Answered step by step

Verified Expert Solution

Question

1 Approved Answer

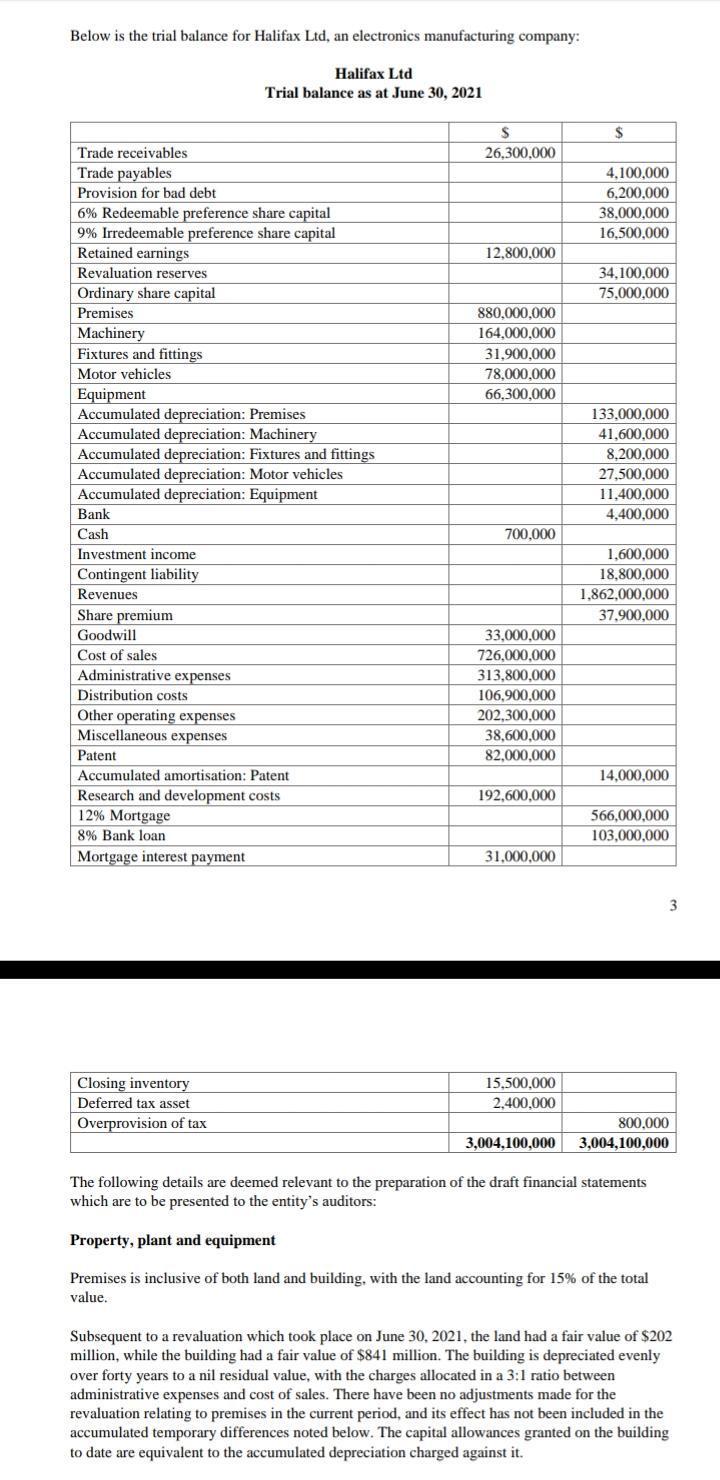

Below is the trial balance for Halifax Ltd, an electronics manufacturing company: Trade receivables Trade payables Provision for bad debt 6% Redeemable preference share

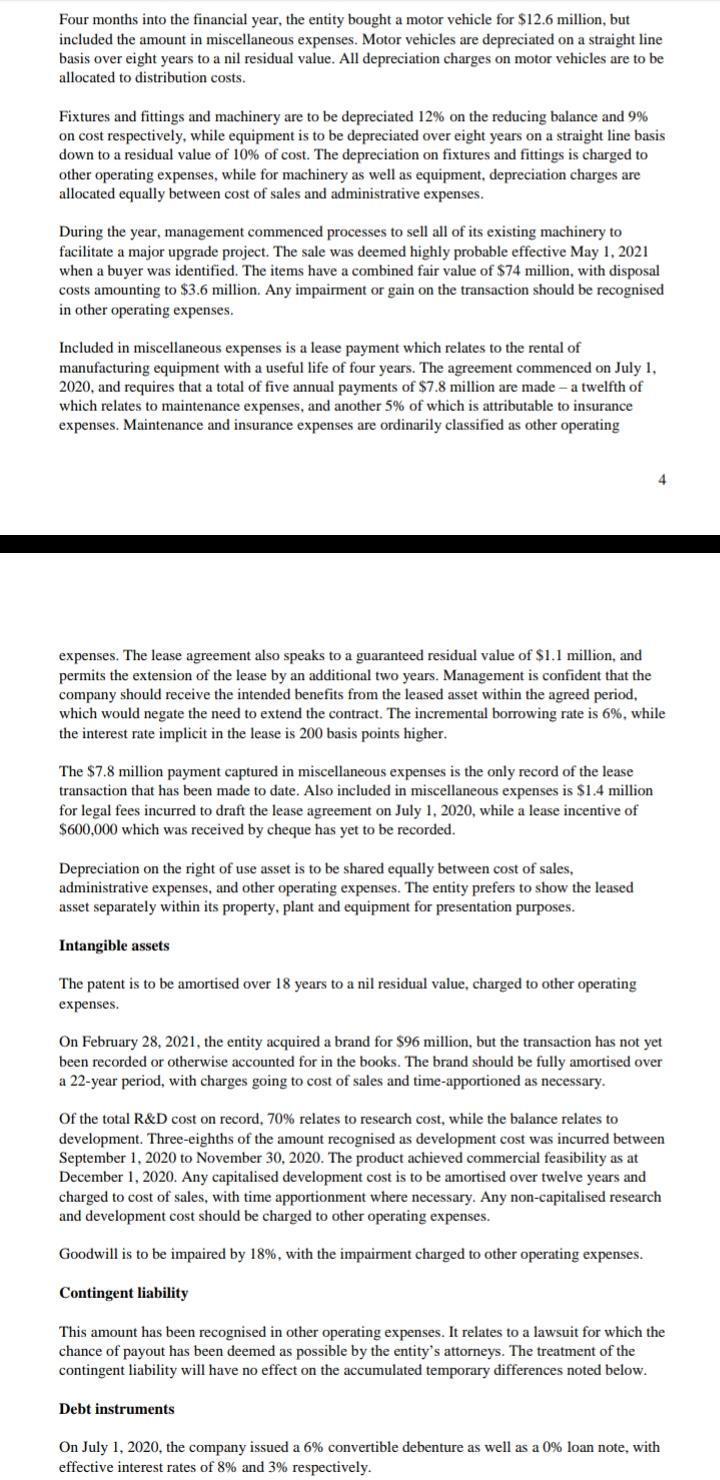

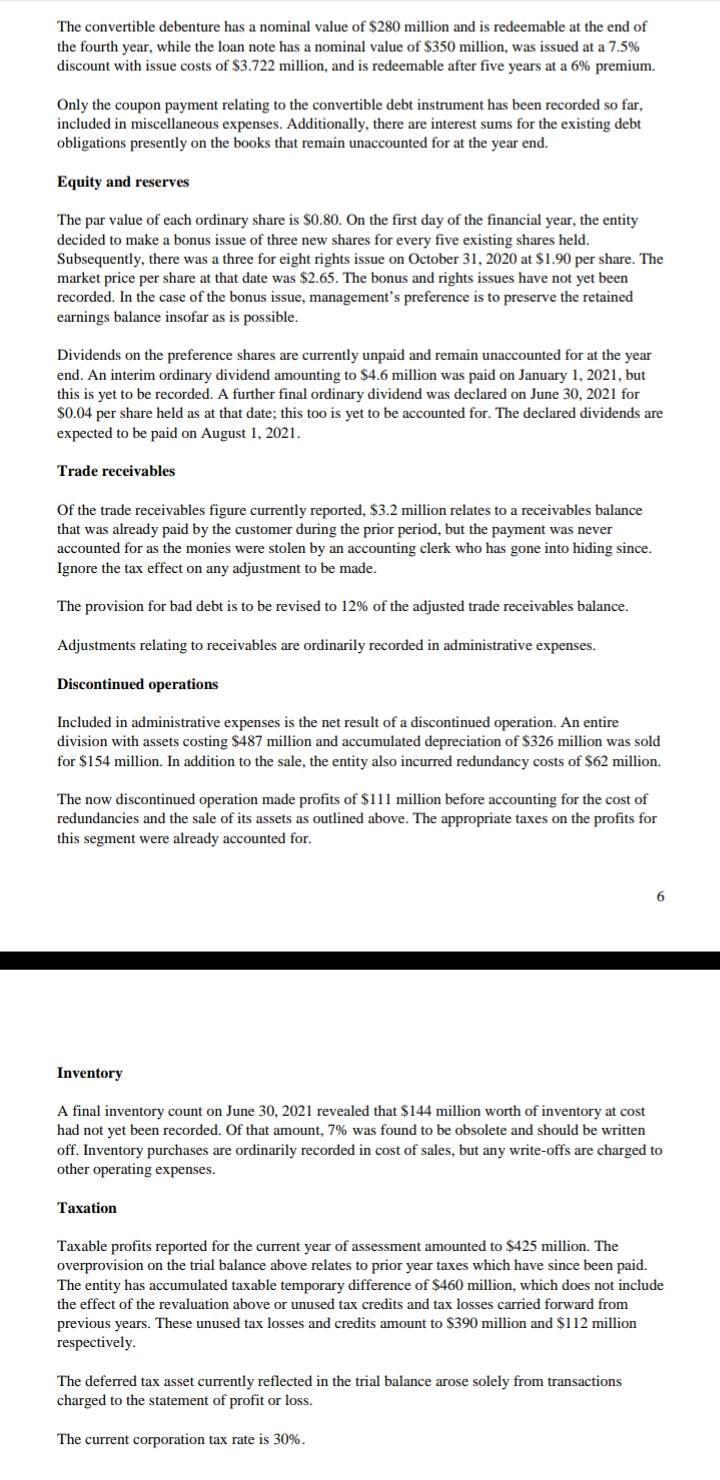

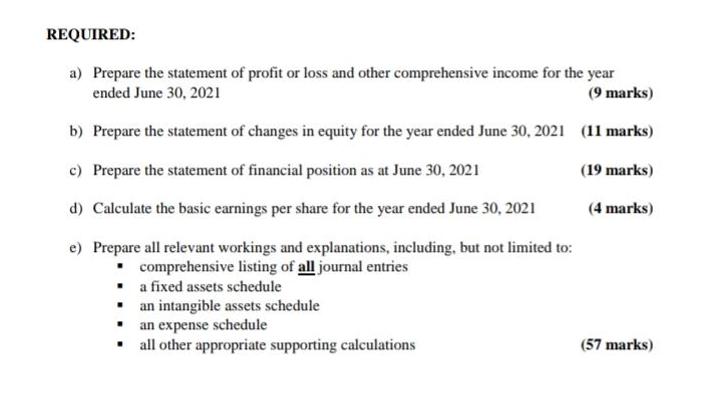

Below is the trial balance for Halifax Ltd, an electronics manufacturing company: Trade receivables Trade payables Provision for bad debt 6% Redeemable preference share capital 9% Irredeemable preference share capital Retained earnings Revaluation reserves Ordinary share capital Premises Machinery Fixtures and fittings Motor vehicles Equipment Accumulated depreciation: Premises Accumulated depreciation: Machinery Accumulated depreciation: Fixtures and fittings Accumulated depreciation: Motor vehicles Accumulated depreciation: Equipment Bank Cash Investment income Contingent liability Revenues Share premium Goodwill Cost of sales Administrative expenses Distribution costs Halifax Ltd Trial balance as at June 30, 2021 Other operating expenses Miscellaneous expenses Patent Accumulated amortisation: Patent Research and development costs 12% Mortgage 8% Bank loan Mortgage interest payment Closing inventory Deferred tax asset Overprovision of tax S 26,300,000 12,800,000 880,000,000 164,000,000 31,900,000 78,000,000 66,300,000 700,000 33,000,000 726,000,000 313,800,000 106,900,000 202,300,000 38,600,000 82,000,000 192,600,000 31,000,000 15,500,000 2,400,000 $ 4,100,000 6,200,000 38,000,000 16,500,000 34,100,000 75,000,000 133,000,000 41,600,000 8,200,000 27,500,000 11,400,000 4,400,000 1,600,000 18,800,000 1,862,000,000 37,900,000 14,000,000 566,000,000 103,000,000 3 800,000 3,004,100,000 3,004,100,000 The following details are deemed relevant to the preparation of the draft financial statements which are to be presented to the entity's auditors: Property, plant and equipment Premises is inclusive of both land and building, with the land accounting for 15% of the total value. Subsequent to a revaluation which took place on June 30, 2021, the land had a fair value of $202 million, while the building had a fair value of $841 million. The building is depreciated evenly over forty years to a nil residual value, with the charges allocated in a 3:1 ratio between administrative expenses and cost of sales. There have been no adjustments made for the revaluation relating to premises in the current period, and its effect has not been included in the accumulated temporary differences noted below. The capital allowances granted on the building to date are equivalent to the accumulated depreciation charged against it. Four months into the financial year, the entity bought a motor vehicle for $12.6 million, but included the amount in miscellaneous expenses. Motor vehicles are depreciated on a straight line basis over eight years to a nil residual value. All depreciation charges on motor vehicles are to be allocated to distribution costs. Fixtures and fittings and machinery are to be depreciated 12% on the reducing balance and 9% on cost respectively, while equipment is to be depreciated over eight years on a straight line basis down to a residual value of 10% of cost. The depreciation on fixtures and fittings is charged to other operating expenses, while for machinery as well as equipment, depreciation charges are allocated equally between cost of sales and administrative expenses. During the year, management commenced processes to sell all of its existing machinery to facilitate a major upgrade project. The sale was deemed highly probable effective May 1, 2021 when a buyer was identified. The items have a combined fair value of $74 million, with disposal costs amounting to $3.6 million. Any impairment or gain on the transaction should be recognised in other operating expenses. Included in miscellaneous expenses is a lease payment which relates to the rental of manufacturing equipment with a useful life of four years. The agreement commenced on July 1, 2020, and requires that a total of five annual payments of $7.8 million are made - a twelfth of which relates to maintenance expenses, and another 5% of which is attributable to insurance expenses. Maintenance and insurance expenses are ordinarily classified as other operating expenses. The lease agreement also speaks to a guaranteed residual value of $1.1 million, and permits the extension of the lease by an additional two years. Management is confident that the company should receive the intended benefits from the leased asset within the agreed period, which would negate the need to extend the contract. The incremental borrowing rate is 6%, while the interest rate implicit in the lease is 200 basis points higher. The $7.8 million payment captured in miscellaneous expenses is the only record of the lease transaction that has been made to date. Also included in miscellaneous expenses is $1.4 million for legal fees incurred to draft the lease agreement on July 1, 2020, while a lease incentive of $600,000 which was received by cheque has yet to be recorded. Depreciation on the right of use asset is to be shared equally between cost of sales, administrative expenses, and other operating expenses. The entity prefers to show the leased asset separately within its property, plant and equipment for presentation purposes. Intangible assets. The patent is to be amortised over 18 years to a nil residual value, charged to other operating expenses. 4 On February 28, 2021, the entity acquired a brand for $96 million, but the transaction has not yet been recorded or otherwise accounted for in the books. The brand should be fully amortised over a 22-year period, with charges going to cost of sales and time-apportioned as necessary. Of the total R&D cost on record, 70% relates to research cost, while the balance relates to development. Three-eighths of the amount recognised as development cost was incurred between September 1, 2020 to November 30, 2020. The product achieved commercial feasibility as at December 1, 2020. Any capitalised development cost is to be amortised over twelve years and charged to cost of sales, with time apportionment where necessary. Any non-capitalised research and development cost should be charged to other operating expenses. Goodwill is to be impaired by 18%, with the impairment charged to other operating expenses. Contingent liability This amount has been recognised in other operating expenses. It relates to a lawsuit for which the chance of payout has been deemed as possible by the entity's attorneys. The treatment of the contingent liability will have no effect on the accumulated temporary differences noted below. Debt instruments On July 1, 2020, the company issued a 6% convertible debenture as well as a 0% loan note, with effective interest rates of 8% and 3% respectively. The convertible debenture has a nominal value of $280 million and is redeemable at the end of the fourth year, while the loan note has a nominal value of $350 million, was issued at a 7.5% discount with issue costs of $3.722 million, and is redeemable after five years at a 6% premium. Only the coupon payment relating to the convertible debt instrument has been recorded so far, included in miscellaneous expenses. Additionally, there are interest sums for the existing debt obligations presently on the books that remain unaccounted for at the year end. Equity and reserves The par value of each ordinary share is $0.80. On the first day of the financial year, the entity decided to make a bonus issue of three new shares for every five existing shares held. Subsequently, there was a three for eight rights issue on October 31, 2020 at $1.90 per share. The market price per share at that date was $2.65. The bonus and rights issues have not yet been recorded. In the case of the bonus issue, management's preference is to preserve the retained earnings balance insofar as is possible. Dividends on the preference shares are currently unpaid and remain unaccounted for at the year end. An interim ordinary dividend amounting to $4.6 million was paid on January 1, 2021, but this is yet to be recorded. A further final ordinary dividend was declared on June 30, 2021 for $0.04 per share held as at that date; this too is yet to be accounted for. The declared dividends are expected to be paid on August 1, 2021. Trade receivables Of the trade receivables figure currently reported, $3.2 million relates to a receivables balance that was already paid by the customer during the prior period, but the payment was never accounted for as the monies were stolen by an accounting clerk who has gone into hiding since. Ignore the tax effect on any adjustment to be made. The provision for bad debt is to be revised to 12% of the adjusted trade receivables balance. Adjustments relating to receivables are ordinarily recorded in administrative expenses. Discontinued operations Included in administrative expenses is the net result of a discontinued operation. An entire division with assets costing $487 million and accumulated depreciation of $326 million was sold for $154 million. In addition to the sale, the entity also incurred redundancy costs of $62 million. The now discontinued operation made profits of $111 million before accounting for the cost of redundancies and the sale of its assets as outlined above. The appropriate taxes on the profits for this segment were already accounted for. Inventory A final inventory count on June 30, 2021 revealed that $144 million worth of inventory at cost had not yet been recorded. Of that amount, 7% was found to be obsolete and should be written off. Inventory purchases are ordinarily recorded in cost of sales, but any write-offs are charged to other operating expenses. Taxation The Taxable profits reported for the current year of assessment amounted to $425 million. The overprovision on the trial balance above relates to prior year taxes which have since been paid. has accumulated taxable temporary difference of $460 million, which does not include the effect of the revaluation above or unused tax credits and tax losses carried forward from previous years. These unused tax losses and credits amount to $390 million and $112 million respectively. The deferred tax asset currently reflected in the trial balance arose solely from transactions charged to the statement of profit or loss. The current corporation tax rate is 30%. REQUIRED: a) Prepare the statement of profit or loss and other comprehensive income for the year ended June 30, 2021 (9 marks) b) Prepare the statement of changes in equity for the year ended June 30, 2021 (11 marks) c) Prepare the statement of financial position as at June 30, 2021 (19 marks) d) Calculate the basic earnings per share for the year ended June 30, 2021 (4 marks) e) Prepare all relevant workings and explanations, including, but not limited to: comprehensive listing of all journal entries a fixed assets schedule . an intangible assets schedule an expense schedule all other appropriate supporting calculations (57 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Statement Item Amount million Statement of Profit or Loss and Other Comprehensive Income Revenue 1877 Cost of sales 726 Gross profit 931 Administrative expenses 2023 Operating profit 603 Finance cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started