Answered step by step

Verified Expert Solution

Question

1 Approved Answer

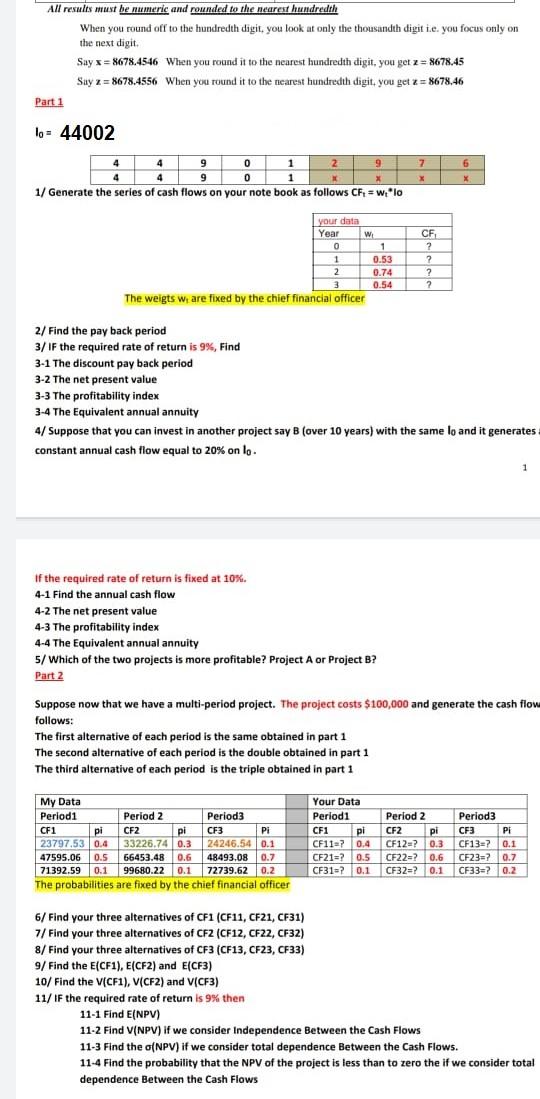

All results must be numeric and rounded to the nearest hundredth When you round off to the hundredth digit, you look at only the thousandth

All results must be numeric and rounded to the nearest hundredth When you round off to the hundredth digit, you look at only the thousandth digitte. you focus only on the next digit. Say s = 8678.4546 When you round it to the nearest hundredth digit, you get = 8678.45 Say z = 8678.4556 When you round it to the nearest hundredth digit, you get 2 = 8678.46 . Part 1 1o = 44002 7 4 4 4 9 9 0 1 2 9 4 4 9 9 0 1 x 1/ Generate the series of cash flows on your note book as follows CF = wtlo 6 x your data Year w 0 1 1 1 0.53 2 0.74 3 0.54 The weigts w, are fixed by the chief financial officer CF ? ? 2 ? ? 2/ Find the pay back period 3/ If the required rate of return is 9%, Find 3-1 The discount pay back period 3-2 The net present value 3-3 The profitability index 3-4 The Equivalent annual annuity 4/ Suppose that you can invest in another project say B (over 10 years) with the same lo and it generates constant annual cash flow equal to 20% on lo. If the required rate of return is fixed at 10%. 4-1 Find the annual cash flow 4-2 The net present value 4-3 The profitability Index 4-4 The Equivalent annual annuity 5/ Which of the two projects is more profitable? Project A or Project B? Part 2 Suppose now that we have a multi-period project. The project costs $100,000 and generate the cash flow follows: The first alternative of each period is the same obtained in part 1 The second alternative of each period is the double obtained in part 1 The third alternative of each period is the triple obtained in part 1 My Data Periodi Period Z Period3 CF1 pi CF2 pi CF3 Pi 23797.530.4 33226.74 0.3 24246.54 0.1 47595.06 0.5 66453.48 0.6 48493.08 0.7 71392.59 0.1 99680.22 0.1 72739.62 0.2 The probabilities are fixed by the chief financial officer Your Data Period 1 CF1 pi CF11=7 0.4 CF21=? 0.5 CF31? 0.1 Period 2 CF2 pi CF12-? 0.3 CF22=? 0.6 CF32=? 0.1 Period3 CF3 PI CF13=70.1 CF2370.7 CF33=? 0.2 = 6/ Find your three alternatives of CF1 (CF11, CF21, CF31) 7/ Find your three alternatives of CF2 (CF12, CF22, CF32) / (, , ) 8/ Find your three alternatives of CF3 (CF13, CF23, CF33) 9/ Find the E(CF1), E(CF2) and E(CF3) . 10/ Find the VCF1), V(CF2) and V(CF3) 11/ If the required rate of return is 9% then required 11-1 Find E(NPV) 11-2 Find V(NPV) if we consider Independence Between the Cash Flows 11-3 Find the o(NPV) if we consider total dependence Between the Cash Flows. 11-4 Find the probability that the NPV of the project is less than to zero the if we consider total dependence Between the Cash Flows All results must be numeric and rounded to the nearest hundredth When you round off to the hundredth digit, you look at only the thousandth digitte. you focus only on the next digit. Say s = 8678.4546 When you round it to the nearest hundredth digit, you get = 8678.45 Say z = 8678.4556 When you round it to the nearest hundredth digit, you get 2 = 8678.46 . Part 1 1o = 44002 7 4 4 4 9 9 0 1 2 9 4 4 9 9 0 1 x 1/ Generate the series of cash flows on your note book as follows CF = wtlo 6 x your data Year w 0 1 1 1 0.53 2 0.74 3 0.54 The weigts w, are fixed by the chief financial officer CF ? ? 2 ? ? 2/ Find the pay back period 3/ If the required rate of return is 9%, Find 3-1 The discount pay back period 3-2 The net present value 3-3 The profitability index 3-4 The Equivalent annual annuity 4/ Suppose that you can invest in another project say B (over 10 years) with the same lo and it generates constant annual cash flow equal to 20% on lo. If the required rate of return is fixed at 10%. 4-1 Find the annual cash flow 4-2 The net present value 4-3 The profitability Index 4-4 The Equivalent annual annuity 5/ Which of the two projects is more profitable? Project A or Project B? Part 2 Suppose now that we have a multi-period project. The project costs $100,000 and generate the cash flow follows: The first alternative of each period is the same obtained in part 1 The second alternative of each period is the double obtained in part 1 The third alternative of each period is the triple obtained in part 1 My Data Periodi Period Z Period3 CF1 pi CF2 pi CF3 Pi 23797.530.4 33226.74 0.3 24246.54 0.1 47595.06 0.5 66453.48 0.6 48493.08 0.7 71392.59 0.1 99680.22 0.1 72739.62 0.2 The probabilities are fixed by the chief financial officer Your Data Period 1 CF1 pi CF11=7 0.4 CF21=? 0.5 CF31? 0.1 Period 2 CF2 pi CF12-? 0.3 CF22=? 0.6 CF32=? 0.1 Period3 CF3 PI CF13=70.1 CF2370.7 CF33=? 0.2 = 6/ Find your three alternatives of CF1 (CF11, CF21, CF31) 7/ Find your three alternatives of CF2 (CF12, CF22, CF32) / (, , ) 8/ Find your three alternatives of CF3 (CF13, CF23, CF33) 9/ Find the E(CF1), E(CF2) and E(CF3) . 10/ Find the VCF1), V(CF2) and V(CF3) 11/ If the required rate of return is 9% then required 11-1 Find E(NPV) 11-2 Find V(NPV) if we consider Independence Between the Cash Flows 11-3 Find the o(NPV) if we consider total dependence Between the Cash Flows. 11-4 Find the probability that the NPV of the project is less than to zero the if we consider total dependence Between the Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started