Topic: The performance of a trading strategy with futures, options, and/or cash assets Content: 1. Choose a particular technical or fundamental framework for trading

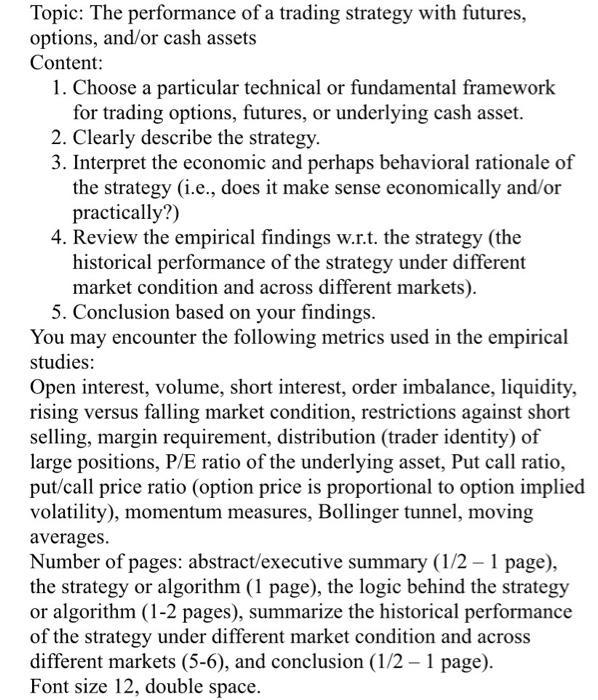

Topic: The performance of a trading strategy with futures, options, and/or cash assets Content: 1. Choose a particular technical or fundamental framework for trading options, futures, or underlying cash asset. 2. Clearly describe the strategy. 3. Interpret the economic and perhaps behavioral rationale of the strategy (i.e., does it make sense economically and/or practically?) 4. Review the empirical findings w.r.t. the strategy (the historical performance of the strategy under different market condition and across different markets). 5. Conclusion based on your findings. You may encounter the following metrics used in the empirical studies: Open interest, volume, short interest, order imbalance, liquidity, rising versus falling market condition, restrictions against short selling, margin requirement, distribution (trader identity) of large positions, P/E ratio of the underlying asset, Put call ratio, put/call price ratio (option price is proportional to option implied volatility), momentum measures, Bollinger tunnel, moving averages. Number of pages: abstract/executive summary (1/2 - 1 page), the strategy or algorithm (1 page), the logic behind the strategy or algorithm (1-2 pages), summarize the historical performance of the strategy under different market condition and across different markets (5-6), and conclusion (1/2 - 1 page). Font size 12, double space.

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

An algorithm is a sequences of computational an output It is a tool for solving a wellspecified comp...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started