Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all questions please 1. A loom is expected to produce regular annual cash flows of $15,000 with the first regular cash flow expected later today

all questions please

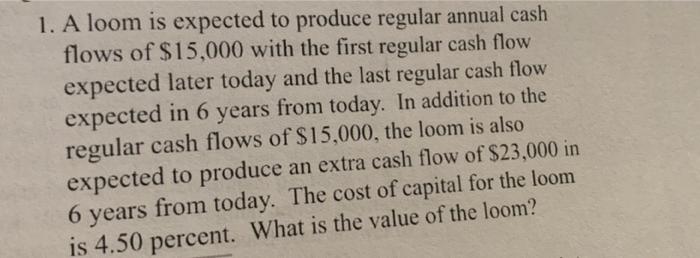

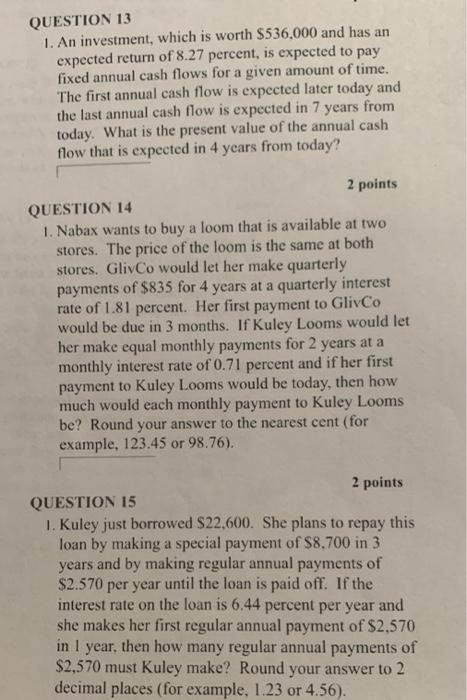

1. A loom is expected to produce regular annual cash flows of $15,000 with the first regular cash flow expected later today and the last regular cash flow expected in 6 years from today. In addition to the regular cash flows of $15,000, the loom is also expected to produce an extra cash flow of $23,000 in 6 years from today. The cost of capital for the loom is 4.50 percent. What is the value of the loom? QUESTION 13 1. An investment, which is worth $536,000 and has an expected return of 8.27 percent, is expected to pay fixed annual cash flows for a given amount of time. The first annual cash flow is expected later today and the last annual cash flow is expected in 7 years from today. What is the present value of the annual cash flow that is expected in 4 years from today? 2 points QUESTION 14 1. Nabax wants to buy a loom that is available at two stores. The price of the loom is the same at both stores. GlivCo would let her make quarterly payments of $835 for 4 years at a quarterly interest rate of 1.81 percent. Her first payment to GlivCo would be due in 3 months. If Kuley Looms would let her make equal monthly payments for 2 years at a monthly interest rate of 0.71 percent and if her first payment to Kuley Looms would be today, then how much would each monthly payment to Kuley Looms be? Round your answer to the nearest cent (for example, 123.45 or 98.76). 2 points QUESTION 15 1. Kuley just borrowed $22,600. She plans to repay this loan by making a special payment of $8.700 in 3 years and by making regular annual payments of $2.570 per year until the loan is paid off. If the interest rate on the loan is 6.44 percent per year and she makes her first regular annual payment of $2,570 in 1 year, then how many regular annual payments of $2,570 must Kuley make? Round your answer to 2 decimal places (for example, 1.23 or 4.56) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started