Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All the following postmortem estate-planning objectives can be accomplished by use of a disclaimer, EXCEPT: (Topic 71) (A) Avoiding estate taxes by reducing the size

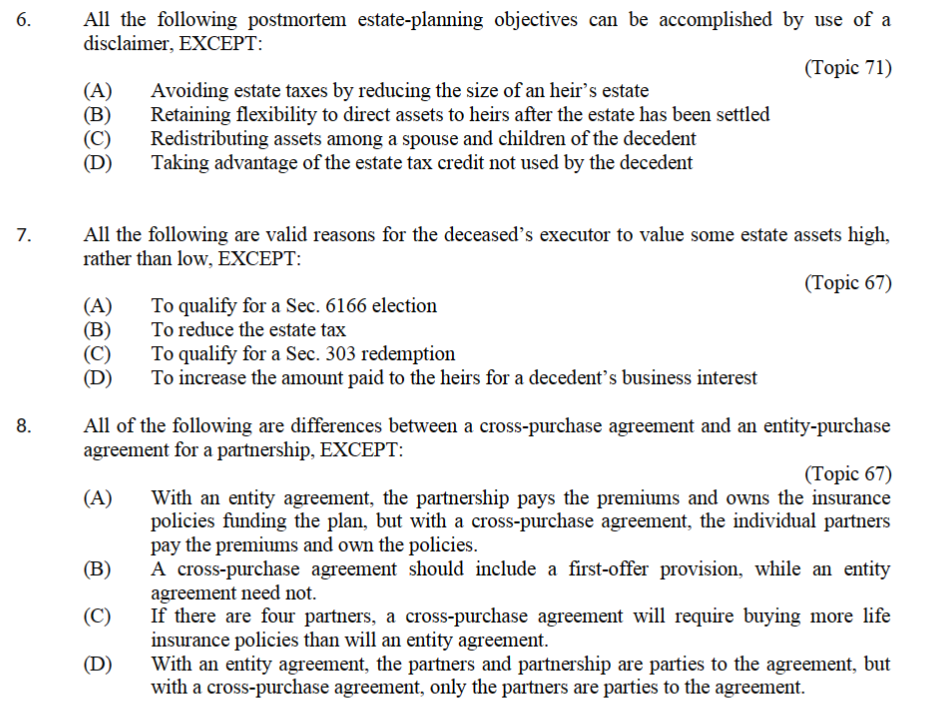

All the following postmortem estate-planning objectives can be accomplished by use of a disclaimer, EXCEPT: (Topic 71) (A) Avoiding estate taxes by reducing the size of an heir's estate (B) Retaining flexibility to direct assets to heirs after the estate has been settled (C) Redistributing assets among a spouse and children of the decedent (D) Taking advantage of the estate tax credit not used by the decedent All the following are valid reasons for the deceased's executor to value some estate assets high, rather than low, EXCEPT: (Topic 67) (A) To qualify for a Sec. 6166 election (B) To reduce the estate tax (C) To qualify for a Sec. 303 redemption (D) To increase the amount paid to the heirs for a decedent's business interest All of the following are differences between a cross-purchase agreement and an entity-purchase agreement for a partnership, EXCEPT: (A) With an entity agreement, the partnership pays the premiums and owns the insurance policies funding the plan, but with a cross-purchase agreement, the individual partners pay the premiums and own the policies. (B) A cross-purchase agreement should include a first-offer provision, while an entity agreement need not. (C) If there are four partners, a cross-purchase agreement will require buying more life insurance policies than will an entity agreement. (D) With an entity agreement, the partners and partnership are parties to the agreement, but with a cross-purchase agreement, only the partners are parties to the agreement

All the following postmortem estate-planning objectives can be accomplished by use of a disclaimer, EXCEPT: (Topic 71) (A) Avoiding estate taxes by reducing the size of an heir's estate (B) Retaining flexibility to direct assets to heirs after the estate has been settled (C) Redistributing assets among a spouse and children of the decedent (D) Taking advantage of the estate tax credit not used by the decedent All the following are valid reasons for the deceased's executor to value some estate assets high, rather than low, EXCEPT: (Topic 67) (A) To qualify for a Sec. 6166 election (B) To reduce the estate tax (C) To qualify for a Sec. 303 redemption (D) To increase the amount paid to the heirs for a decedent's business interest All of the following are differences between a cross-purchase agreement and an entity-purchase agreement for a partnership, EXCEPT: (A) With an entity agreement, the partnership pays the premiums and owns the insurance policies funding the plan, but with a cross-purchase agreement, the individual partners pay the premiums and own the policies. (B) A cross-purchase agreement should include a first-offer provision, while an entity agreement need not. (C) If there are four partners, a cross-purchase agreement will require buying more life insurance policies than will an entity agreement. (D) With an entity agreement, the partners and partnership are parties to the agreement, but with a cross-purchase agreement, only the partners are parties to the agreement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started