Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the questions connect, so please help me with all of them Suppose that Calloway golf would like to capitalize on Phil Michelson winning the

all the questions connect, so please help me with all of them

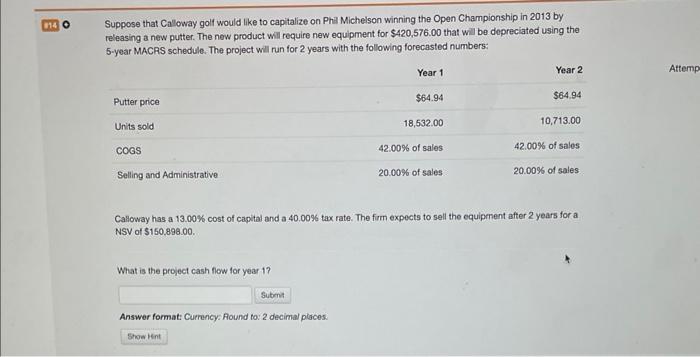

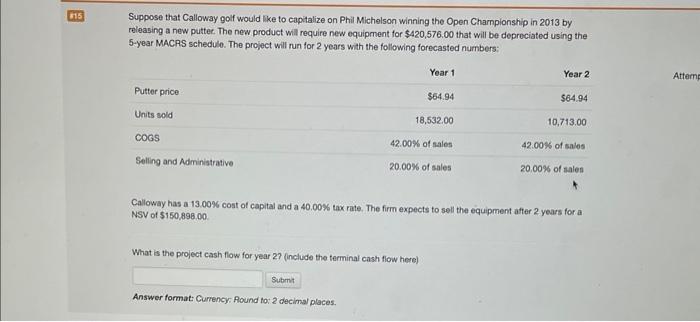

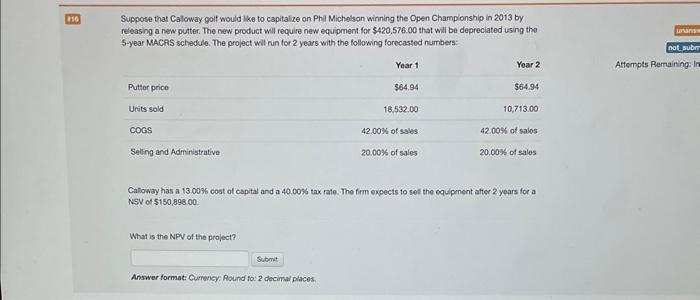

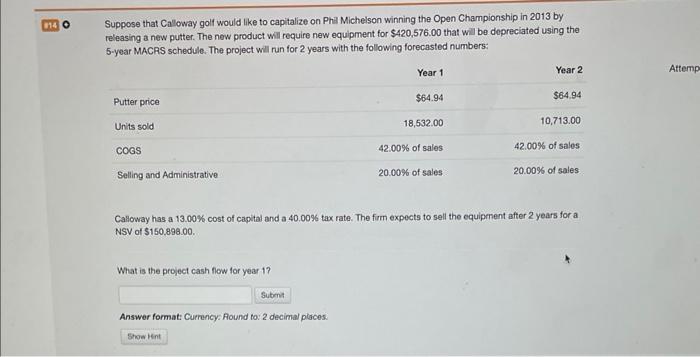

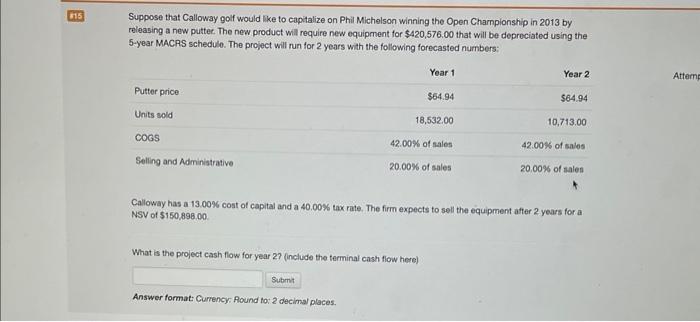

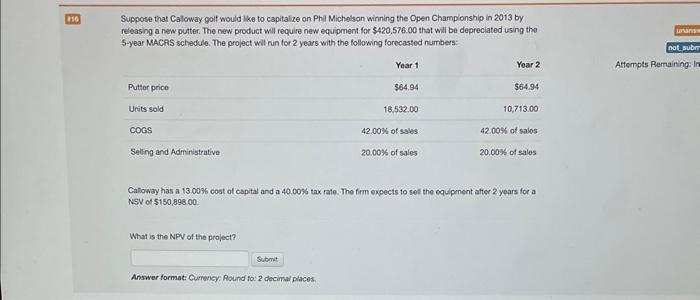

Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Championship in 2013 by releasing a new putter. The new product will require new equipment for $420,576.00 that will be depreciated using the 5 -year MACRS schedule. The project will run for 2 years with the following forecasted numbers: Calloway has a 13.00% cost of capital and a 40.00% tax rate. The firm expects to sell the equipment after 2 years for a NSV of $150.898.00. Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Charnpionship in 2013 by releasing a new puttec. The new product will require new equipment for $420,576.00 that will be depreciated using the 5-year MACAS schedula. The project will run for 2 years with the following forecasted numbers: Calloway has a 13.00% cost of capital and a 40.00% tax rate. The firm expects to sell the equipment atter 2 years for a NSV of $150,898,00. What is the project cash flow for year 27 (include the terminal cash flow here) Suppose that Catoway golf would lke to capitaize on Phil Micholson winning the Open Championship in 2013 by reeasing a new putter. The new product will require new equipment for $420,576.00 that will be depreciated using the 5-year MACRS schedule. The project will run for 2 years with the following forecasted numbers: Attempts Remaining: In Caloway has a 13.005 cost of capital and a 40.00% tax rate. The fim expects to set the equipment after 2 years for a NSV of $150,896.00 What is the NPV of the project? Answer format: Gurrency: Round fo: 2 decimal places

Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Championship in 2013 by releasing a new putter. The new product will require new equipment for $420,576.00 that will be depreciated using the 5 -year MACRS schedule. The project will run for 2 years with the following forecasted numbers: Calloway has a 13.00% cost of capital and a 40.00% tax rate. The firm expects to sell the equipment after 2 years for a NSV of $150.898.00. Suppose that Calloway golf would like to capitalize on Phil Michelson winning the Open Charnpionship in 2013 by releasing a new puttec. The new product will require new equipment for $420,576.00 that will be depreciated using the 5-year MACAS schedula. The project will run for 2 years with the following forecasted numbers: Calloway has a 13.00% cost of capital and a 40.00% tax rate. The firm expects to sell the equipment atter 2 years for a NSV of $150,898,00. What is the project cash flow for year 27 (include the terminal cash flow here) Suppose that Catoway golf would lke to capitaize on Phil Micholson winning the Open Championship in 2013 by reeasing a new putter. The new product will require new equipment for $420,576.00 that will be depreciated using the 5-year MACRS schedule. The project will run for 2 years with the following forecasted numbers: Attempts Remaining: In Caloway has a 13.005 cost of capital and a 40.00% tax rate. The fim expects to set the equipment after 2 years for a NSV of $150,896.00 What is the NPV of the project? Answer format: Gurrency: Round fo: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started