Question

All the Peanuts characters pool their money to buy an Old House. They take out a 10 year mortgage for 82000 dollars at a rate

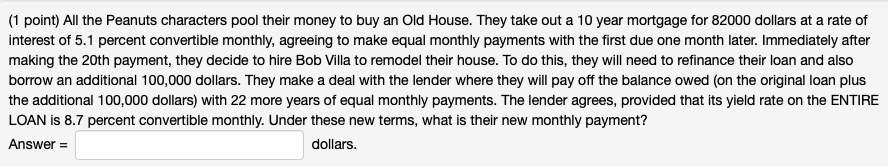

All the Peanuts characters pool their money to buy an Old House. They take out a 10 year mortgage for 82000 dollars at a rate of interest of 5.1 percent convertible monthly, agreeing to make equal monthly payments with the first due one month later. Immediately after making the 20th payment, they decide to hire Bob Villa to remodel their house. To do this, they will need to refinance their loan and also borrow an additional 100,000 dollars. They make a deal with the lender where they will pay off the balance owed (on the original loan plus the additional 100,000 dollars) with 22 more years of equal monthly payments. The lender agrees, provided that its yield rate on the ENTIRE LOAN is 8.7 percent convertible monthly. Under these new terms, what is their new monthly payment? Answer = dollars.

All the Peanuts characters pool their money to buy an Old House. They take out a 10 year mortgage for 82000 dollars at a rate of interest of 5.1 percent convertible monthly, agreeing to make equal monthly payments with the first due one month later. Immediately after making the 20th payment, they decide to hire Bob Villa to remodel their house. To do this, they will need to refinance their loan and also borrow an additional 100,000 dollars. They make a deal with the lender where they will pay off the balance owed (on the original loan plus the additional 100,000 dollars) with 22 more years of equal monthly payments. The lender agrees, provided that its yield rate on the ENTIRE LOAN is 8.7 percent convertible monthly. Under these new terms, what is their new monthly payment? Answer = dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started