Directions Using the tax software, complete the tax retur, including Form 1040 and all appropri ate forms, schedules, or worksheets Answer the questions following

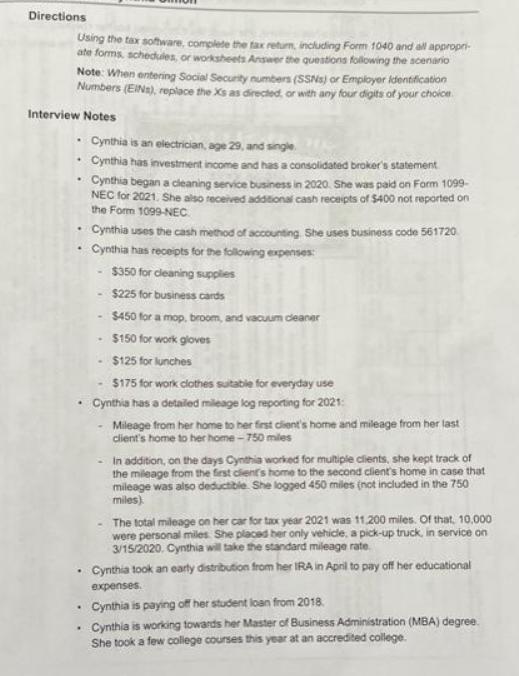

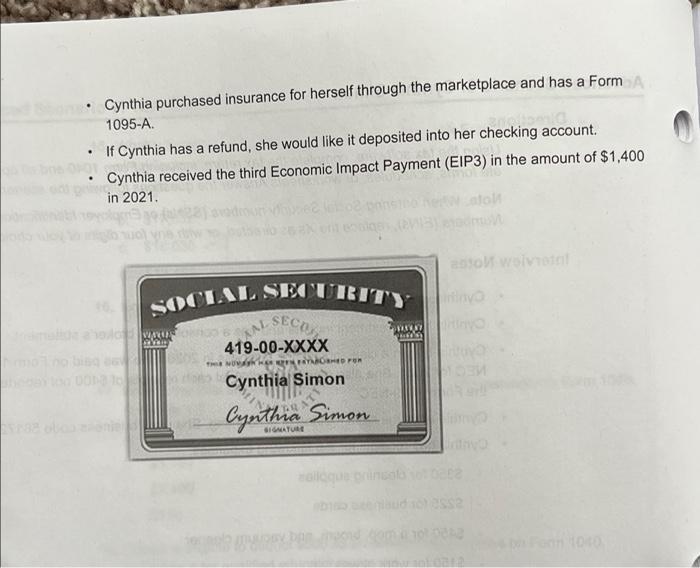

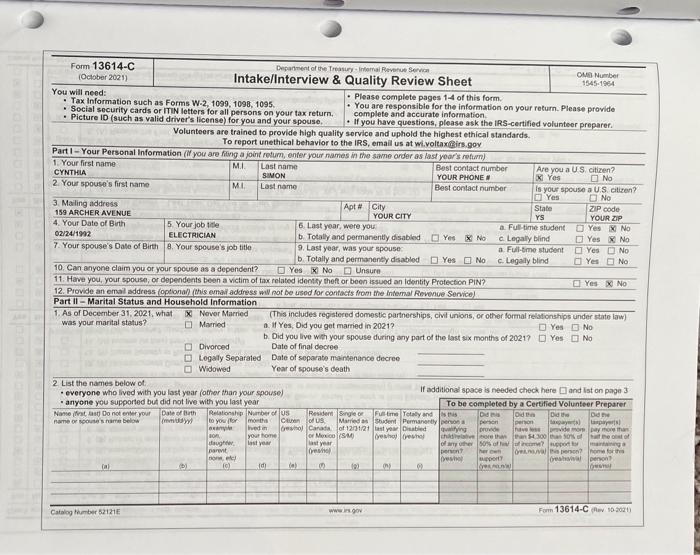

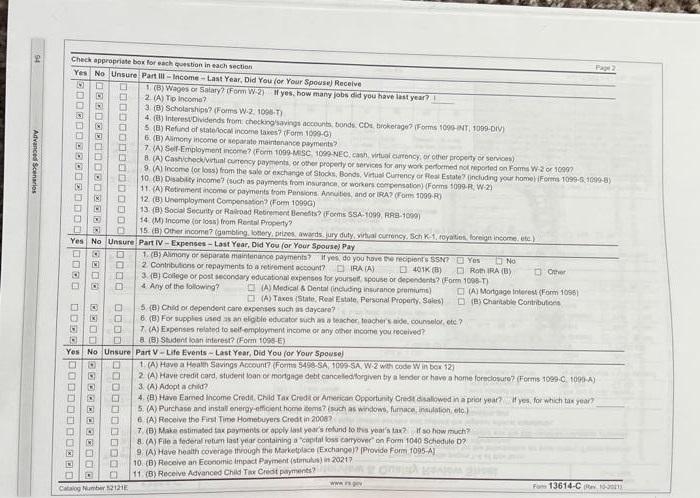

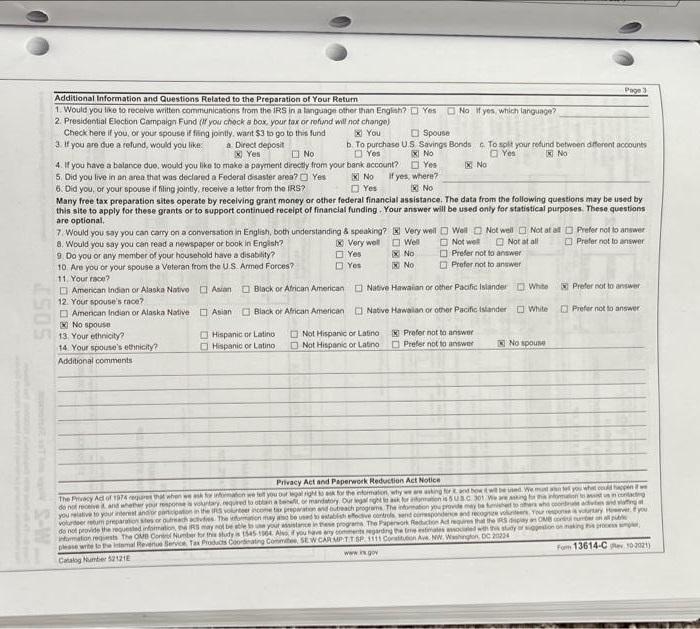

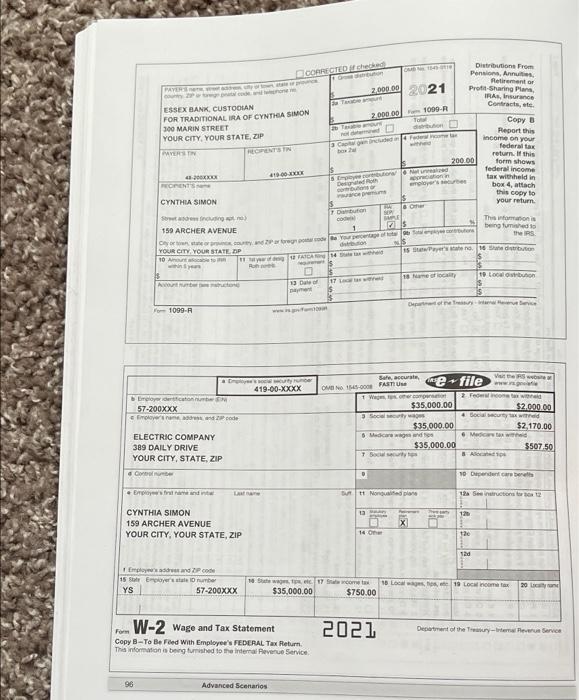

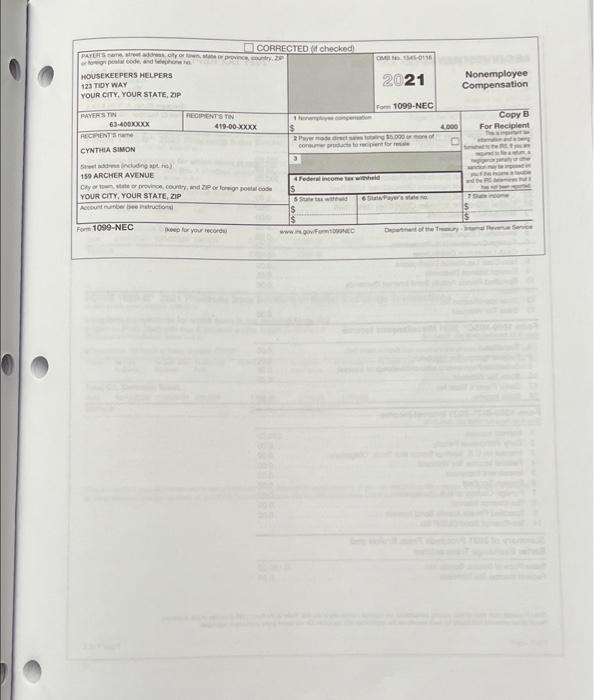

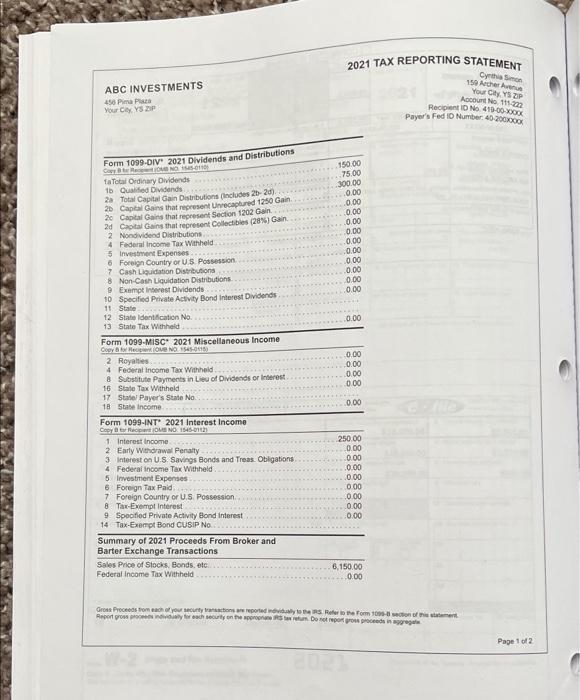

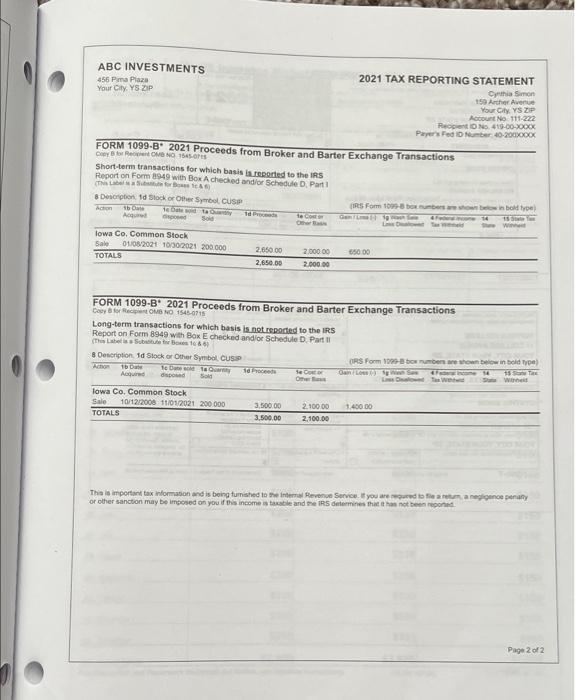

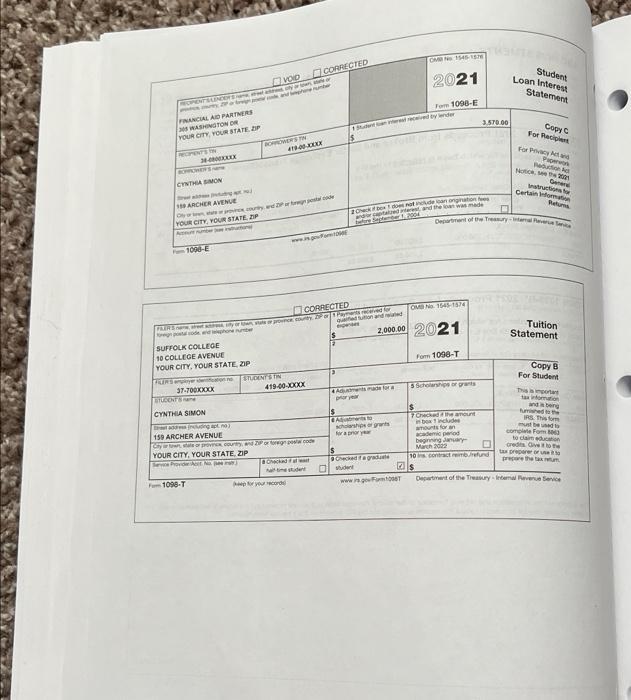

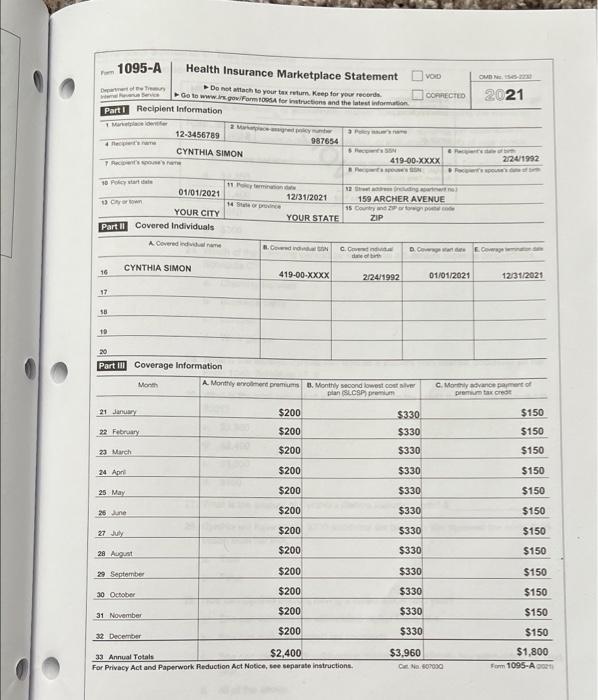

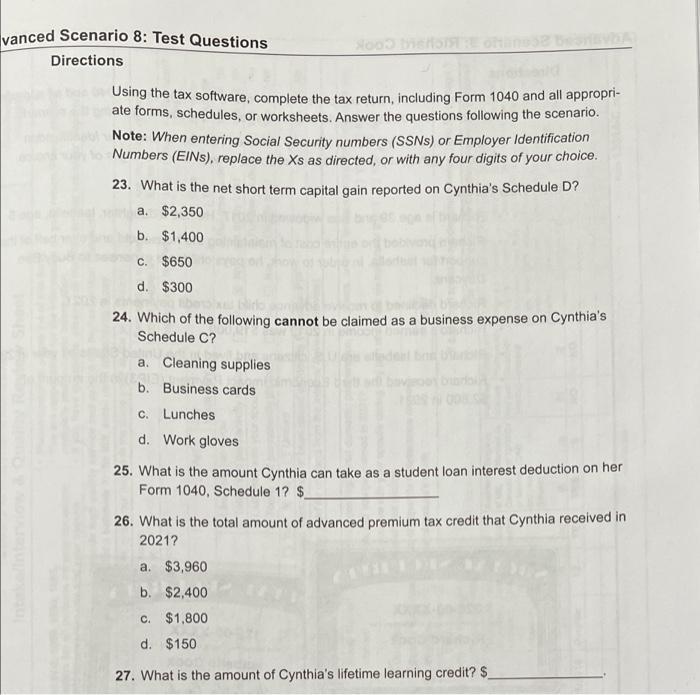

Directions Using the tax software, complete the tax retur, including Form 1040 and all appropri ate forms, schedules, or worksheets Answer the questions following the scenario Note: When entering Social Security numbers (SSNS) or Employer identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. Interview Notes Cynthia is an electrician, age 29, and single Cynthia has investment income and has a consolidated broker's statement . . Cynthia began a cleaning service business in 2020. She was paid on Form 1099- NEC for 2021. She also received additional cash receipts of $400 not reported on the Form 1099-NEC Cynthia uses the cash method of accounting She uses business code 561720 Cynthia has receipts for the following expenses: $350 for cleaning supplies $225 for business cards - $450 for a mop, broom, and vacuum cleaner - $150 for work gloves $125 for lunches - $175 for work clothes suitable for everyday use Cynthia has a detailed mileage log reporting for 2021: Mileage from her home to her first client's home and mileage from her last client's home to her home-750 miles In addition, on the days Cynthia worked for multiple clients, she kept track of the mileage from the first client's home to the second client's home in case that mileage was also deductible. She logged 450 miles (not included in the 750 miles). The total mileage on her car for tax year 2021 was 11,200 miles. Of that, 10.000 were personal miles. She placed her only vehicle, a pick-up truck, in service on 3/15/2020, Cynthia will take the standard mileage rate Cynthia took an early distribution from her IRA in April to pay off her educational expenses. Cynthia is paying off her student loan from 2018. . . Cynthia is working towards her Master of Business Administration (MBA) degree. She took a few college courses this year at an accredited college. Cynthia purchased insurance for herself through the marketplace and has a Form A 1095-A. If Cynthia has a refund, she would like it deposited into her checking account. Cynthia received the third Economic Impact Payment (EIP3) in the amount of $1,400 in 2021. SOCIAL SECURITY WAUS ORG0 www SECU 419-00-XXXX THIS NOVASK EEN FATARORMED FOR Cynthia Simon Cynthia Simon AAL zalloqu wwwny antol wolvietnl MAR tol nur sof 03 rinyo Form 13614-C (October 2021) You will need: Tax Information such as Forms W-2, 1099, 1098, 1095. Social security cards or ITIN letters for all persons on your tax return. Picture ID (such as valid driver's license) for you and your spouse. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltax@@irs.gov Part I-Your Personal Information (If you are filing a joint retum, enter your names in the same order as last year's return) 1. Your first name M.I. CYNTHIA Best contact number YOUR PHONE # Best contact number 2. Your spouse's first name. 3. Mailing address 159 ARCHER AVENUE 4. Your Date of Birth 02/24/1992 5. Your job title ELECTRICIAN 7. Your spouse's Date of Birth 8. Your spouse's job title Name (frat last) Do not enter your name or spouse's name below (a) Department of the Treasury-Internal Revenue Service Intake/Interview & Quality Review Sheet 000 Catalog Number 52121E M.I. 6. Last year, were you b. Totally and permanently disabled Yes No 9. Last year, was your spouse b. Totally and permanently disabled Yes No Unsure 10. Can anyone claim you or your spouse as a dependent? 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? 12. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) Part II-Marital Status and Household Information 1. As of December 31, 2021, what X Never Married was your marital status? Married Date of Birth (mm/yy (B) Last name SIMON Last name 2 List the names below of everyone who lived with you last year (other than your spouse) anyone you supported but did not live with you last year Divorced Legally Separated Widowed Please complete pages 1-4 of this form. You are responsible for the information on your return. Please provide complete and accurate information. If you have questions, please ask the IRS-certified volunteer preparer. Apt # City idi Date of separate maintenance decree Year of spouse's death (0) YOUR CITY Relationship Number of US Resident Single or Full time Totally and to you for months Cuen of US Married as Student Permanently example ved in desito) Canada of 12/31/21 last year Disabled so your home or Mexico (SMM) (yeah)(yesha daughter last year parent non, etc (0) last year (reso M (This includes registered domestic partnerships, civil unions, or other formal relationships a. If Yes, Did you get married in 2021? Yes b. Did you live with your spouse during any part of the last six months of 2021? Yes Date of final decree (9) www.in.gov ON Yes No 99 Are you a US citizen? Yes No qualifying childwa of any other person? (yesho OMB Number 1545-1964 is your spouse a U.S. citizen? Yes No ZIP code YOUR ZIP Yes No Yes No State YS a. Full-time student c. Legally blind a. Full-time student c. Legally blind Yes Yes No No 3 If additional space is needed check here and list on page To be completed by a Certified Volunteer Preparer this Od Od the Did the Did the taxpayers) taxpayers) provide have provide mor pay more than eore than than $4.300 than 50% of hat the post of 50% of his of income? support for maintaining her own Omaval this person? home for this support TOPLA Greataival person? Tommy Yes X No under state law) No No Form 13614-C (v 10-2021) 94 Advanced Scenarios Check appropriate box for each question in each section Yes No Unsure Part Ill-Income-Last Year, Did You (or Your Spouse) Receive COOOOOOOOOOOOO 0000 20000000000000020000 DOB0900000000000 0000200000000000 D Yes No Unsure Part IV-Expenses-Last Year, Did You (or Your Spouse) Pay 00000000000000000000000 O D Yes No Unsure D 100000 1. (B) Wages or Salary? (Form W-2) If yes, how many jobs did you have last year? 1 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (8) InterestDividends from checking'savings accounts, bonds CDs brokerage? (Forms 1099-INT, 1099-DIV) 5 (8) Refund of state/local income taxes? (Form 1000-G) D D O Catalog Number 52121 6. (B) Alimony income or separate maintenance payments? 7 (A) Self-Employment income? (Form 1099-MISC 1099-NEC, cash, virtual currency, or other property of services) 8. (A) Cashicheck/virtual currency payments, or other property or services for any work performed not reported on Forms W-2 or 10997 9. (A) Income (or loss) from the sale or exchange of Stocks, Bonds, Virtual Currency or Real Estate? (including your home) (Forms 1099-5 1099-8) 10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1099-R, W-2) 11. (A) Retirement income or payments from Pansions Annuities, and or IRA? (Form 1000-R) 12. (B) Unemployment Compensation? (Form 10990) 13 (8) Social Security or Railroad Retirement Benefits? (Forms SSA-1099, RRB-1099) 14. (M) Income (or loss) from Rental Property? 15. (B) income? (gambling, lottery, prizes, awards, jury duty, virtual currency, Sch K-1, royalties, foreign income, etc.) Yes No Roth IRA (B) 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipient's SSN? 2 Contributions or repayments to a retirement account? IRA (A) 401K (B) 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T) (A) Medical & Dental (including insurance premiums) 4 Any of the following? (A) Taxes (State, Real Estate, Personal Property, Sales) 5(8) Child or dependent care expenses such as daycare? 6 (8) For supplies used as an eligible educator such as a teacher, teacher's aide, counselor, etc? 7. (A) Expenses related to self-employment income or any other income you received? 8 (8) Student loan interest? (Form 1098-E) Part V-Life Events-Last Year, Did You (or Your Spouse) Other www.g (A) Mortgage Interest (Form 1096) (B) Charitable Contributions 1. (A) Have a Health Savings Account? (Forms 5498-SA, 1099-5A, W-2 with code Winbox 12) 2 (A) Have credit card, studerit loan or mortgage debt cancelledforgiven by a lender or have a home foreclosure? (Forms 1099-C 1090-A) 3. (A) Adopt a child? 4. (B) Have Earned Income Credit. Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year? 5. (A) Purchase and install energy-efficient home items? (such as windows, fumace, insulation, etc.) 6 (A) Receive the First Time Homebuyers Credit in 2008? 7. (B) Make estimated tax payments or apply last year's refund to this year's tax? If so how much? 8. (A) File a federal return last year containing a "capital loss carryover" on Form 1040 Schedule D? 9. (A) Have health coverage through the Marketplace (Exchange)? (Provide Form 1095-A) 10. (B) Receive an Economic Impact Payment (stimulus) in 20217 11. (B) Receive Advanced Child Tax Credit payments? For 13614-C - (505 Additional Information and Questions Related to the Preparation of Your Return 1. Would you like to receive written communications from the IRS in a language other than English? Yes No If yes, which language? 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) You Check here if you, or your spouse if filing jointly, want $3 to go to this fund 3. If you are due a refund, would you like a Direct deposit Yes No 4. If you have a balance due, would you like to make a payment directly from your bank account? 5. Did you live in an area that was declared a Federal disaster area? No If yes, where? Yes No Yes 6. Did you, or your spouse if filing jointly, receive a letter from the IRS? Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional. American Indian or Alaska Native 12. Your spouse's race? American Indian or Alaska Native No spouse 13. Your ethnicity? 14. Your spouse's ethnicity? Additional comments Black or African American Black or African American b. To purchase US Yes Asian Asian Hispanic or Latino Hispanic or Latino Well Prefer not to answer 7. Would you say you can carry on a conversation in English, both understanding & speaking? K Very wellWell Not well Not at at Prefer not to answer 8. Would you say you can read a newspaper or book in English? Not at all 9. Do you or any member of your household have a disability? 10. Are you or your spouse a Veteran from the U.S. Armed Forces? 11. Your race? X Very well Yes Not well Prefer not to answer Prefer not to answer Yes No No Not Hispanic or Latino Not Hispanic or Latino Spouse Savings Bonds To split your refund between different accounts No Yes No Yes No Native Hawaian or other Pacific Islander Native Hawaian or other Pacific Islander Prefer not to answer Prefer not to answer Page 3 White White No spouse Prefer not to answer Prefer not to answer Privacy Act and Paperwork Reduction Act Notice are asking for and bow twit be used. We must ate you what could happen w The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why do not receive and whether your response is voluntary required to obtain a best or mandatory Our legal right to ask for anormation is 5 USC 301 We are sting te this information to assist us in contactg you relative to your interest andior panicipation in the RS volunteer income tax preparation and outreach programs. The information you provide may be fished to others who coondrue advt volunteer retum preparation sites or outreach acties. The formation may also be used to establish effective controls send corespondence and recognize volunteers Your response is turtary However you do not provide the requested information, se IRS may not be able to use your assistance in these programs The Paperwork Reduction Ad requires that the IRS diplay an OMB con unber on all pub information requests The OMB Cone Number for this study is 1545 1064 Alo f you have any comments regarding the tre estimates associated with this study of siption on making pro please write to the internal Revenue Service Tax Products Coordinating Commitee, SEW CAR MPTT SP 1111 Conatuon Ave NW Washington, DC 20224 Form 13614-C102021) www.go Catalog Number 52121 PAYERS cu 2 tog pratal code and 43-300XXXX ESSEX BANK, CUSTODIAN FOR TRADITIONAL IRA OF CYNTHIA SIMON 300 MARIN STREET YOUR CITY, YOUR STATE, ZIP PAYERS T RECENTS CYNTHIA SIMON 96 For 1000-R including no Employer desfication number 57-200XXX Employer's name, address and code ELECTRIC COMPANY 389 DAILY DRIVE YOUR CITY, STATE, ZIP Contralumber Employ's first name and city of atas or proce Employee's address and ZIP code 15 State Employer's state ID number YS CYNTHIA SIMON 159 ARCHER AVENUE YOUR CITY, YOUR STATE, ZIP REOPENTS FIN 57-200XXX 419-00-XXXX Laste CORRECTED if checked Geistreution Ro y of 12 FATCA am 1 Street 159 ARCHER AVENUE $ Corn state or procurand 2Portregn postal code e Your percentage of totalt fotal egyee coreutions debution YOUR CITY, YOUR STATE OP 10 Amount www. sorty under 419-00-XXXX 13 Dale of payment Advanced Scenarios Form W-2 Wage and Tax Statement Copy B-To Be Fied With Employee's FEDERAL Tax Return. This information is being furnished to the internal Revenue Service la Taxable amout 2.000.00 in Taxable amour not dem S a Capital gain included in CAD 1549 0 2,000.00 2021 Employee corbutona Designated Roth coulions or inance premiums Dabution code 14 ate tax 17 Las res 1 One SEP SALE OMB No 1545-0008 FASTU D Toal debuton 3 Socialsty 13 1099-R Net und appreciation employer's serbes Safe, accurate, 7 Social security 18 Name of locality 14 Other 1 Wagen somer compensatio $35,000.00 $35,000.00 $35,000.00 5 Medicare wages and 200.00 S 15 StawPayer's state no. 16 Sue distribution Sutt Nonquated plane Distributions From Pensions, Annues, Retirement or Profit-Sharing Plans, IRAS, Insurance Contracts, etc. 18 State wages, 1p, etc. 17 Sale income tax 18 Local wages, $35,000.00 $750.00 2021 Department of the Turyn e beve efile Copy B Report this income on your federal tax return. If this form shows federal income tax withheld in box 4, attach this copy to your return. This information is being furnished to the IRS 19 Local distribution 120 2 Federal income tax withheld 120 120 Visit the RS www.g 4 Social security tax withheld Medic tax w & Alocated p 10 Dependent care benes 12 See instructions for a 12 $2.000.00 $2,170.00 $507.50 19 Local income tax 20 Layan Department of the Treasury-Internal Revenue Service PAYER'S name, street address, city or town, state or province, country, 20 or foreign postal code and telephone n HOUSEKEEPERS HELPERS 123 TIDY WAY YOUR CITY, YOUR STATE, ZIP PAYERS TIN 63-400XXXX RECIPIENT'S name CYNTHIA SIMON Set address including aptr) 159 ARCHER AVENUE RECIPENT'S TIN Form 1099-NEC CORRECTED (if checked) 419-00-XXXX City or town, state or province, country, and ZP or foreign postal code YOUR CITY, YOUR STATE, ZIP Account number beeinstructions keep for your record 1 Noapy compensation |$ 2 CM 1545-0136 Payer made dret saw tutaing $5.000 or more consumer products to recipient for rese 2021 Form 1099-NEC www.n.gov/Form 4 Federal income tax withheld $ 5 State wild Sate Payer's state 4.000 Department of the Tury Nonemployee Compensation Copy B For Recipient Revenue Service ABC INVESTMENTS 450 Pima Plaza Your Cly, YS ZIP Form 1099-DIV 2021 Dividends and Distributions Copy 8 Ro NO 1545-0110 faTotal Ordinary Dividends 1b Qualified Dividends 2a Total Capital Gain Distributions (Includes 2b-20). 2b Capital Gains that represent Unrecaptured 1250 Gain 20 Capital Gains that represent Section 1202 Gain 2d Capital Gains that represent Collectibles (28%) Gain 2 Nondividend Distributions. 4 Federal Income Tax Withheld 5 Investment Expenses 6 Foreign Country or U.S. Possession 7 Cash Liquidation Distributions 8 Non-Cash Liquidation Distributions 9 Exempt Interest Dividends 10 Specified Private Activity Bond Interest Dividends 11 State 12 State Identification No. 13 State Tax Withheld Form 1099-MISC 2021 Miscellaneous Income Copy & for Rent (OMB NO 1545-0115) 2 Royalties 4 Federal Income Tax Withheld 8 Substitute Payments in Lieu of Dividends or Interest. 16 State Tax Withheld 17 State! Payer's State No. 18 State Income Form 1099-INT 2021 Interest Income Copyr Recipient (OMENO: 1545-01121 1 Interest Income 2 Early Withdrawal Penalty 3. Interest on U.S. Savings Bonds and Treas Obligations. 4 Federal Income Tax Withheld 5 Investment Expenses 6 Foreign Tax Paid 7 Foreign Country or U.S. Possession 8 Tax-Exempt Interest 9 Specified Private Activity Bond Interest 14 Tax-Exempt Bond CUSIP No. Summary of 2021 Proceeds From Broker and Barter Exchange Transactions Sales Price of Stocks, Bonds, etc. Federal Income Tax Withheld 2021 TAX REPORTING STATEMENT Cynthia Simon 159 Archer Avenue Your City, YS ZIP Account No. 111-222 150.00 75.00 300.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 250.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 6,150.00 0.00 Recipient ID No. 419-00-300x Payer's Fed ID Number: 40-200x000x Gross Proceeds from each of your security transactions are reported individually to the RS Refer to the Form 1095-8 section of this statem Report gross proces individually for each security on the appropriate tax retum. Do not report gross proceeds in aggregate Page 1 of 2 ABC INVESTMENTS 456 Pima Plaza Your City. YS ZIP FORM 1099-B 2021 Proceeds from Broker and Barter Exchange Transactions Copy for Recipen OMB NO 1545-OPES Short-term transactions for which basis is reported to the IRS Report on Form 8949 with Box A checked and/or Schedule D. Part 1 (This Labela Subse for boss teA) 8 Description 1d Stock or Other Symbol, CUSP te Datesid ta Candy disposed Sold Action 16 Cate Acquired lowa Co. Common Stock Sale 01/08/2021 10/30/2021 200.000 TOTALS 1d Prod 8 Description 1d Stock or Other Symbol,CUSS Action 16 Dale te Date solda Quantity disposed Acquired Sold 2,650.00 2,650.00 lowa Co. Common Stock Sale 10/12/2008 11/01/2021 200 000 TOTALS Long-term transactions for which basis is not reported to the IRS Report on Form 8949 with Box E checked and/or Schedule D. Part I (This Labelisa Subitute for Boxes 10 & 6) te Cost 14 Proceeds 2,000.00 2.000.00 FORM 1099-B 2021 Proceeds from Broker and Barter Exchange Transactions Copy for Recipient OMB NO 1545-0715 3,500.00 3,500.00 2021 TAX REPORTING STATEMENT Cynthia Simon 159 Archer Avenue Your City YS ZIP Account No 111-222 Reopent 10 No. 419-00-3000x Payer's Fed ID Number: 40-2000000xXx Se Cost or Other 2.100.00 2,100.00 (IRS Form 1099-8 box numbers are shown below in bold type) Gem/Lep 15 Stele You Wi 50.00 ORS Form 1099-8 box numbers Oan/Loesgen Saw 1,400 00 Los Delowed Tax Wed below in bold type) 14 15 Se Tax S Wine This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported Page 2 of 2 OPENTSAENDE FINANCIAL AID PARTNERS WASHINGTON DR YOUR CITY, YOUR STATE ZIP RECIPIENTS IN CYNTHIA SIMON 36-400XXXX Potrd FILERS ayer s SUFFOLK COLLEGE 10 COLLEGE AVENUE YOUR CITY, YOUR STATE, ZIP 37-700XXXX 19 ARCHER AVENUE Oye coury and Proce YOUR CITY, YOUR STATE ZIP Aber ictoral F 1098-E STUDENTS CYNTHIA SIMON VOID BORROWERS IN add freudig apt.no) STUDENT'S FIN CORRECTED FLER & ab ay or wts or one county 2 or 1 Pay for Non potalode, ed phone number qualed tution and read 41-00-XXXXX CORRECTED www.is.fDE 419-00-XXXXX for your record 159 ARCHER AVENUE Cytown, state or province country, and 2 or foreign poco YOUR CITY, YOUR STATE, ZIP Service Provider Act 1096-T Checked fal wat student 13 Sunt interest received by ender Check box 1 does not include an ongnation fees and capitalized interest and the loan was made 2004 OMB No 1545-1574 2,000.00 2021 For 1096-T & Aquatments made for a por year 1$ OMB No 1545-1576 2021 Tom 1098-E Auto scholarships or grants rapor year Checked if a graduate student www.insgewm1006 3.570.00 5 Scholarships or grants $ 7 Checked the amount in box 1 includes amounts for an academic period beginning January March 2022 10 in contract remb/refund s Student Loan Interest Statement Department of the Treasury Internal Revenue S B Copy C For Recipient For Privacy Act and Pipero Raduction Act Notion, the 201 Genera Instructions for Certain Information Returns Tuition Statement Copy B For Student This is important tax information and is being fumished to the IRS This form must be used complate Fom 8063 to claim education credits Give to the tax preparer prepare the tax Department of the Treasury-Internal Revenue Service 16:19 Departm Service Part Recipient Information 4 Recent's name 1095-A 7 Recipient's spouse's 10 Policy start da 13 Crown 16 01/01/2021 YOUR CITY Part II Covered Individuals A Covered individual name 17 18 19 21 January CYNTHIA SIMON 20 Part II Coverage Information 22 February 23 March 24 April 25 May 26 June 27 July Month Health Insurance Marketplace Statement Do not attach to your tax return. Keep for your records. Go to www.ins.gov/Form 1096A for instructions and the latest information 28 August 29 September 30 October 31 November 12-3456789 CYNTHIA SIMON 32 December 2 Mahapace-aged policy number 987654 11 Puky termination a 14 State or province 12/31/2021 YOUR STATE 8. Cind 419-00-XXXX 3 Puly $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $Recent's 554 Pents spo C. Convid date of bi 33 Annual Totals $2,400 For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. 419-00-XXXX 12 including apartmano 159 ARCHER AVENUE 15 Country and 2 or towign pol ZIP 2/24/1992 A. Monthly enrolment premiums B. Monthly second lowest cost silver plan (SLCSP) premium VOID D. Coverage s $330 $330 $330 $330 $330 $330 $330 $330 CORRECTED $330 $330 $330 $330 $3,960 01/01/2021 OMD N545-2233 & Fantae of th CN 607000 2021 2/24/1992 spouse's date of b Coverage et de 12/31/2021 C. Monthly advance payment of premium tax cred $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $1,800 Form 1095-A0021) vanced Scenario 8: Test Questions Directions bielom Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNS) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. 23. What is the net short term capital gain reported on Cynthia's Schedule D? a. $2,350 b. $1,400 c. $650 d. $300 Bido 24. Which of the following cannot be claimed as a business expense on Cynthia's Schedule C? a. Cleaning supplies b. Business cards c. Lunches d. Work gloves 25. What is the amount Cynthia can take as a student loan interest deduction on her Form 1040, Schedule 1? $. 26. What is the total amount of advanced premium tax credit that Cynthia received in 2021? a. $3,960 b. $2,400 c. $1,800 d. $150 27. What is the amount of Cynthia's lifetime learning credit? $_

Step by Step Solution

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Im unable to directly complete tax returns or access tax software However I can guide you through th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started