All the answers are already given. I just need an explanation how did it came like that. Pls help me since its our midterm week and I need to know where did I go wrong.

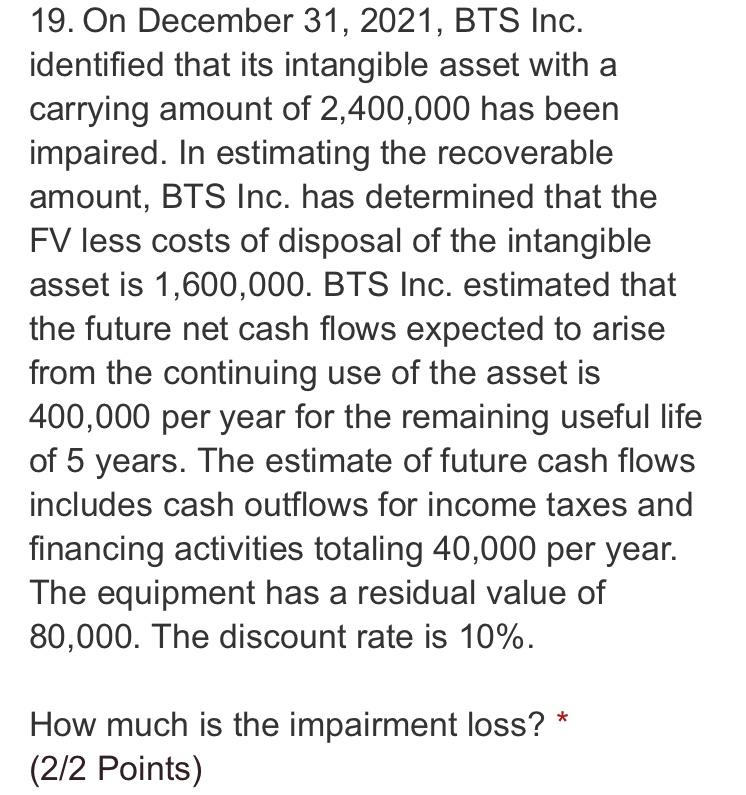

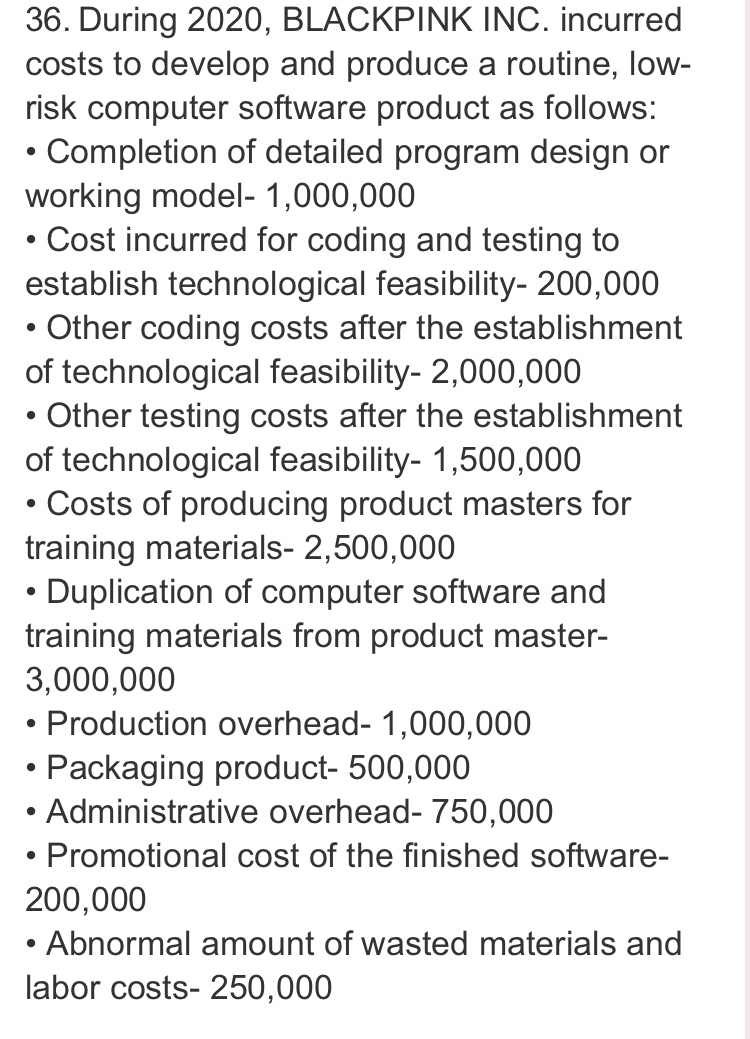

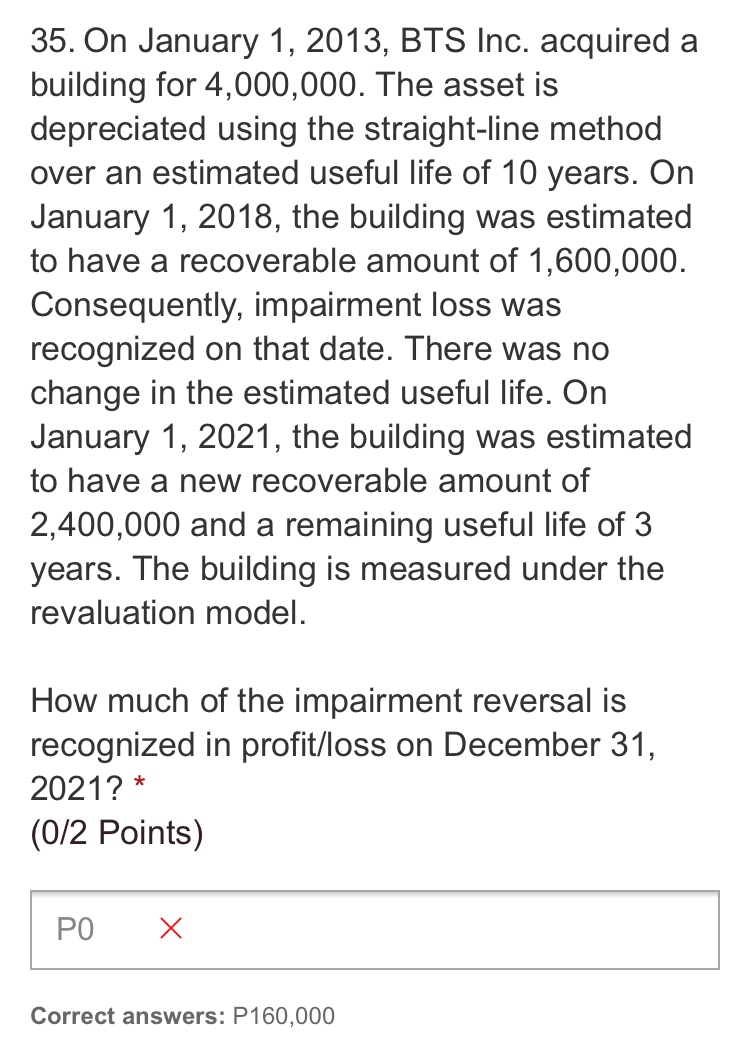

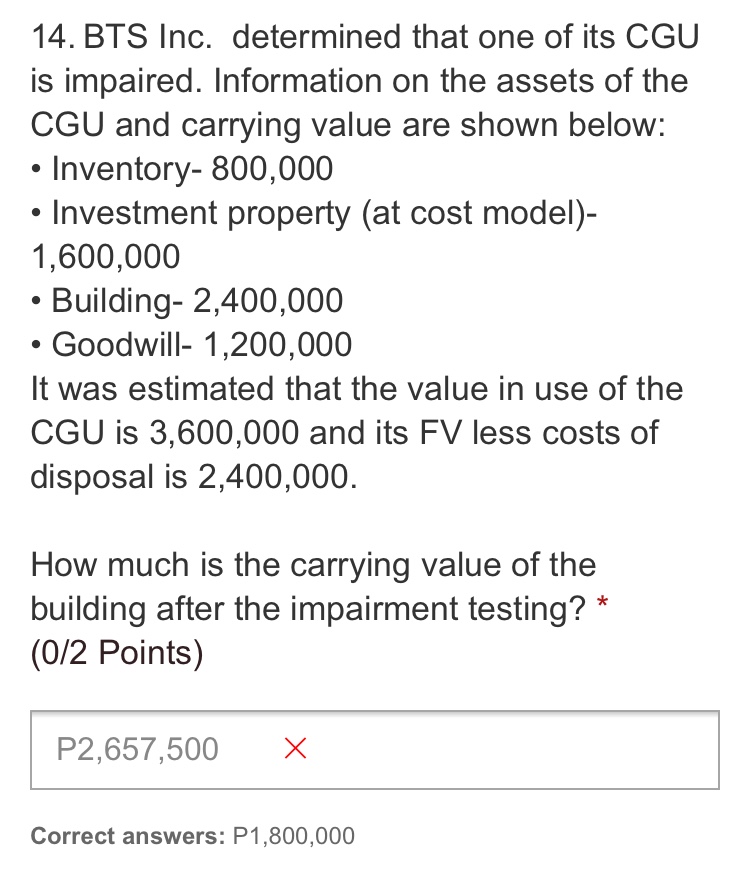

1)

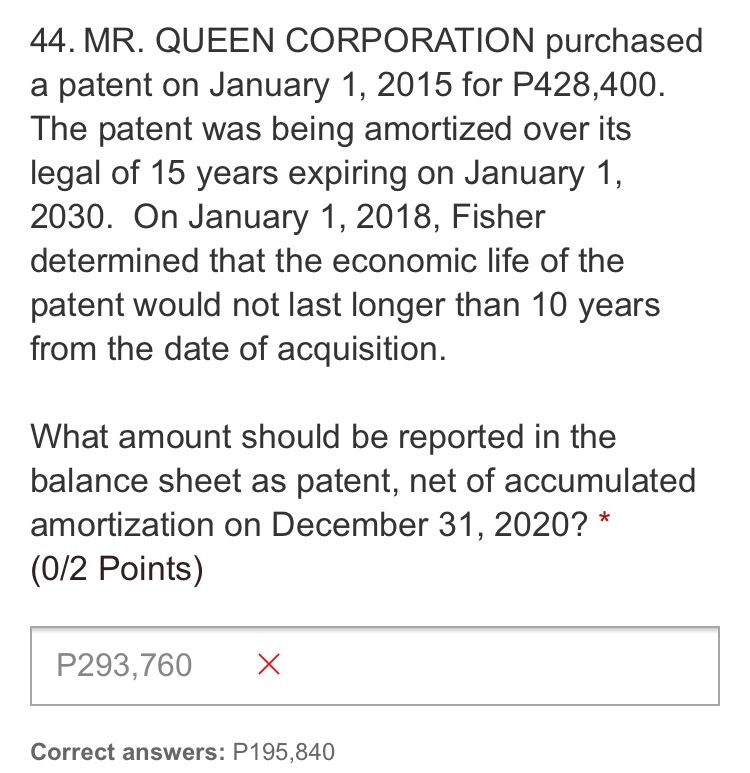

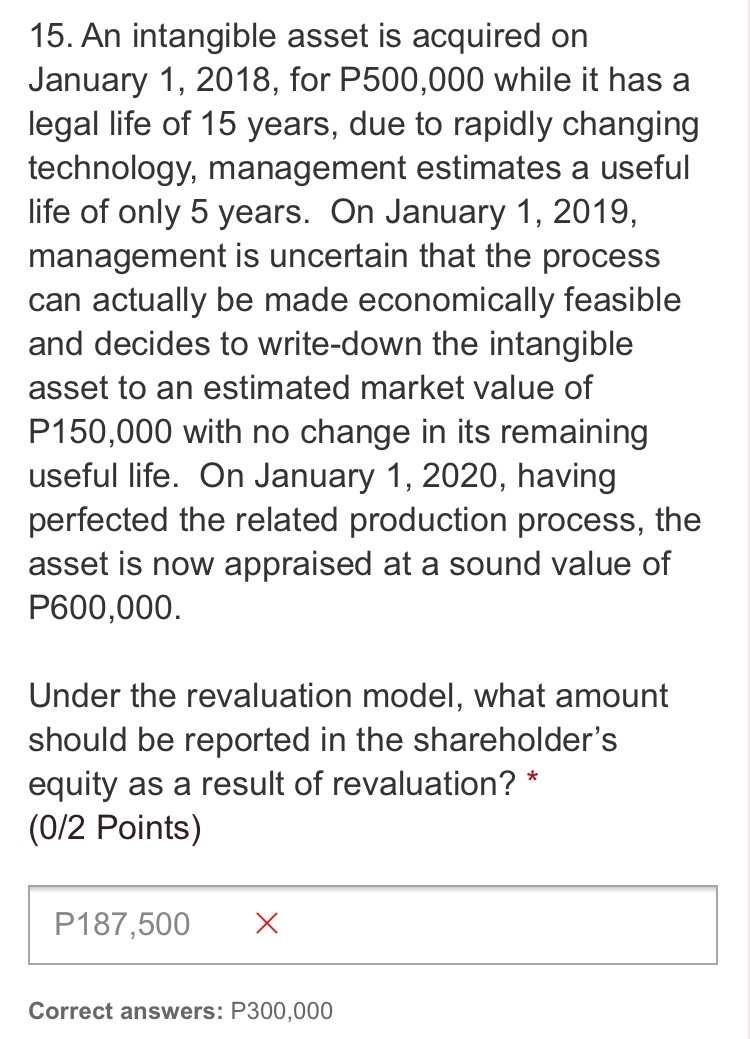

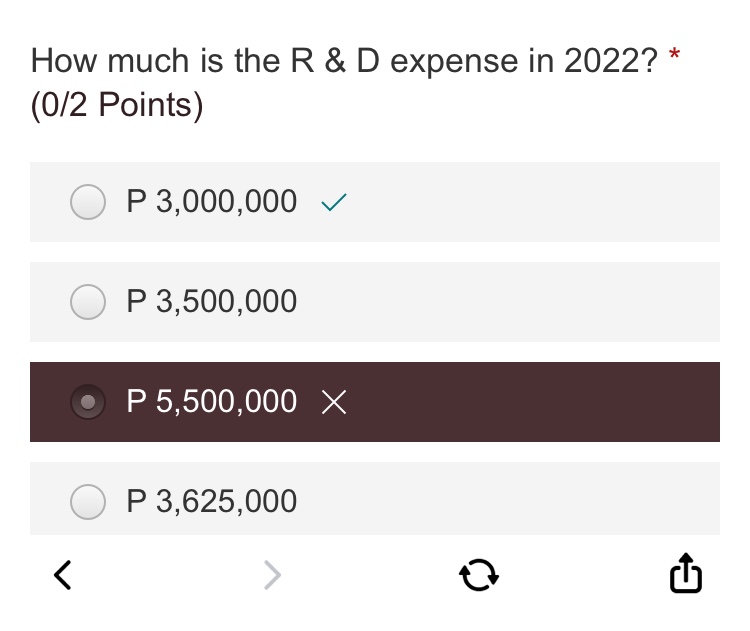

44. MR. QUEEN CORPORATION purchased a patent on January 1, 2015 for P428,400. The patent was being amortized over its legal of 15 years expiring on January 1, 2030. On January 1, 2018, Fisher determined that the economic life of the patent would not last longer than 10 years from the date of acquisition. What amount should be reported in the balance sheet as patent, net of accumulated amortization on December 31, 2020? * (0/2 Points) P293,760 X Correct answers: P195340 15. An intangible asset is acquired on January 1, 2018, for P500,000 while it has a legal life of 15 years, due to rapidly changing technology, management estimates a useful life of only 5 years. On January 1, 2019, management is uncertain that the process can actually be made economically feasible and decides to write-down the intangible asset to an estimated market value of P150,000 with no change in its remaining useful life. On January 1, 2020, having perfected the related production process, the asset is now appraised at a sound value of P600,000. Under the revaluation model, what amount should be reported in the shareholder's equity as a result of revaluation? * (02 Points) P187500 X Correct answers: P300,000 \fIn the December 31, 2020 balance sheet, what amount should be reported as inventory? * 19. On December 31, 2021, BTS Inc. identied that its intangible asset with a carrying amount of 2,400,000 has been impaired. In estimating the recoverable amount, BTS Inc. has determined that the FV less costs of disposal of the intangible asset is 1,600,000. BTS Inc. estimated that the future net cash flows expected to arise from the continuing use of the asset is 400,000 per year for the remaining useful life of 5 years. The estimate of future cash flows includes cash outflows for income taxes and nancing activities totaling 40,000 per year. The equipment has a residual value of 80,000. The discount rate is 10%. How much is the impairment loss? * (2/2 Points) 36. During 2020, BLACKPINK INC. incurred costs to develop and produce a routine, low- risk computer software product as follows: . Completion of detailed program design or working model- 1,000,000 . Cost incurred for coding and testing to establish technological feasibility- 200,000 . Other coding costs after the establishment of technological feasibility- 2,000,000 . Other testing costs after the establishment of technological feasibility- 1,500,000 . Costs of producing product masters for training materials- 2,500,000 . Duplication of computer software and training materials from product master- 3,000,000 . Production overhead- 1,000,000 . Packaging product- 500,000 . Administrative overhead- 750,000 . Promotional cost of the finished software- 200,000 . Abnormal amount of wasted materials and labor costs- 250,00029. START-UP Software Company is an established computer software company. In 2022, the rm incurred the following costs in the process of designing, developing, and producing a new software program using the JAVA technology to access the Internet: - Designing and planning- 1,000,000 - Code development- 1,500,000 - Testing- 500,000 - Production of product master 2,500,000 In 2023, Start-Up incurred P1 ,000,000 in costs to produce the software program for sale in 2023. The costs of designing and planning, code development, and testing were all incurred before the technological feasibility of the product was established. Start-Up began marketing the software program in 2023 and earned revenues of P2,400,000 in 2023. Start-Up estimates that total revenues over the 4-year life of the product will be P12,000,000. At the end of 2023, Start-Up was offered P4,000,000 for the rights to distribute the software. 35. On January 1, 2013, BTS Inc. acquired a building for 4,000,000. The asset is depreciated using the straight-line method over an estimated useful life of 10 years. On January 1, 2018, the building was estimated to have a recoverable amount of 1,600,000. Consequently, impairment loss was recognized on that date. There was no change in the estimated useful life. On January 1, 2021, the building was estimated to have a new recoverable amount of 2,400,000 and a remaining useful life of 3 years. The building is measured under the revaluation model. How much of the impairment reversal is recognized in profit/loss on December 31, 2021? * (0/2 Points) P0 X Correct answers: P160,000 14. BTS Inc. determined that one of its CGU is impaired. Information on the assets of the CGU and carrying value are shown below: - Inventory- 800,000 - Investment property (at cost model)- 1,600,000 - Building- 2,400,000 - Goodwill- 1,200,000 It was estimated that the value in use of the CGU is 3,600,000 and its FV less costs of disposal is 2,400,000. How much is the carrying value of the building after the impairment testing? * (0/2 Points) P2,657,500 >