Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the information is there. What is it that is missing? Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a

all the information is there. What is it that is missing?

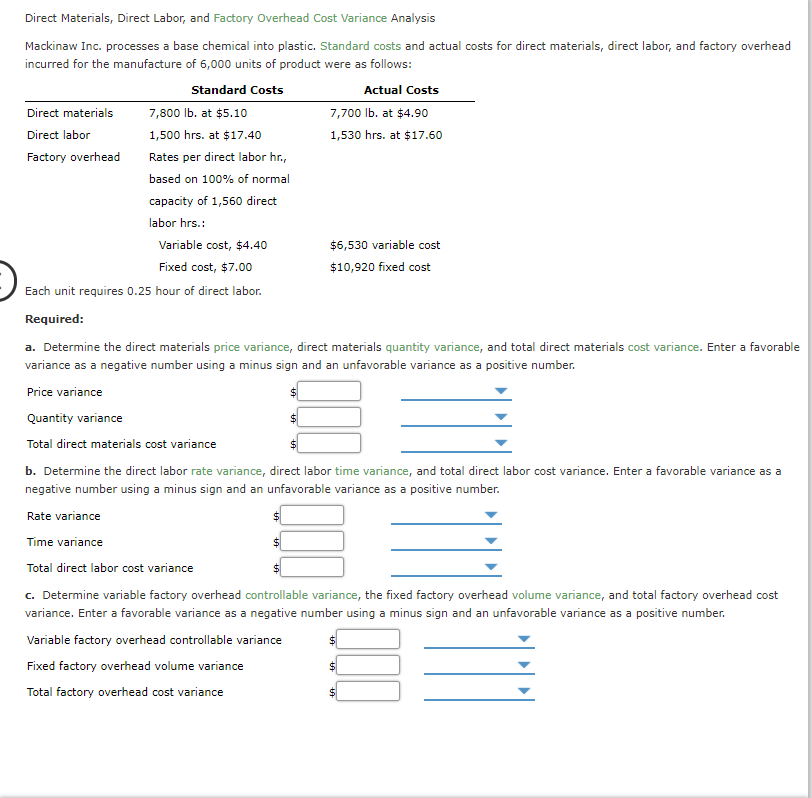

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 6,000 units of product were as follows: Standard Costs Actual Costs Direct materials Direct labor Factory overhead 7,800 lb. at $5.10 1,500 hrs. at $17.40 Rates per direct labor hr., based on 100% of normal capacity of 1,560 direct labor hrs.: 7,700 lb. at $4.90 1,530 hrs. at $17.60 Variable cost, $4.40 $6,530 variable cost Fixed cost, $7.00 $10,920 fixed cost Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Price variance Quantity variance Total direct materials cost variance b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number Rate variance Time variance Total direct labor cost variance c. Determine variable factory overhead controllable variance, the fixed factory overhead volume variance, and total factory overhead cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variable factory overhead controllable variance Fixed factory overhead volume variance Total factory overhead cost varianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started