John has created an incredibly successful wine operation in the Northeast. All 5 are in a separate S-Corporation with all the stock owned by the

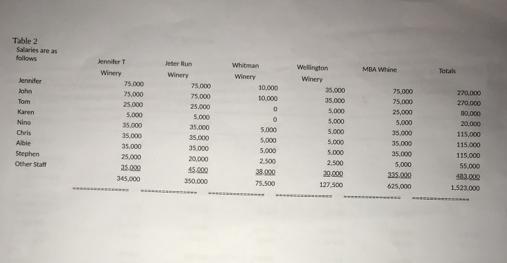

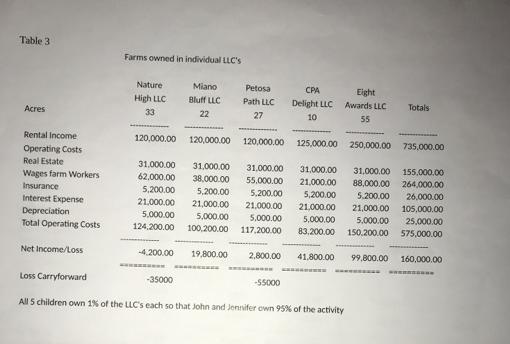

John has created an incredibly successful wine operation in the Northeast. All 5 are in a separate S-Corporation with all the stock owned by the parent Company Petosa Vineyards Inc, also an S-Corporation. John and his wife Jennifer own 75% of the stock of the parent Company which means they own 75% of all of the value of the entities. Jennifer and John are each other’s second marriage. John has three children from his prior marriage and Jennifer has 2 children from her previous marriage. John and Jennifer’s family have been an important part of the Company’s growth. John’s brother, Tom became a partner in the business providing much needed capital when the wineries were in a growth stage. Tom owns 20% of the remaining stock and he has 2 children who work at the winery on weekends doing wine tasting but have other jobs during the week. Jennifer’s sister Karen owns the remaining 5% of the outstanding shares. Karen has 3 children, none of which are involved in the wine operations. After much trial and error, he has become one of the best wine makers in the world, owning much of his success to his grandfather’s teaching and the assistance of Paul Hobbs, one of the greatest wine makers ever. All the land is owned by John and Jennifer in separate LLC’s. Each LLC charges the respective S-Corporations rent for the use of the land. The rent charged is usually enough to cover the cost of the real estate taxes, insurance and mortgage on the properties. However, 2 of the LLC’s have loss carryforwards since they just started operations and the business end of the winery could not afford a fair market rent. The LLC’s elected to be treated as partnerships. Jennifer and John have included their children as minority owners of the LLC’s.

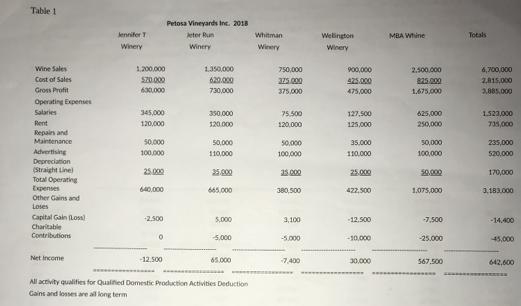

Specific requirements based on the information provided in Tables 1, 2 and 3 compute the following:

- Using the information provided, compute the 2019 tax return for John and Jennifer based on the S corporation and the LLC’s activity. Be sure to show line item detail of the 1040 and any supporting schedules. You may use the actual forms but it is not necessary. John and Jennifer use the standard deduction and have no other income items such as interest, dividends etc. outside of the information provided in the tables.

- Compute the overall tax effect if the S corporations were C corporations including the revised individual income tax consequence to John and Jennifer. Comment on the effect.

- Compute the overall tax effect if all the S corporations, and the LLC’s are taxed as C corporations including the revised individual income tax consequence to John and Jennifer. Comment on the effect.

- Do you recommend any additional entity revisions to lower John and Jennifer’s overall tax consequence in light of the new tax law changes?

- Returning to the original scenario, if John and Jennifer were interested in funding the $4,000,000 expansion of the Tennity Ice Pavilion to include a lacrosse and baseball field to further the Men’s club hockey, lacrosse and baseball programs in honor of their three sons who were all the captains of their respective teams while attending Syracuse University how would this potentially impact their current or future tax returns and tax liability?

Assume that John and Jennifer use the standard deduction on their personal return, since they live on the winery property and have no separate mortgage or interest expense. Be sure to take advantage of any credits available using the new tax laws and consider all sales from the winery business to qualify as domestic production activity.

Table 1 Wine Sales Cost of Sales Gross Profit Operating Expenses Salaries Rent Repairs and Maintenance Advertising Depreciation (Straight Line) Total Operating Expenses Other Gains and Loses Capital Gain (Loss) Charitable Contributions Net Income Jennifer Winery 1,200,000 $70.000 630,000 345,000 120,000 50,000 100.000 25.000 640,000 +2.500 0 -12.500 Petosa Vineyards Inc. 2018 Jeter Run Winery 1,350,000 620.000 730,000 ass 350,000 120.000 50,000 110,000 665,000 5,000 -5,000 65.000 All activity qualifies for Qualified Domestic Production Activities Deduction Gains and losses are all long term Whitman Winery 750,000 375.000 375,000 75.500 120,000 50,000 100,000 35.000 380,500 3,100 -5.000 -7,400 Wellington Winery 900,000 425.000 475,000 127,500 125,000 35.000 110,000 25,000 422,500 -12,500 -10,000 30,000 MBA Whine 2.500.000 825.000 1,675,000 625,000 250,000 50,000 100,000 1.075,000 -7,500 -25.000 567.500 Totals 6,700,000 2.815.000 3,885,000 1.523,000 735,000 235,000 $20.000 170,000 3,183,000 -14.400 45,000 642,600 CAREER

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 S Corporation Income Winery Sales 6700000 Cost of Sales 2815000 Gross Profit 3885000 Operating Exp...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started