Question

All ratios must be computed using the ratios listed in the Appendix: Financial Ratio Formula Sheet. Show all workings. (a) Compute the following for the

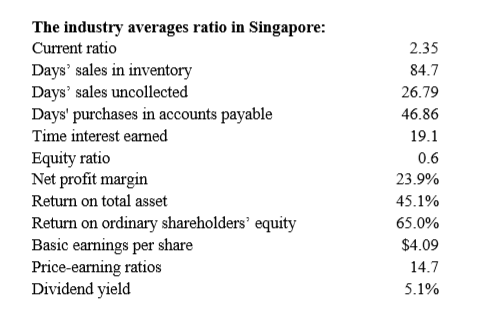

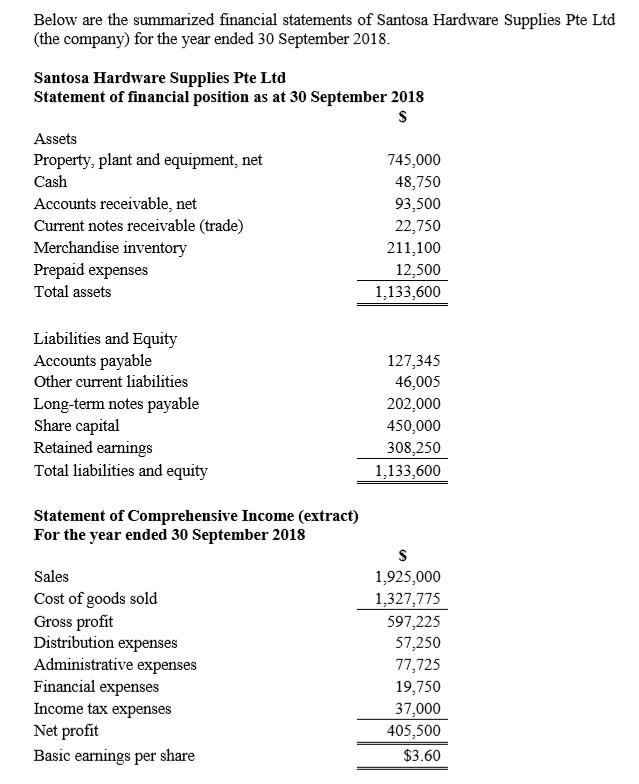

All ratios must be computed using the ratios listed in the Appendix: Financial Ratio Formula Sheet. Show all workings. (a) Compute the following for the company: (i) The current ratio. (ii) Days sales in inventory. (iii) Days sales uncollected. (iv) Days' purchases in accounts payable. (8 marks) (b) Use the ratios from (a) to report on the short term credit risk of the company compared to the industry average. (5 marks) (c) Compute the following for the company: (i) Time interest earned. (ii) Equity ratio. (d) Analyse and comment on the ratios computed in (c).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started