Answered step by step

Verified Expert Solution

Question

1 Approved Answer

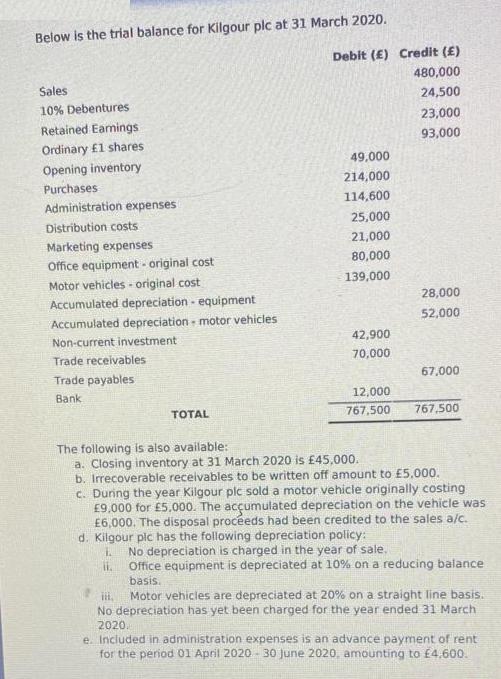

Below is the trial balance for Kilgour plc at 31 March 2020. Debit (E) Sales 10% Debentures Retained Earnings Ordinary 1 shares 49,000 Opening

Below is the trial balance for Kilgour plc at 31 March 2020. Debit (E) Sales 10% Debentures Retained Earnings Ordinary 1 shares 49,000 Opening inventory Purchases 214,000 Administration expenses 114,600 Distribution costs 25,000 Marketing expenses 21,000 Office equipment - original cost 80,000 Motor vehicles-original cost 139,000 28,000 Accumulated depreciation equipment Accumulated depreciation motor vehicles 52,000 Non-current investment 42,900 Trade receivables 70,000 Trade payables 67,000 Bank 12,000 TOTAL 767,500 767,500 The following is also available: a. Closing inventory at 31 March 2020 is 45,000. b. Irrecoverable receivables to be written off amount to 5,000. c. During the year Kilgour plc sold a motor vehicle originally costing 9,000 for 5,000. The accumulated depreciation on the vehicle was 6,000. The disposal proceeds had been credited to the sales a/c. d. Kilgour plc has the following depreciation policy: L. No depreciation is charged in the year of sale. 11. Office equipment is depreciated at 10% on a reducing balance basis. iii. Motor vehicles are depreciated at 20% on a straight line basis. No depreciation has yet been charged for the year ended 31 March 2020. e. Included in administration expenses is an advance payment of rent for the period 01 April 2020-30 June 2020. amounting to 4.600. Credit (E) 480,000 24,500 23,000 93,000 f. The rate of corporation tax is 20%. Required Prepare a Statement of Profit or Loss for the year ended 31 March 2020 and a Statement of Financial Position as at 31 March 2020, in a form that complies with IAS 1 Presentation of Financial Statements. Below is the trial balance for Kilgour plc at 31 March 2020. Debit (E) Sales 10% Debentures Retained Earnings Ordinary 1 shares 49,000 Opening inventory Purchases 214,000 Administration expenses 114,600 Distribution costs 25,000 Marketing expenses 21,000 Office equipment - original cost 80,000 Motor vehicles-original cost 139,000 28,000 Accumulated depreciation equipment Accumulated depreciation motor vehicles 52,000 Non-current investment 42,900 Trade receivables 70,000 Trade payables 67,000 Bank 12,000 TOTAL 767,500 767,500 The following is also available: a. Closing inventory at 31 March 2020 is 45,000. b. Irrecoverable receivables to be written off amount to 5,000. c. During the year Kilgour plc sold a motor vehicle originally costing 9,000 for 5,000. The accumulated depreciation on the vehicle was 6,000. The disposal proceeds had been credited to the sales a/c. d. Kilgour plc has the following depreciation policy: L. No depreciation is charged in the year of sale. 11. Office equipment is depreciated at 10% on a reducing balance basis. iii. Motor vehicles are depreciated at 20% on a straight line basis. No depreciation has yet been charged for the year ended 31 March 2020. e. Included in administration expenses is an advance payment of rent for the period 01 April 2020-30 June 2020. amounting to 4.600. Credit (E) 480,000 24,500 23,000 93,000 f. The rate of corporation tax is 20%. Required Prepare a Statement of Profit or Loss for the year ended 31 March 2020 and a Statement of Financial Position as at 31 March 2020, in a form that complies with IAS 1 Presentation of Financial Statements.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Assumed Debenture inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started