Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all that needs to be answered is part A and part B The fokeveng infovmation appves to the questions dupioyed below) the schood WT aiso

all that needs to be answered is part A and part B

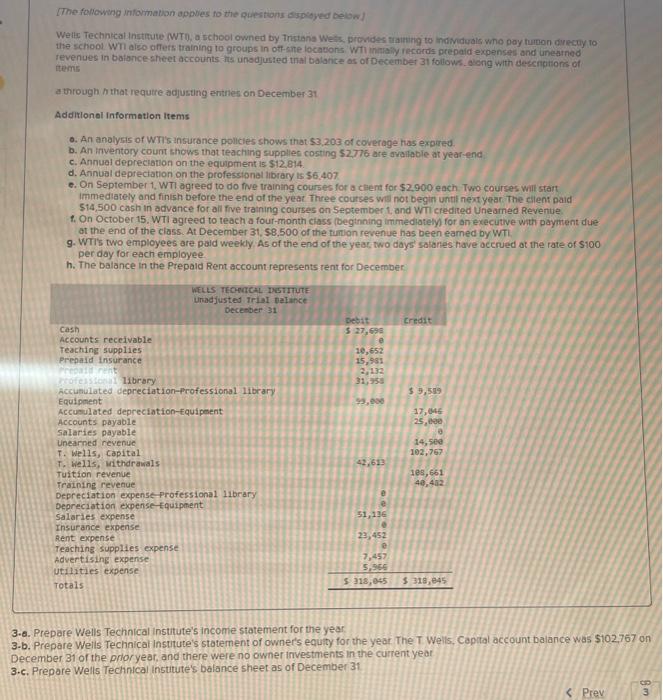

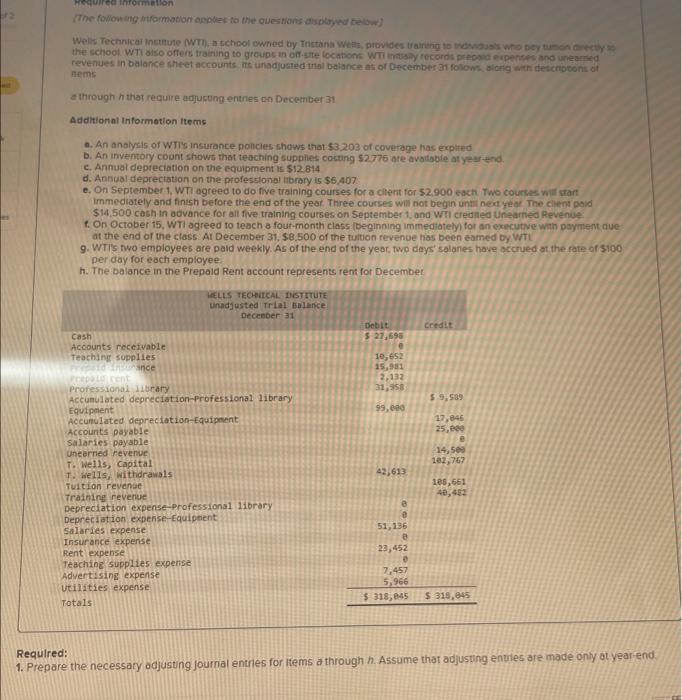

The fokeveng infovmation appves to the questions dupioyed below) the schood WT aiso offers training to groups in oft-ene locasons Wfl inmally records prepaid expenses and unearned tithis at through h that requtre adjusting erthes on December 31 Additionel informetion items 0. An analysis of WT's ansurance policles shows that $3,203 of coverage has expired. b. An irventory count shows that teacting suppllec costing 52.776 are avaliable at yearend c. Annual deprectation on the equipment is $12.814. d. Annual depreciation on the professional library is 56,407 . e. On September 1, WTi agreed to do five training courses for a client for $2,900 each. Two courses will srart immediarely and fintsh before the end of the yeat. Three coutses wit not begin untl nextytar, The ellent paid 514,500 cash in advance for all five training courses on September 1 , and WTi credited Uneamed Revenue 1. On October 15. WTl agreed to teach a four-month class (begtining immediately) for am executive with payment due at the end of the class. At December 31, 58,500 of the fumion revenue has been earned by WT. 9. WTi's two employees are paid weekly. As of the end of the year, wo days sataries have accrued at the rate of stoo per day for each employee h. The balance in the Prepaid Rent account represents rent for December 3.6. Prepare Wells Technical institute's income statement for the year. 3.b. Prepare Wells Technical insutute's statement of owner's equity for the year. The T Wells, Capital account balance was $102767 on December Bi of the prioryear, and there were no owner investments in the current year. 3.c. Prepare Wells Technical Institute's balance sheet as of December 31. The fonowing mithmanion epples to the questions dipityed felow) fins a through h that require adjusung entnes po December 31 Additional informotion items a. An analyzis of WTis insurance policies shows that $3.203 of coverage has explred D. An inventory count shows that teaching supplies coisting $2776 are avoitobie at year-and. c. Annual depreciation on the equipment is 512.814 d. Annual-deprectation on the professional labrary is $6,407. e. On September 1, WTI agreed to do five training courses for a client for 52,900 each. Two courses will crart immediately and finish before the end of the year. Three courses will not begin untir neat year The clent paid $14,500 cash in advance for all five training courses on September 1, and WTI crediled Unearned Revenue 1. On October 15, WTh agreed to teoch a fout-month class (beginning immediately) for an executve with payment cue at the end of the class. At December 31,$8.500 of the tuition revenue has been eamed by. Wri 9. WTis two employees are pald weekly. As of the end of the year, two days' salanes have accrued at the rate of 5100 per day for each employee. h. The balance in the Prepaid Rent account represents rent for December Required: 1. Prepare the necessary odjusting journal entries for ttems a through h. Assume that adjusting endies are made only at ygarend: The fokeveng infovmation appves to the questions dupioyed below) the schood WT aiso offers training to groups in oft-ene locasons Wfl inmally records prepaid expenses and unearned tithis at through h that requtre adjusting erthes on December 31 Additionel informetion items 0. An analysis of WT's ansurance policles shows that $3,203 of coverage has expired. b. An irventory count shows that teacting suppllec costing 52.776 are avaliable at yearend c. Annual deprectation on the equipment is $12.814. d. Annual depreciation on the professional library is 56,407 . e. On September 1, WTi agreed to do five training courses for a client for $2,900 each. Two courses will srart immediarely and fintsh before the end of the yeat. Three coutses wit not begin untl nextytar, The ellent paid 514,500 cash in advance for all five training courses on September 1 , and WTi credited Uneamed Revenue 1. On October 15. WTl agreed to teach a four-month class (begtining immediately) for am executive with payment due at the end of the class. At December 31, 58,500 of the fumion revenue has been earned by WT. 9. WTi's two employees are paid weekly. As of the end of the year, wo days sataries have accrued at the rate of stoo per day for each employee h. The balance in the Prepaid Rent account represents rent for December 3.6. Prepare Wells Technical institute's income statement for the year. 3.b. Prepare Wells Technical insutute's statement of owner's equity for the year. The T Wells, Capital account balance was $102767 on December Bi of the prioryear, and there were no owner investments in the current year. 3.c. Prepare Wells Technical Institute's balance sheet as of December 31. The fonowing mithmanion epples to the questions dipityed felow) fins a through h that require adjusung entnes po December 31 Additional informotion items a. An analyzis of WTis insurance policies shows that $3.203 of coverage has explred D. An inventory count shows that teaching supplies coisting $2776 are avoitobie at year-and. c. Annual depreciation on the equipment is 512.814 d. Annual-deprectation on the professional labrary is $6,407. e. On September 1, WTI agreed to do five training courses for a client for 52,900 each. Two courses will crart immediately and finish before the end of the year. Three courses will not begin untir neat year The clent paid $14,500 cash in advance for all five training courses on September 1, and WTI crediled Unearned Revenue 1. On October 15, WTh agreed to teoch a fout-month class (beginning immediately) for an executve with payment cue at the end of the class. At December 31,$8.500 of the tuition revenue has been eamed by. Wri 9. WTis two employees are pald weekly. As of the end of the year, two days' salanes have accrued at the rate of 5100 per day for each employee. h. The balance in the Prepaid Rent account represents rent for December Required: 1. Prepare the necessary odjusting journal entries for ttems a through h. Assume that adjusting endies are made only at ygarend Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started