Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all the questions connect, so please help me with all of them ABC Corporation has hired you to evaluate a new FOUR year project for

all the questions connect, so please help me with all of them

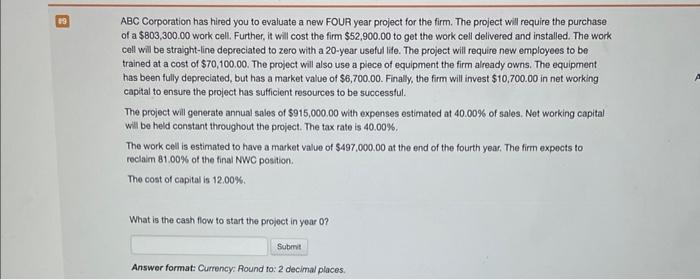

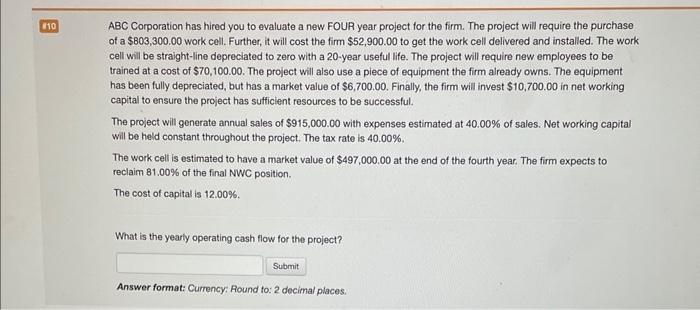

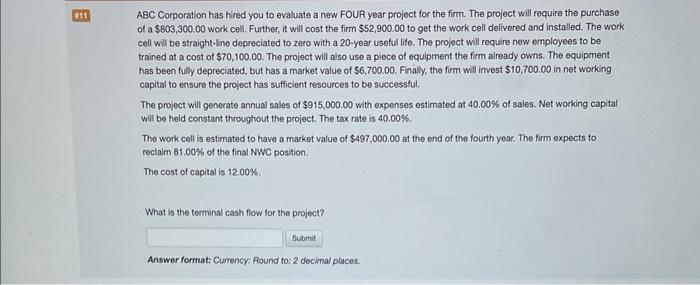

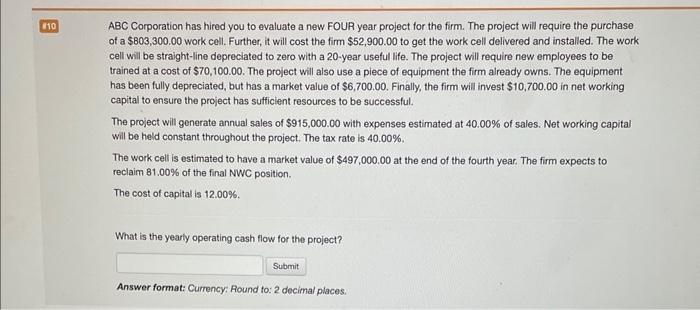

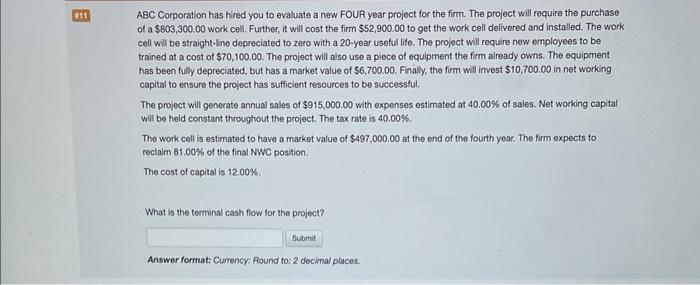

ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $803,300.00 work cell. Further, it will cost the firm $52,900.00 to get the work cell delivered and installed. The work call will be straight-line depreciated to zero with a 20-year useful life. The project will require new employeos to be trained at a cost of $70,100.00. The project will also use a plece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $6,700.00. Finally, the firm will invest $10,700.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $915,000.00 with expenses estimated at 40.00% of sales. Not working capital Will be held constant throughout the project. The tax rate is 40.00%. The work cell is estimated to have a market value of $497,000.00 at the end of the fourth year. The firm expects to reclaim 81.00% of the final NWC position. The cost of capital is 12.00%. What is the cash flow to start the project in year 0 ? Answer format: Currency: Round to: 2 decimal places. ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $803,300.00 work cell. Further, it will cost the firm $52,900.00 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $70,100.00. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $6,700.00. Finally, the firm will invest $10,700.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $915,000.00 with expenses estimated at 40.00% of sales. Net working capital will be held constant throughout the project. The tax rate is 40.00%. The work celt is estimated to have a market value of $497,000.00 at the end of the fourth year. The firm expects to reclaim 81.00% of the final NWC position. The cost of capital is 12.00%. What is the yearfy operating cash flow for the project? Answer format: Currency: Round to: 2 decimal places. ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $803,300.00 work cell. Further, it will cost the firm $52,900.00 to get the work cell delivered and installed. The work cell will be straight-ine depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $70,100,00. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $6,700.00. Finally, the firm will invest $10,700.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $915,000.00 with expenses estimated at 40.00% of sales. Net working capital Will be held constant throughout the project. The tax rate is 40.00%. The work cell is estimated to have a market value of $497.000.00 at the end of the fourth year. The firm expects to rectaim 81.00% of the final NWC position. The cost of capital is 12.00%. What is the terminal cash flow for the project? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started