Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All - Star Corporation and transfers its assets to All - Star ir begin{tabular}{|c|c|c|c|c|} hline Assets & & & begin{tabular}{c} Adjusted Basis end{tabular} &

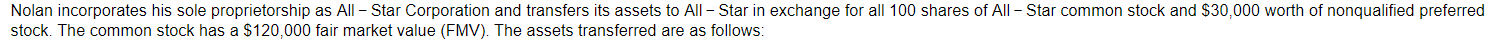

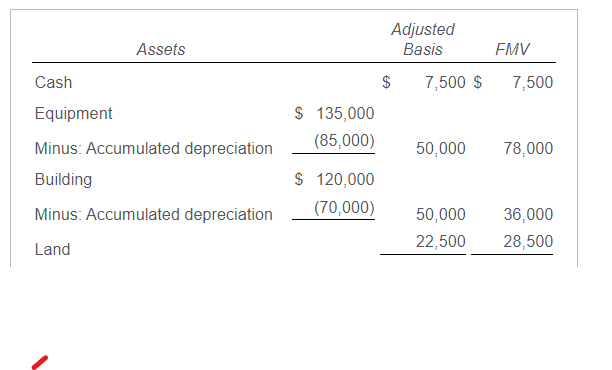

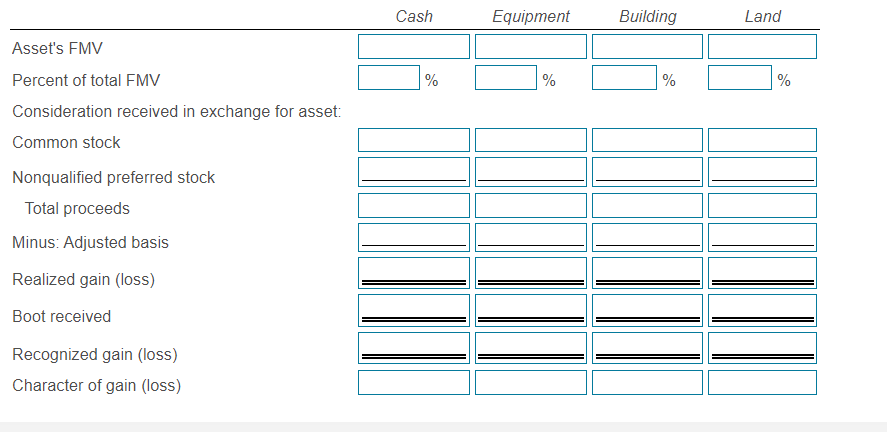

All - Star Corporation and transfers its assets to All - Star ir \begin{tabular}{|c|c|c|c|c|} \hline Assets & & & \begin{tabular}{c} Adjusted \\ Basis \end{tabular} & FMV \\ \hline Cash & & & 7,500$ & 7,500 \\ \hline Equipment & $ & 135,000 & & \\ \hline Minus: Accumulated depreciation & & (85,000) & 50,000 & 78,000 \\ \hline Building & $ & 120,000 & & \\ \hline Minus: Accumulated depreciation & & (70,000) & 50,000 & 36,000 \\ \hline Land & & & 22,500 & 28,500 \\ \hline \end{tabular} a. What are the amounts and character of Nolan's recognized gains or losses? b. What is Nolan's basis in the All - Star common and nonqualified preferred stock? c. What is All - Star's basis in the property received from Nolan? Requirement a. What are the amounts and character of Nolan's recognized gains or losses? Complete the table to determine the amount and character of Nolan's recognized gain or loss for each asset type. If an asset does not have a gain or loss, select "N/A" for the character type. (Round the percentages to the nearest whole percent and dollar amounts to the nearest whole dollar. Use parentheses or a minus sign for losses. Complete all input fields. For amounts with a $0 balance, enter a 0 in the appropriate field.) \begin{tabular}{llll} & Cash & Equipment & Building \\ \hline Asset's FMV & \\ Percent of total FMV & \\ Consideration received in exchange for asset: & \\ Common stock & \\ Nonqualified preferred stock & \\ Minus: Adjusted basis & \\ Realized gain (loss) & \\ Boot received & \\ Recognized gain (loss) & \\ Character of gain (loss) \end{tabular}

All - Star Corporation and transfers its assets to All - Star ir \begin{tabular}{|c|c|c|c|c|} \hline Assets & & & \begin{tabular}{c} Adjusted \\ Basis \end{tabular} & FMV \\ \hline Cash & & & 7,500$ & 7,500 \\ \hline Equipment & $ & 135,000 & & \\ \hline Minus: Accumulated depreciation & & (85,000) & 50,000 & 78,000 \\ \hline Building & $ & 120,000 & & \\ \hline Minus: Accumulated depreciation & & (70,000) & 50,000 & 36,000 \\ \hline Land & & & 22,500 & 28,500 \\ \hline \end{tabular} a. What are the amounts and character of Nolan's recognized gains or losses? b. What is Nolan's basis in the All - Star common and nonqualified preferred stock? c. What is All - Star's basis in the property received from Nolan? Requirement a. What are the amounts and character of Nolan's recognized gains or losses? Complete the table to determine the amount and character of Nolan's recognized gain or loss for each asset type. If an asset does not have a gain or loss, select "N/A" for the character type. (Round the percentages to the nearest whole percent and dollar amounts to the nearest whole dollar. Use parentheses or a minus sign for losses. Complete all input fields. For amounts with a $0 balance, enter a 0 in the appropriate field.) \begin{tabular}{llll} & Cash & Equipment & Building \\ \hline Asset's FMV & \\ Percent of total FMV & \\ Consideration received in exchange for asset: & \\ Common stock & \\ Nonqualified preferred stock & \\ Minus: Adjusted basis & \\ Realized gain (loss) & \\ Boot received & \\ Recognized gain (loss) & \\ Character of gain (loss) \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started