Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the information is provided sir You are the CEO (Chief Executive Officer) of a large industrial grade Group of Bakeries, the operation has been

all the information is provided sir

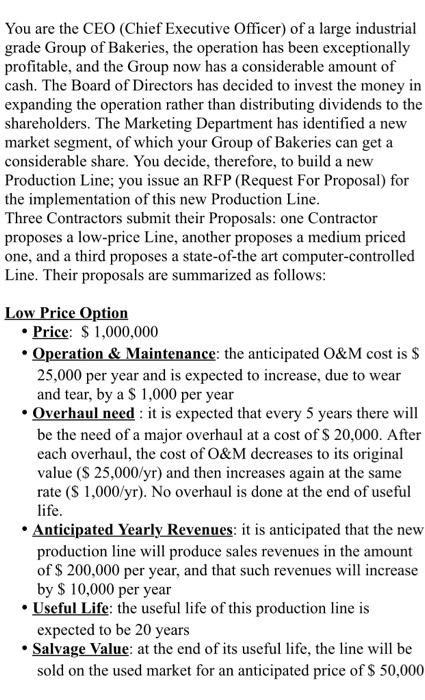

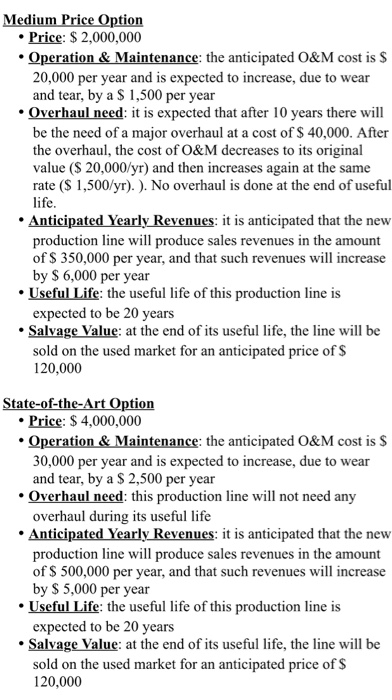

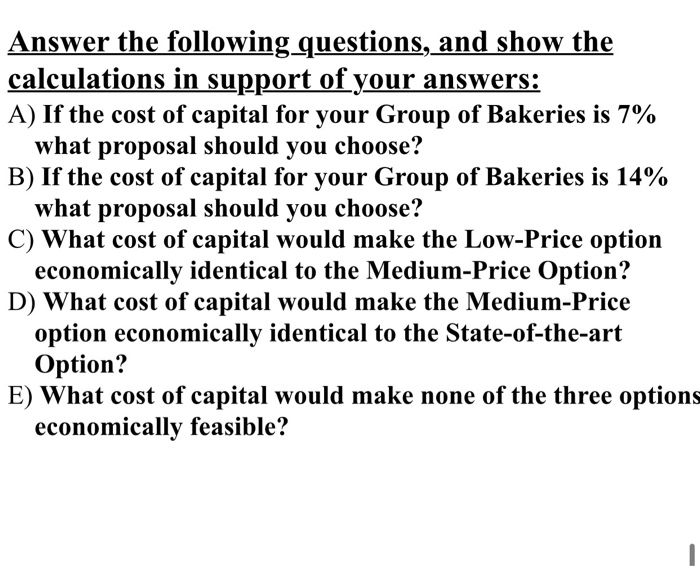

You are the CEO (Chief Executive Officer) of a large industrial grade Group of Bakeries, the operation has been exceptionally profitable, and the Group now has a considerable amount of cash. The Board of Directors has decided to invest the money in expanding the operation rather than distributing dividends to the shareholders. The Marketing Department has identified a new market segment, of which your Group of Bakeries can get a considerable share. You decide, therefore, to build a new Production Line; you issue an RFP (Request For Proposal) for the implementation of this new Production Line. Three Contractors submit their Proposals: one Contractor proposes a low-price Line, another proposes a medium priced one, and a third proposes a state-of-the art computer-controlled Line. Their proposals are summarized as follows: Low Price Option Price: $ 1,000,000 Operation & Maintenance: the anticipated O&M cost is $ 25,000 per year and is expected to increase, due to wear and tear, by a $1,000 per year Overhaul need : it is expected that every 5 years there will be the need of a major overhaul at a cost of $ 20,000. After each overhaul, the cost of O&M decreases to its original value ($ 25,000/yr) and then increases again at the same rate ($ 1,000/yr). No overhaul is done at the end of useful life. Anticipated Yearly Revenues: it is anticipated that the new production line will produce sales revenues in the amount of $ 200,000 per year, and that such revenues will increase by $ 10,000 per year Useful Life: the useful life of this production line is expected to be 20 years Salvage Value: at the end of its useful life, the line will be sold on the used market for an anticipated price of $ 50,000 Medium Price Option Price: $ 2,000,000 Operation & Maintenance: the anticipated O&M cost is $ 20,000 per year and is expected to increase, due to wear and tear, by a $ 1,500 per year Overhaul need: it is expected that after 10 years there will be the need of a major overhaul at a cost of $ 40,000. After the overhaul, the cost of O&M decreases to its original value ($ 20,000/yr) and then increases again at the same rate ($ 1,500/yr). ). No overhaul is done at the end of useful life. Anticipated Yearly Revenues: it is anticipated that the new production line will produce sales revenues in the amount of $ 350,000 per year, and that such revenues will increase by $ 6,000 per year Useful Life: the useful life of this production line is expected to be 20 years Salvage Value: at the end of its useful life, the line will be sold on the used market for an anticipated price of $ 120,000 State-of-the-Art Option Price: $4,000,000 Operation & Maintenance: the anticipated O&M cost is $ 30,000 per year and is expected to increase, due to wear and tear, by a $ 2,500 per year Overhaul need: this production line will not need any overhaul during its useful life Anticipated Yearly Revenues: it is anticipated that the new production line will produce sales revenues in the amount of $ 500,000 per year, and that such revenues will increase by $ 5,000 per year Useful Life: the useful life of this production line is expected to be 20 years Salvage Value: at the end of its useful life, the line will be sold on the used market for an anticipated price of $ 120,000 Answer the following questions, and show the calculations in support of your answers: A) If the cost of capital for your Group of Bakeries is 7% what proposal should you choose? B) If the cost of capital for your Group of Bakeries is 14% what proposal should you choose? C) What cost of capital would make the Low-Price option economically identical to the Medium-Price Option? D) What cost of capital would make the Medium-Price option economically identical to the State-of-the-art Option? E) What cost of capital would make none of the three options economically feasible Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started