.60 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Income statement of Manus Mirrors for the year ended 21 March 20X1 Pa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started