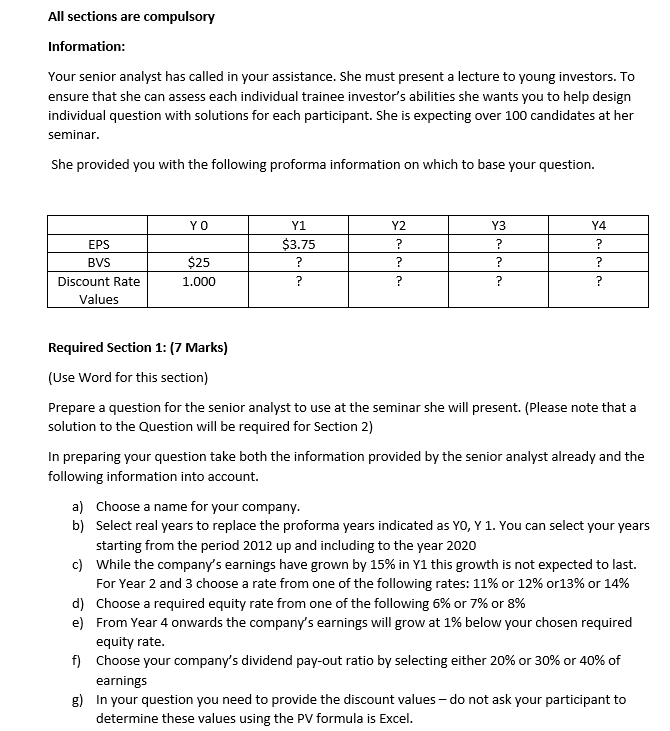

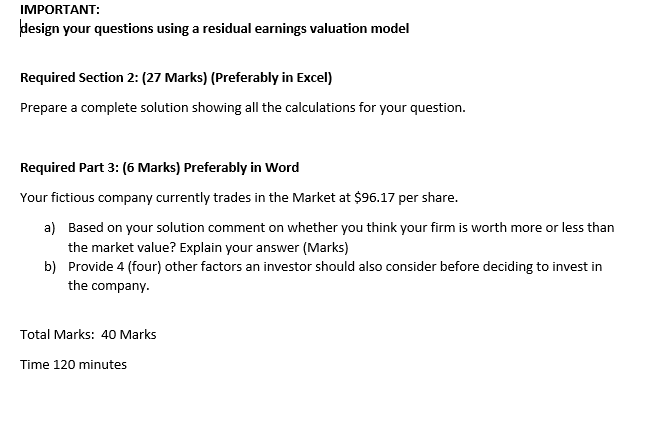

All sections are compulsory Information: Your senior analyst has called in your assistance. She must present a lecture to young investors. To ensure that she can assess each individual trainee investor's abilities she wants you to help design individual question with solutions for each participant. She is expecting over 100 candidates at her seminar. She provided you with the following proforma information on which to base your question. YO Y2 Y3 Y4 Y1 $3.75 ? ? ? $25 ? EPS BVS Discount Rate Values ? ? ? ? ? 1.000 ? ? Required Section 1: (7 Marks) (Use Word for this section) Prepare a question for the senior analyst to use at the seminar she will present. (Please note that a solution to the Question will be required for Section 2) In preparing your question take both the information provided by the senior analyst already and the following information into account. a) Choose a name for your company. b) Select real years to replace the proforma years indicated as YO, Y 1. You can select your years starting from the period 2012 up and including to the year 2020 c) While the company's earnings have grown by 15% in Y1 this growth is not expected to last. For Year 2 and 3 choose a rate from one of the following rates: 11% or 12% or 13% or 14% d) Choose a required equity rate from one of the following 5% or 7% or 3% e) From Year 4 onwards the company's earnings will grow at 1% below your chosen required equity rate. f) Choose your company's dividend pay-out ratio by selecting either 20% or 30% or 40% of earnings g) In your question you need to provide the discount values - do not ask your participant to determine these values using the PV formula is Excel. IMPORTANT: design your questions using a residual earnings valuation model Required Section 2: (27 Marks) (Preferably in Excel) Prepare a complete solution showing all the calculations for your question. Required Part 3: (6 Marks) Preferably in Word Your fictious company currently trades in the Market at $96.17 per share. a) Based on your solution comment on whether you think your firm is worth more or less than the market value? Explain your answer (Marks) b) Provide 4 (four) other factors an investor should also consider before deciding to invest in the company. Total Marks: 40 Marks Time 120 minutes All sections are compulsory Information: Your senior analyst has called in your assistance. She must present a lecture to young investors. To ensure that she can assess each individual trainee investor's abilities she wants you to help design individual question with solutions for each participant. She is expecting over 100 candidates at her seminar. She provided you with the following proforma information on which to base your question. YO Y2 Y3 Y4 Y1 $3.75 ? ? ? $25 ? EPS BVS Discount Rate Values ? ? ? ? ? 1.000 ? ? Required Section 1: (7 Marks) (Use Word for this section) Prepare a question for the senior analyst to use at the seminar she will present. (Please note that a solution to the Question will be required for Section 2) In preparing your question take both the information provided by the senior analyst already and the following information into account. a) Choose a name for your company. b) Select real years to replace the proforma years indicated as YO, Y 1. You can select your years starting from the period 2012 up and including to the year 2020 c) While the company's earnings have grown by 15% in Y1 this growth is not expected to last. For Year 2 and 3 choose a rate from one of the following rates: 11% or 12% or 13% or 14% d) Choose a required equity rate from one of the following 5% or 7% or 3% e) From Year 4 onwards the company's earnings will grow at 1% below your chosen required equity rate. f) Choose your company's dividend pay-out ratio by selecting either 20% or 30% or 40% of earnings g) In your question you need to provide the discount values - do not ask your participant to determine these values using the PV formula is Excel. IMPORTANT: design your questions using a residual earnings valuation model Required Section 2: (27 Marks) (Preferably in Excel) Prepare a complete solution showing all the calculations for your question. Required Part 3: (6 Marks) Preferably in Word Your fictious company currently trades in the Market at $96.17 per share. a) Based on your solution comment on whether you think your firm is worth more or less than the market value? Explain your answer (Marks) b) Provide 4 (four) other factors an investor should also consider before deciding to invest in the company. Total Marks: 40 Marks Time 120 minutes